The S&P 500 had a good week due to the impressive start of Q1 earnings and favorable inflation data. In March, the consumer price index rose 5%, lower than the previous month's 6%, and met economists' expectations.

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

The era of COVID-19 cheap money is over. Who is afraid of the Fed's tightening cycle? Apparently not the stock market!

In a move aimed to fight the worst inflation in the US in 40 years, the Federal Reserve announced on March 16 a 0.25% increase in interest rates. It's the first time in more than three years that the Fed raises the benchmark interest rate. The last increase was in December 2018. The 25 basis point hike brings the current interest rate to the range of 0.25%-0.5%. All of this was expected because markets have priced in this increase for a long time. However, the strange thing was the US stock markets' reaction after the rate hike. Markets didn't behave the way they are supposed to.

In theory, higher rates should make stocks less attractive, because higher rates mean higher borrowing costs for businesses and consumers, which lowers the overall spending. In turn, profits are affected, which is reflected in stock market prices. However, this time, investors have rebelled against this traditional wisdom, and have pounced on the stock markets. US markets jumped after the Fed announced its long-awaited rate hike and indicated the possibility of six more hikes this year. The S&P 500 closed that day 2.2% higher.

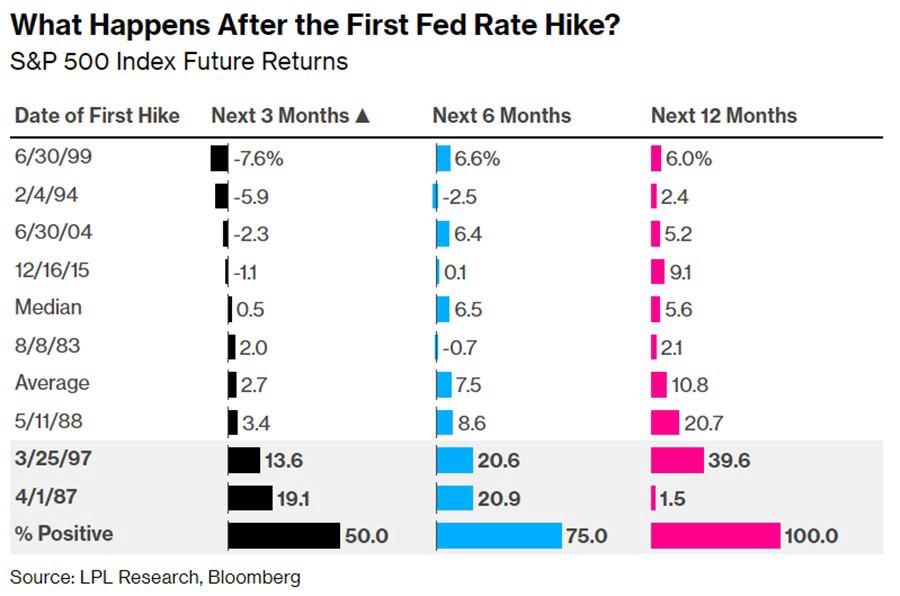

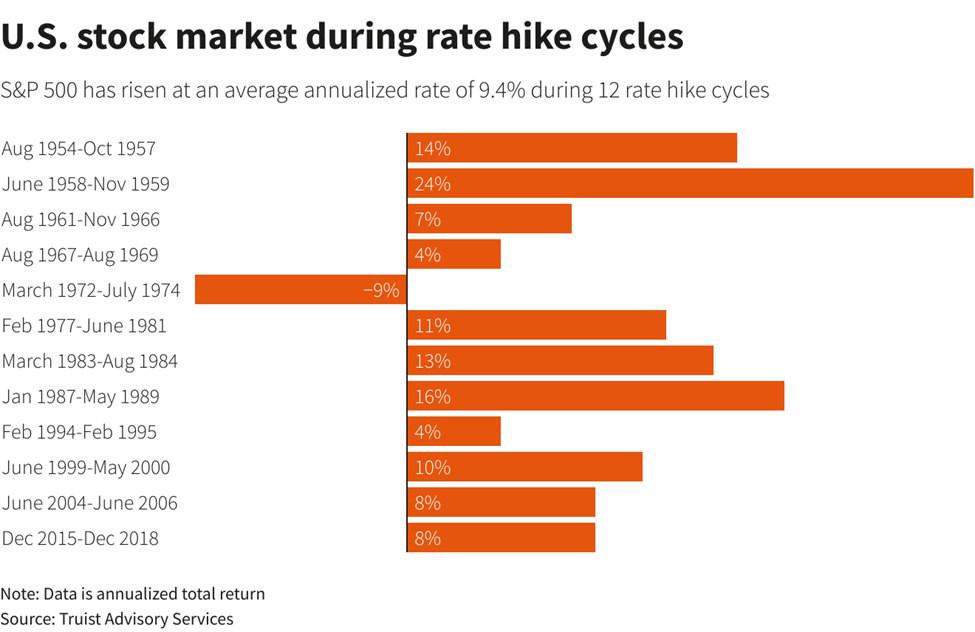

Over the past two years, the stock market has soared and stayed strong in the face of the worst global pandemic in a century, one of the most divisive presidential elections in US history, and the Capitol building under attack. Now stocks are facing Europe's biggest ground war since World War II, and the fastest inflation since the 1980s. History indicates that US stocks are poised to face more volatility after a rate hike. This, however, does not mean that the bull market is over. In fact, in the previous eight tightening cycles, S&P 500 was higher a year after the first increase each time, according to LPL Financial.

Here's a look at what history has to say about the US stock market when the Fed starts raising rates:

Finally, the free money from the Federal Reserve was such a wonderful gift to the stock market during the pandemic that they became addicted to it. Therefore, although the high rates may pose a challenge to the US stock market, it may be able to overcome it by the end of the year. Traders must manage this volatility carefully to profit from it.

The S&P 500 had a good week due to the impressive start of Q1 earnings and favorable inflation data. In March, the consumer price index rose 5%, lower than the previous month's 6%, and met economists' expectations.

FAANG stocks started recovering. Which ones are the best according to fundamental analysis?

The previous year 2022, was undoubtedly tumultuous for the stock markets, with several stocks plummeting across multiple industries. Analysts have blamed the hard times on inflation, hawkish federal reserve policies, an impending global recession, and the ongoing crisis in Ukraine. This year, however, we're beginning to see some recovery in the stock markets. This article will find a few stocks worth buying this year.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later