eurusd-is-falling-what-to-expect-from-the-future-price-movement

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

The US central bank will lift interest rates at its next meeting on Wednesday, July 27. We'll watch if the Federal Reserve goes with a 75-basis-point or a 100bp hike. Several factors influence the Fed's decision. In theory, the Fed's goal in using a rate hike tool is to tame inflation without causing a recession.

To decide on the appropriate rate hike, FOMC members will look at the key inflation metrics such as the Consumer Price Index (CPI) and the indicators of economic growth such as employment numbers to get a better view of the economy.

The Consumer Price Index (CPI) measures the daily inflation of products and services. The change in this indicator shows how higher/lower prices were during the previous month. Inflation in the US continues to surprise everyone after the last reading came above expectations and jumped to 9.1% in June (the highest level in 40 years), compared to 8.6% in May.

Inflation will continue to heat up and is expected to remain elevated in the coming months. It might prompt the Fed to continue raising rates. However, it won't need to raise rates at a more aggressive pace than the current one. There are tentative signs that inflation might start to calm down relatively, and we are on the cusp of a shift in price growth.

The reasons are lower energy and oil prices. In addition, wage growth has cooled from an elevated level early this year because companies are now halting/slowing hiring to counter the rising prices. With lower commodity prices - particularly food and base metals - price growth may calm slightly.

Gasoline prices are unlikely to continue falling, with the prospect of oil rising again. But a broader decline in commodity prices should help reduce pressures on core inflation.

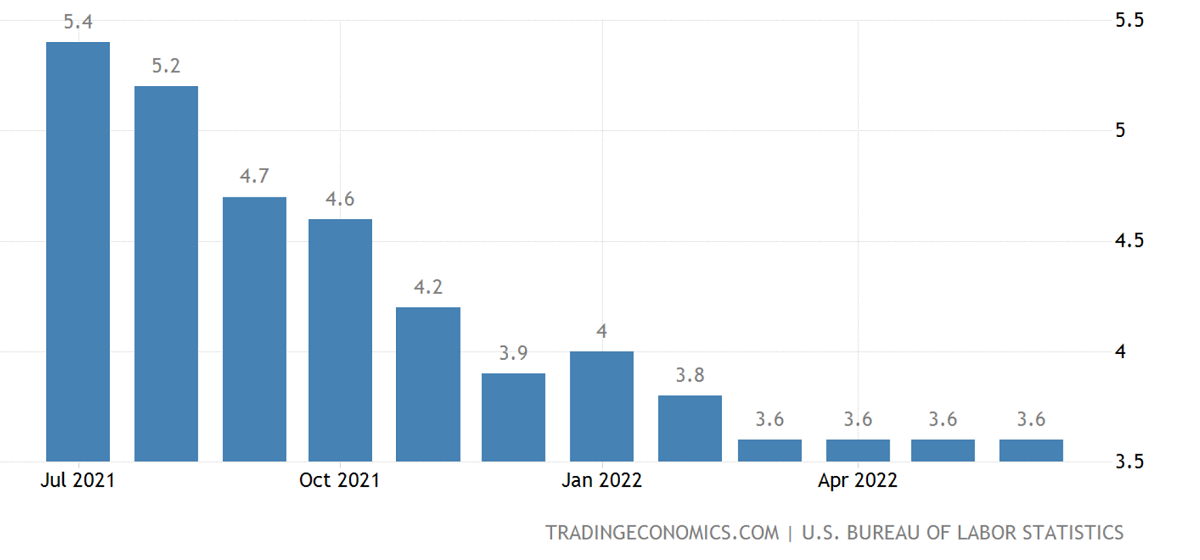

Robust US unemployment data may serve as an argument for the Federal Reserve to raise rates further. Nonfarm payrolls increased by 372K in June, but the unemployment rate remained at 3.6%, defying fears of recession. The June employment report indicates that the US economy is neither on the cusp of recession nor is overheating.

However, despite the strong US labor market, the Fed won't risk accelerating rate hikes, fearing that efforts to contain inflation, if excessive, will lead to a recession and a sharp increase in unemployment. Raising rates may cause a slowdown in the economy and will likely lead to increased unemployment over time.

Bets to hike rates by a whole percentage point increased after inflation in America surged to 9.1%. Higher rates should cool the raging prices. However, concerns about the impact of rate hikes on the US economy may limit the rate increase by 75 basis points.

Overall, the market is ready for a 75-point hike. If the Fed signals slower rate increases in the future, the USD may slip versus other major currencies, while the US500 will get a boost.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later