The G20 summit took place in Bali, Indonesia, on November 2022…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

The Australian dollar has been in a downtrend versus the greenback since the start of 2018.

Last year, the US currency strengthened against its Australian counterpart as the Federal Reserve was increasing the federal funds rate. The Reserve Bank of Australia had kept its Cash rate at 0.5% from August 2016 until June 5, 2019, when it reduced it to 1.25%. Since then, AUD/USD has once again turned down. Although the Fed has stopped rate hikes and the market now expects the US central bank to cut rates two times this year, the Aussie still keeps depreciating. It happens as traders think that the RBA will be more aggressive in its policy easing than the Fed.

According to bond futures, the probability of another 25-bps rate cut in Australia in July equals to 66%. If the RBA doesn’t make this move next month, market players are almost certain that it will happen in August.

Australian economy

Australian domestic figures are soft. The nation’s problems are serious: low wages, a housing slump and below-target inflation.

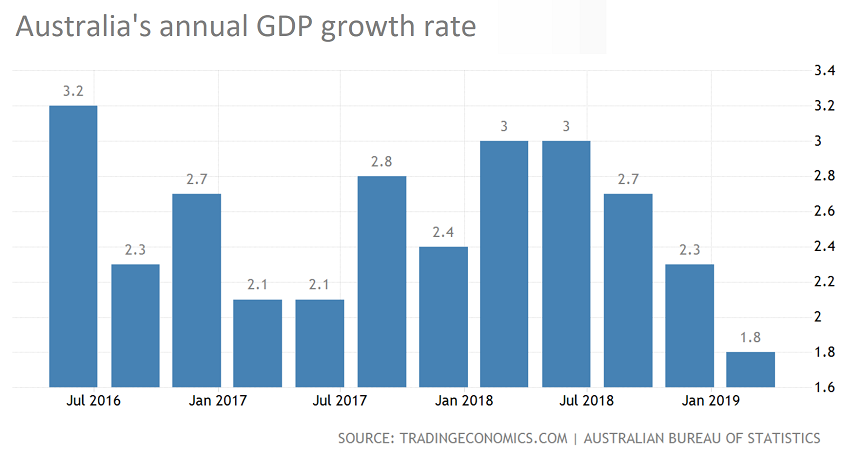

The RBA targets the unemployment rate of 4.5%, while the current level of the indicator is 5.2%. The annual GDP growth in Q1 fell to 1.8% (vs. 3.2% in the US), the lowest level since 2009. Retail sales contracted by 0.1% in April. Sales of new homes in Australia fell by 11.8% in April making the biggest decline since 2005. Private capital expenditure - a leading indicator of economic health - went down by 1.7% in the first 3 months of the year. Quarterly CPI growth slowed down from 0.5% in Q4 to 0.0% in Q1.

You can see that wherever we look, the picture is negative. That’s why analysts are so sure that the RBA will continue to cut rates.

AUD as a risky currency

The ongoing trade war between the United States and China is bad for the Australian currency. China is Australia's major trading partner and its well-being is very important for Australia's economy and, consequently, the AUD.

The future will be decided at the G20 summit that will take place on June 28-29. If the US President Donald Trump doesn’t find common grounds with the Chinese leader Xi Jinping, America will probably announce the next rounds off tariffs on $325 billion of imports from China. That will hurt the Asian economy and, consequently, the AUD.

Conclusion

The decline of the AUD won’t be very rapid as the USD will be weakened by the Fed. In addition, the price of iron ore, Australia’s biggest export, is quite resilient. However, only a real US-Sino trade deal is capable to reverse the downtrend in AUD/USD. Until that happens, the Aussie’s pullbacks to the upside will be temporary. Even if the Fed cuts its main rate, it will still be higher than that of Australia.

The G20 summit took place in Bali, Indonesia, on November 2022…

The deafening news shocked the whole world yesterday: the British Queen Elizabeth II died peacefully at the age of 96…

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later