Suddenly, the US Dollar Index fell 6.70% over the last two weeks, marking the biggest decrease in the currency since 2020.

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

On May 4, the US Federal Reserve revealed the federal funds rate for the next two months. Even though a 50 basis points hike was widely expected, the future is not so clear. Let’s figure it out bit by bit!

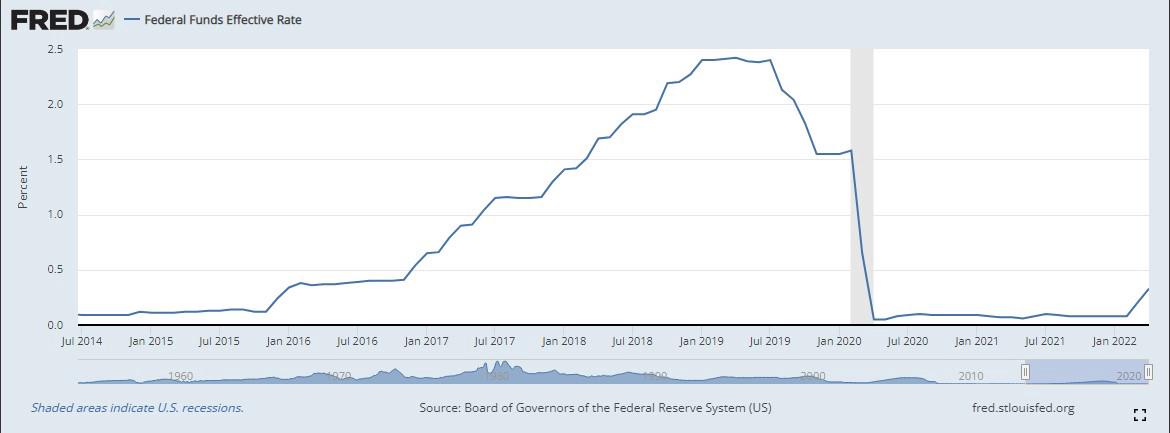

It’s better to start with a retrospective outlook on the funds rate. Since the Covid-19 began, the Fed kept the rates near 0.00% to boost the economy and decrease the negative impact of supply shortages, lockdowns, and slumps in retail sales. You can see a sharp decrease in rates in the figure below.

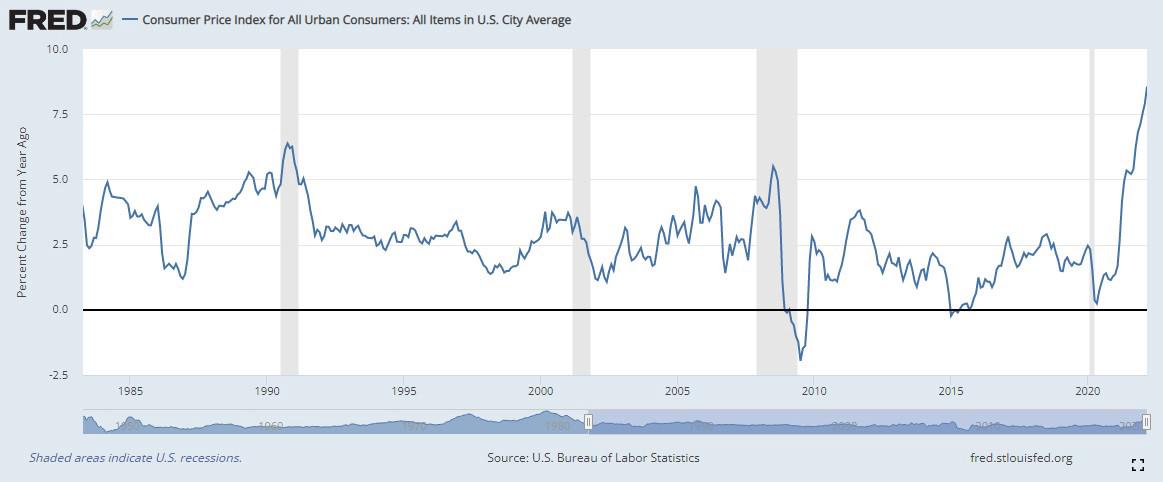

Low rates, $8 trillion printed over two years, and the slow down of the pandemic created a perfect field for inflation to rise. Now, it’s at a 40-year high, and the time has come for strict monetary tightening.

What could go wrong? Well, the war in Ukraine started and caused even more supply shortages. Now, the prices for oil and wheat are rising, so inflation is not likely to end anytime soon. The prices will keep increasing, but here’s the good news. Inflation has probably peaked, and the 8.5% CPI is likely to be the highest point we will see in the next several years. At least, the economy looks this way.

The Fed thinks the same. The Fed stated that inflation has peaked and will decrease over time in their report. Before the FOMC statement came out, the market expected a 50 basis point hike in May and a 75 basis point hike in July 2022. In the statement, Fed chair Jerome Powell said the Fed has no reason to hike rates so aggressively. Thus, the next rate hike will likely be not 75, but 50 basis points increase, which is positive for every risk asset like stocks or crypto.

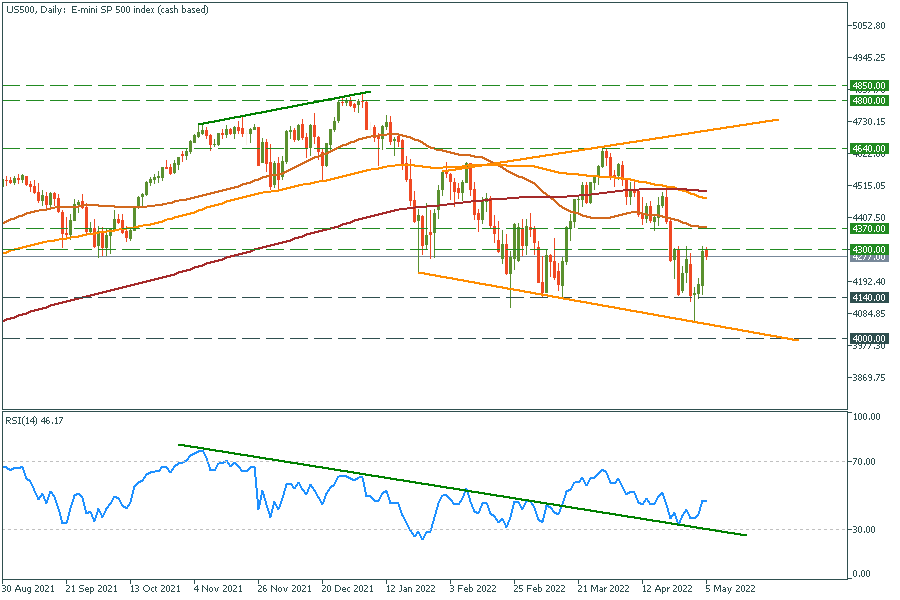

US500 (S&P500) gained almost 3% after the FOMC statement. It’s not a change of the downtrend – the stock market is still under heavy pressure, and there are few positive factors. There is an investment strategy for stocks based on seasonal demand called “Sell in May and go away.” In theory, the period from November to April has significantly stronger stock market growth on average than the other months. Positive news from the Fed will boost the index higher, but not for long.

As for the chart, the US500 formed a daily reversal candle on May 2. Also, we see a bounce from the RSI oscillator. Currently, we are at a crossroad, so watch closely after the support of 4000 and resistance of 4370. We bet there will be a volatile move in the direction of the breakout.

US500 daily chart

Resistance: 4300, 4370, 4640, 4800-4850

Support: 4140, 4000

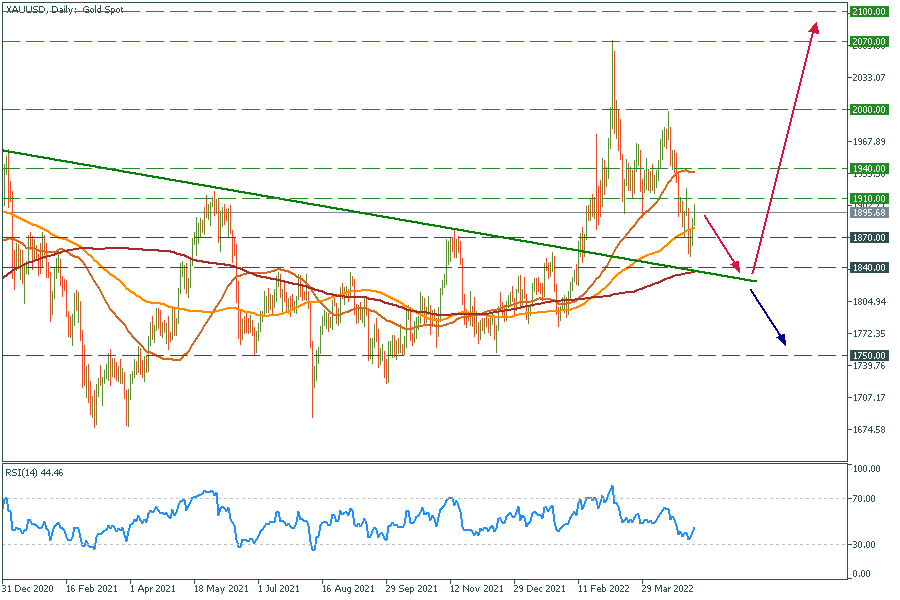

As we stated at the beginning of the article, inflation is here to stay. Most of the time, it’s a bullish factor for the gold price because even with shrinking inflation, prices will keep rising. Thus, the greenback will feel weaker for months, if not years.

Still, we wait for the gold to touch the $1840 support line and hold in this area. This is a trendline that worked for gold for more than two years. Thus, gold must consolidate for some time near this area and then skyrocket with targets at $2000, $2500, and higher. In the worst scenario, gold may fall below the trendline, and the bearish trend will start.

XAUUSD daily chart

Resistance: 1910, 1940, 2000, 2070, 2100

Support: 1870, 1840, 1750

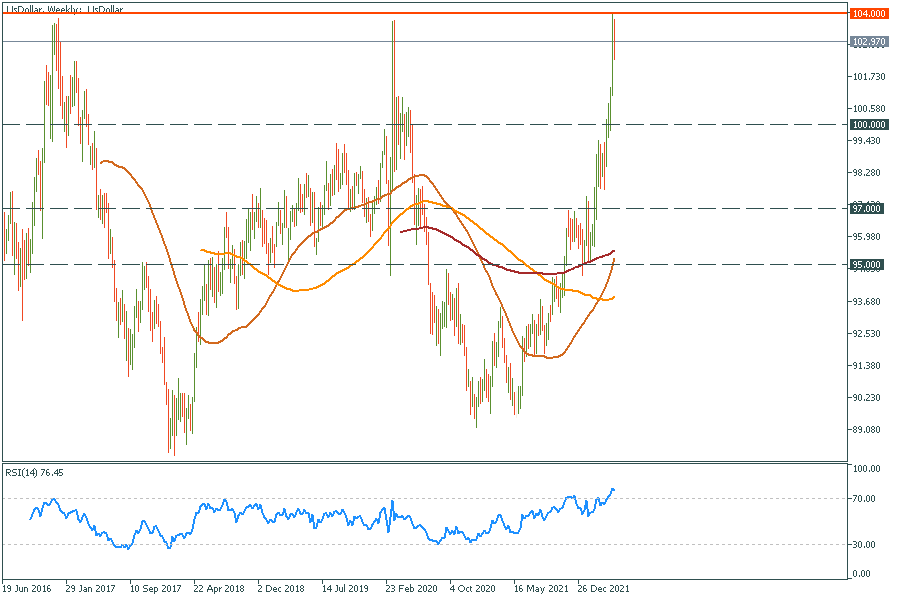

On the contrary, the DXY (the US dollar index) is at the strongest resistance in five years. Thus, we expect a massive reversal from the 104.00 resistance line, another positive factor for gold.

US Dollar weekly chart

Resistance: 104.00

Support: 100.00, 97.00, 95.00

Use this information in your favor!

Suddenly, the US Dollar Index fell 6.70% over the last two weeks, marking the biggest decrease in the currency since 2020.

Many investors treated gold as a protection against inflation. However, last week, gold lost its major support and dropped despite rising inflation. Why did it act like this?

US dollar gains ahead of the US CPI data on July 13th, pressing gold to new lows!

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later