I know we've had quite an amazing run these past few month, with over 78% accuracy in our trade ideas and sentiments, and thousands of pips in profits monthly...

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

It seems like the recent drama between the Reddit users and Wall Street hedge funds has cooled down since the start of this week. If you’ve missed this train, catch up with the article on the FBS website.

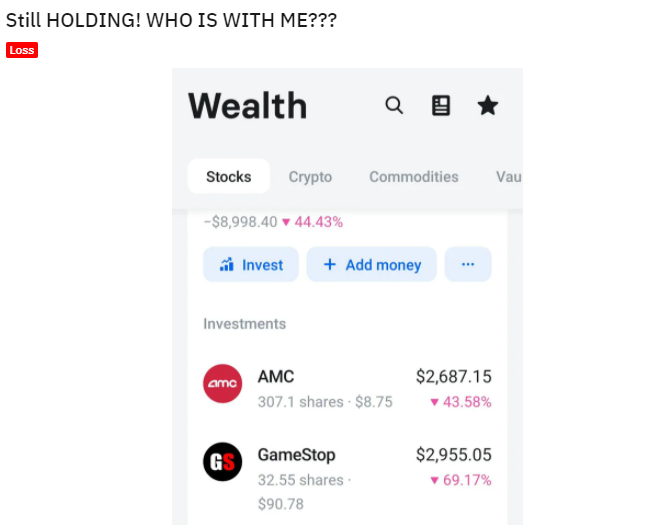

In just five days the Gamestop stock made severe falls to the area where the hype had begun. On February 3, the stock was already 5 times less than its all-time high. Still, a quick glance at the r/Wallstreetbets board tells us that people are hoping for a second spike to the upside.

So, who are these Reddit people, a bunch of losers or revolutionists? We’d say they are neither former nor the latter. They tried to make money fast and some of them did succeed. Others participated just for fun.

In this article, we will dive into the depth of retail trading’s history and make a retrospective analysis of stocks that boomed during the dot-com era. It will help us to answer the main question: will the rise of low-potential stocks continue? Should you join this trend?

If you haven’t read the article about GME performance, we highly recommend you to do that. In short, traders from r/Wallstreetbets started to buy the stocks of Gamestop – an American shop chain, beloved by everyone, but very unsuccessful. The hedge funds from Wall Street held short positions on the stock, as they expected it to fall. Unexpectedly to everyone, the stock started surging, thanks to the Reddit users. This led to a short squeeze – a situation in the market where sellers have to buy a stock at a more expensive price, causing it to go higher. A literal shock made hedge funds lose millions of dollars and even provoked Robinhood, a famous American trading platform, to close access for buying the GME stock. That was when the scandal reached its top point. Many analysts, politicians, businessmen, and even Elon Musk himself claimed the Robinhood decision as unfair. Critics referred to the connection between Robinhood and Citadel Securities that could have led to market manipulation. Both companies denied that, though.

It’s worth mentioning that GameStop was not the only target of Redditors. Other stocks that experienced gains are AMC Entertainment, Blackberry, and Bed Bath & Beyond. The retailers bought silver last week as well, pushing the precious metal to August's high.

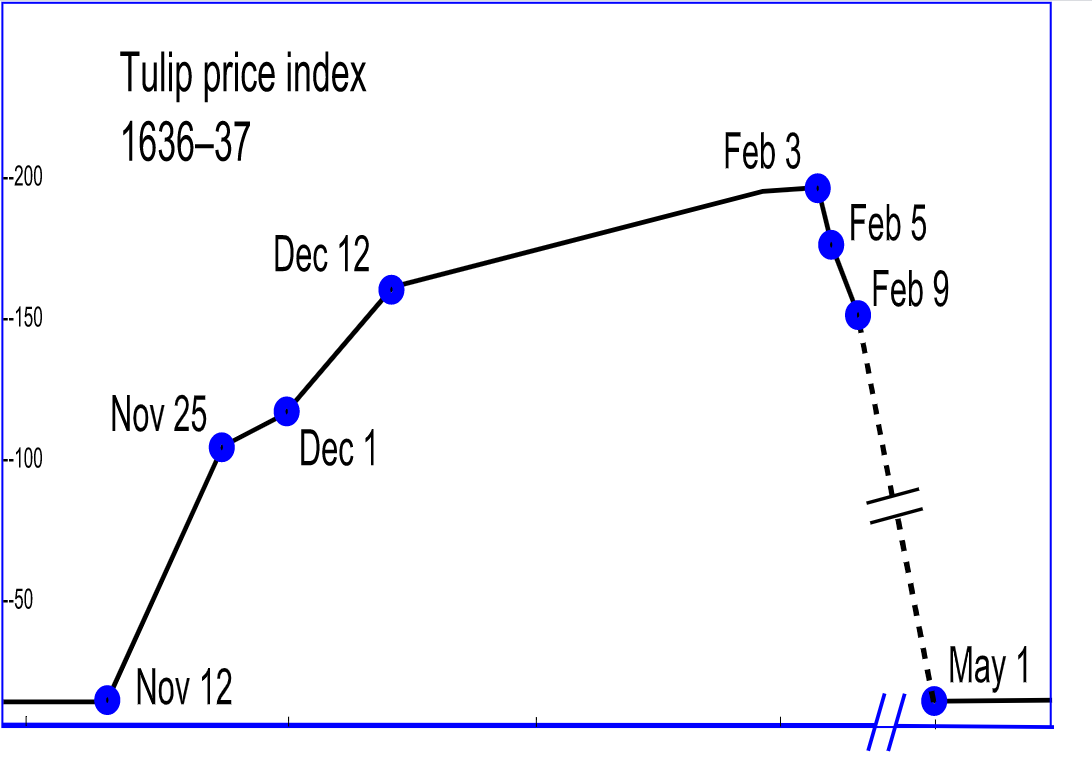

We aren't going to tell you about the Tulip Bulb Mania that happened in the 1600s when a fellow Dutch botanist overvalued the price of a tulip bulb and made everyone go crazy about it. (just like with Gamestop!)

Today, we’d recommend you to look at a more recent example. Back in the late 90s, early 2000s a lot of stocks boomed amid the dot-com popularity. People invested in companies without properly looking at their fundamental bias. Companies’ valuations skyrocketed, but their potential was low.

Another example is even closer to current realities. There were sites similar to Reddit boards back in the 1990s. One of them was siliconinvestor. In 1996 people tried to pump a stock of a tech company Zitel that was expected to fix the Year 2000 problem. The price indeed spiked in the short-term on the rumors about potential investments by George Soros. Now it's almost impossible to find any data about this stock later than from 1998.

So, as we can see it's not the first time people try to milk money out of low-potential stocks. Was it worth it? For those who were lucky enough and treated the market as a casino, yes. Others, who just followed the crowd, most likely did not succeed.

The Gamestop situation creates an unprecedented case for big companies and institutional funds. That has happened because social trading has become extremely popular in recent years. Now, companies are monitoring the Reddit board in an attempt to find the next retailers' target. According to Thinknum Alternative Data's tool, there are Nokia, AT&T, and Toronto Dominion Bank among the most-mentioned companies in the board.

At&T is the next to rise?

If you think that you want to gamble, then why not? However, gambling is not about true trading. In the former case, you trade stocks of companies that are likely to go bankrupt in few years. As for trading, you make your decisions based on fundamental and technical background. As people have noticed, retail traders sometimes lose their capital even more when they try to outplay the Wall Street giants.

All in all, people believe in their power. Reddit traders keep holding the GameStop stock in hopes of the second jump, while analysts keep wondering about their next target. Will it be AT&T?

I know we've had quite an amazing run these past few month, with over 78% accuracy in our trade ideas and sentiments, and thousands of pips in profits monthly...

Futures for Canada's main stock index rose on Monday, following positive global markets and gains in crude oil prices. First Citizens BancShares Inc's announcement of purchasing the loans and deposits of failed Silicon Valley Bank also boosted investor confidence in the global financial system...

Investor confidence in the global financial system has been shaken by the collapse of Silicon Valley Bank and Credit Suisse. As a result, many are turning to bearer assets, such as gold and bitcoin, to store value outside of the system without...

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later