eurusd-is-falling-what-to-expect-from-the-future-price-movement

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

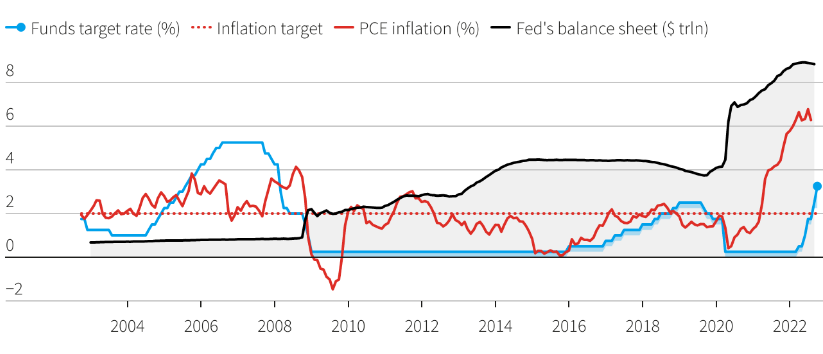

Recent inflation data showed no improvement despite the Fed's aggressive tightening and the key rate hikes.

On Wednesday, September 21, Federal Reserve Chair Jerome Powell announced that the Fed would "keep at" their battle to beat down inflation. The US central bank hiked interest rates by 75 basis points for the third time in a row and signaled that borrowing costs would keep rising this year.

The Fed predicts its policy rate will rise faster and higher than expected, despite the economy slowing down and unemployment rising to the level historically associated with recessions.

The federal funds rate might rise by 125 basis points during the Fed's two remaining policy meetings in 2022, implying another 75-basis-point increase in the near future.

At the press conference, Powell announced the list of economic problems, mentioning rising joblessness and highlighting the housing market. Earlier on Wednesday, the National Association of Realtors reported that the US existing home sales dropped for a seventh straight month in August. Moreover, house prices in August were down about 6% from their peak in June, the biggest 2-month drop in prices in nearly a decade, which is a good sign as a persistent source of rising consumer inflation needed a "correction."

In conclusion, the committee confirmed its commitment to returning inflation to its 2% target.

The economy is still stable, job growth remains solid, and consumer and business spending has increased despite historically high inflation and rising interest rates.

However, there are mounting warning signs. Employment gains are slowing, savings cushions are decreasing, price increases remain high, and corporate profits, which had stayed strong, are declining, underscored by a bleak FedEx warning last week that contributed to a massive stock market sell-off.

Economists believe the worst times are coming over the economy as aggressive Federal Reserve interest rate hikes designed to tame inflation are likely to take a bigger toll on growth in the months ahead.

In 2022, companies have maintained large profits even though they’ve had to pay more for materials and hike wages to deal with worker shortages. However, that’s about to change as consumers temper their spending. According to US economists, earnings of S&P 500 companies grew 3.5% in the third quarter, which would be the slowest pace since 2020. As a result, companies will reduce hiring and capital spending.

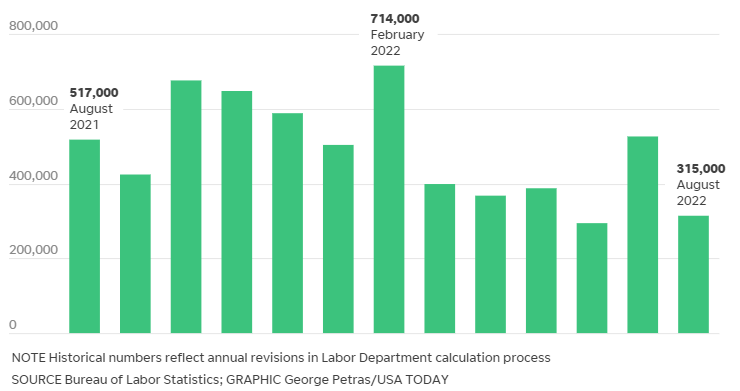

In August, employers added a solid 315 000 jobs, which is lower than an average of 455 000 in the year's first seven months. Less job creation means less income and spending.

Also, average weekly overtime hours for factory workers have dropped 11% since February to the lowest level since 2020. That's worrisome because the declining amount of overtime logged by existing workers can provoke future hiring.

Experts predict hiring to slow down, leading to about 500 000 net job losses in the 2023 spring as the unemployment rate increase from the current 3.7% to 4.8%.

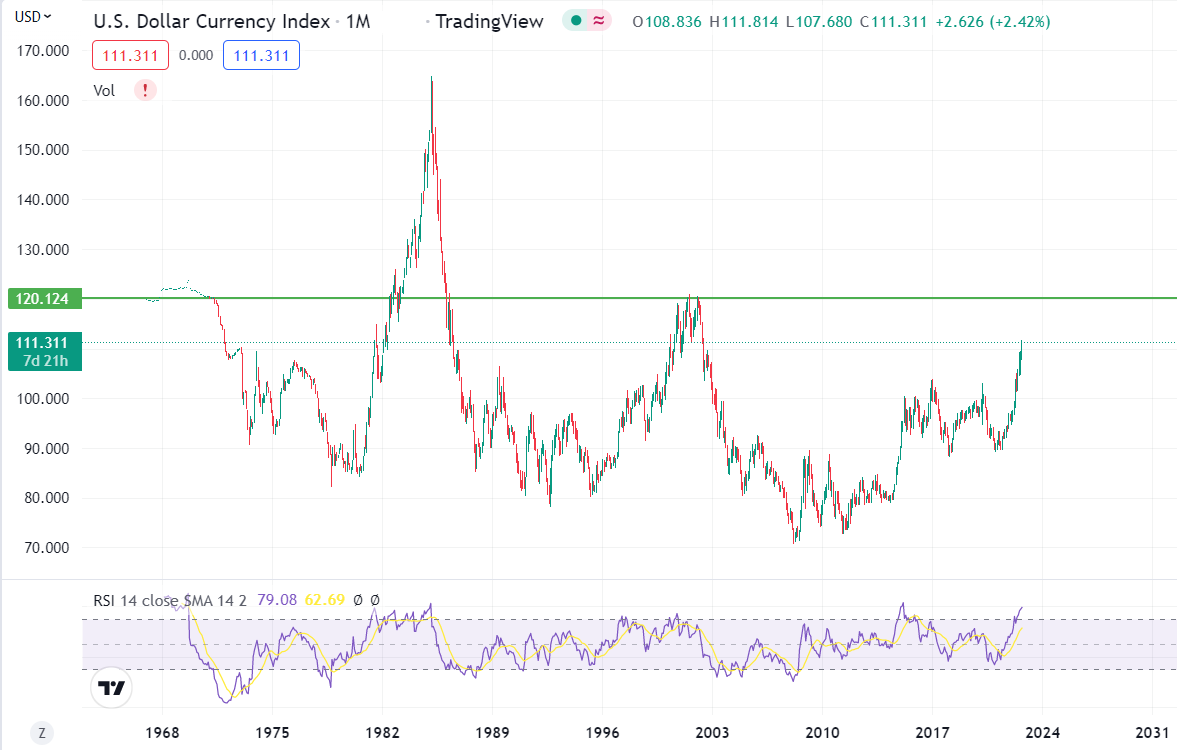

The value of the US dollar against other major currencies has reached its highest level since the early 2000s. Even as recession fears mount and the economy shows signs of slowing, the dollar continues to surge.

Broadly, it happens due the high importance of available cash flow and liquidity for a business, household, or portfolio’s financial health. Keeping cash available, especially during a crisis, adds flexibility to any wallet. Moreover, for investors, free cash is one of the main advantages of keeping liquid assets on hand when the economy turns south and risk assets fall. Therefore, as the recession will pressure the stock and crypto markets, causing sell-offs, more and more investors will turn to cash, pushing the US dollar higher against other currencies.

In addition, the US is the major economy around the globe. As a result, a recession will hurt all other economies that are strongly dependent on it. In these conditions, investors will leave “weak” currencies in favor of the greenback to hedge their capital.

In these conditions, the US dollar index has all chances of reaching the 2000s high of 120.00.

Gold isn’t saving investors from inflation as the metal is sensitive to expected long-term real interest rates. Since metal is a long-duration durable asset, its price has a strong inverse relationship with the long-term real interest rate. A further rise in key rates should drive down the price of gold. Therefore, smart money prefers short-term government bonds to gold, as yields skyrocketed to 15-year highs, providing an opportunity to cover inflation losses partly.

XAUUSD, weekly chart

Buyers are trying to defend the level of 1655.00, but it looks like just a matter of time. After the breakout of this level, we expect a massive impulse towards the psychological support of 1600.00.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later