The G20 summit took place in Bali, Indonesia, on November 2022…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

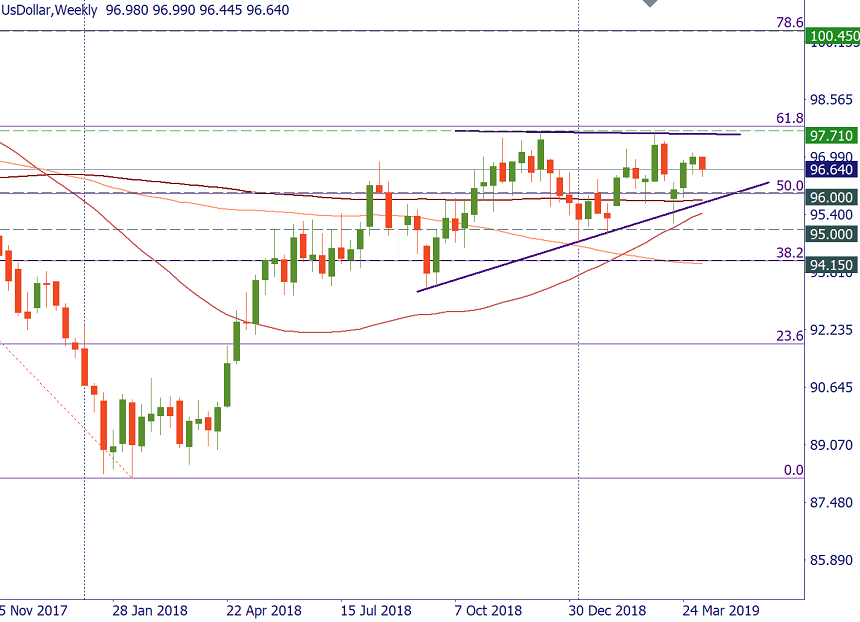

The US currency has been in the period of consolidation since the start of the year. If we look at the chart of the USD index, which tracks the dynamics of the greenback versus the currencies of America’s main trading partners, we will see that it’s not far from the 2018 high at 97.71, but the attempt to retest this level in March wasn’t successful. What is keeping the US currency at these levels and which further direction will it choose?

A few years ago things were much simpler: the Federal Reserve lowered interest rates or issued a bearish statement and the USD went down. However, a long period of monetary easing made everything less evident.

Positive factors for the USD

Although the US economic figures are mixed, the American economy still looks strong compared to the economies of the other developed nations. In addition, even though the policy of the Fed has become more dovish, other central banks did more to weaken their national currencies (browse through the latest statement of the RBNZ or the March decision of the ECB, for example). After all, the FOMC meeting minutes released this week showed that the members of the American central bank hadn’t discussed rate cuts (some analysts thought that they had). As a result, the USD looks attractive in this overall environment.

There is another thing that has recently draw everyone’s attention: US yield curve inverted last month for the first time since the global financial crisis. This event is traditionally regarded as a sign of potential recession (sometime in the future). Although this factor is more positive for gold prices or the Japanese yen, the US can also strengthen as a safe haven versus the riskier commodity currencies like the Australian, Canadian dollar and others.

Finally, uncertainty in Europe and Britain will reduce the appeal of the euro and the British pound, while supporting demand for the US dollar.

Negative factors for the USD

The greenback strengthened throughout 2018 as the Fed was actively raising interest rates. This March, however, the central bank made a U-turn from this policy. The members of the central bank’s rate-setting committee said that they didn’t expect any rate hikes in 2019. So, even though the Fed’s policy doesn’t make the USD fall, it surely does nothing to help it overcome the resistance.

The boost from President Donald Trump's 2018 tax cuts is fading. GDP growth in Q4 was revised down from 2.6% to 2.2%. The softening consumer spending and anemic inflation growth remain the areas of concern.

The trade agreement between the United States and China which is awaited sometime during this month would benefit global trade and the market’s risk sentiment. The appeal of the USD will decline.

Conclusion

As you can see, there are both positive and negative factors for the USD. Each group has significant weight.

The Fed said that its next steps will depend on the incoming economic data. The central bank may wait until May to make sense of the figures for the first quarter and beginning of the second quarter. This may prolong the consolidation period for the USD.

All in all, for the greenback to resume the broad uptrend, we need to see a sharper contrast between the American and other economies: the US should outperform. Keep an eye on the dynamics of the USD index as it may give you hints about trading the US currency in other pairs. As long as the index stays above the support at 96.00, bulls will remain in control. Further support levels are at 95.00 and 94.15. A break above 98.00 is needed to open the way up to 100.00.

The G20 summit took place in Bali, Indonesia, on November 2022…

The deafening news shocked the whole world yesterday: the British Queen Elizabeth II died peacefully at the age of 96…

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later