The G20 summit took place in Bali, Indonesia, on November 2022…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

Last month was mostly driven by market sentiment. The beginning of January was highlighted by the geopolitical crisis between the US and Iran. After the markets calmed down, the coronavirus that appeared at the end of 2019 spread causing depreciation of the risky assets and appreciation of the refuge assets. Will this month be driven by economic releases or external factors?

February 4, 5:30 MT time - Cash Rate, RBA Rate Statement

February 6, 2:30 MT time - Retail Sales m/m, Trade Balance

February 7, 2:30 MT time - RBA Monetary Policy Statement

February 18, 2:30 MT time - Monetary Policy Meeting Minutes

February 20, 2:30 MT time - Employment Change, Unemployment Rate

The AUD/USD pair has been suffering since the beginning of the year. Negative market sentiment was the most important driver of the pair. Currently, the coronavirus is the factor that will keep affecting the AUD. However, traders should keep looking at economic data.

Although the RBA is not expected to change the interest rate, markets anticipate the bank to be cautious. It may pull the currency down. Following economic releases may change the situation if the actual data outperform forecasts.

On the weekly chart, the pair has been trading at the lows of September 2019 of 0.6680. In the case of the breakthrough, the pair will target the next level at 0.6340. However, it’s far, so we expect the formation of additional lows. The RSI indicator and Stochastic oscillator are in the oversold area. As soon as the indicators signal the upward movement, the pair will move towards the range of 0.6877-0.6913, 0.70.

February 4, 23:45 MT time - Employment Change q/q, Unemployment Rate

February 12 3:00 MT time - Official Cash Rate, RBNZ Monetary Policy Statement

February 12 4:00 MT time - RBNZ Press Conference

February 24 23:45 MT time - Retail Sales q/q

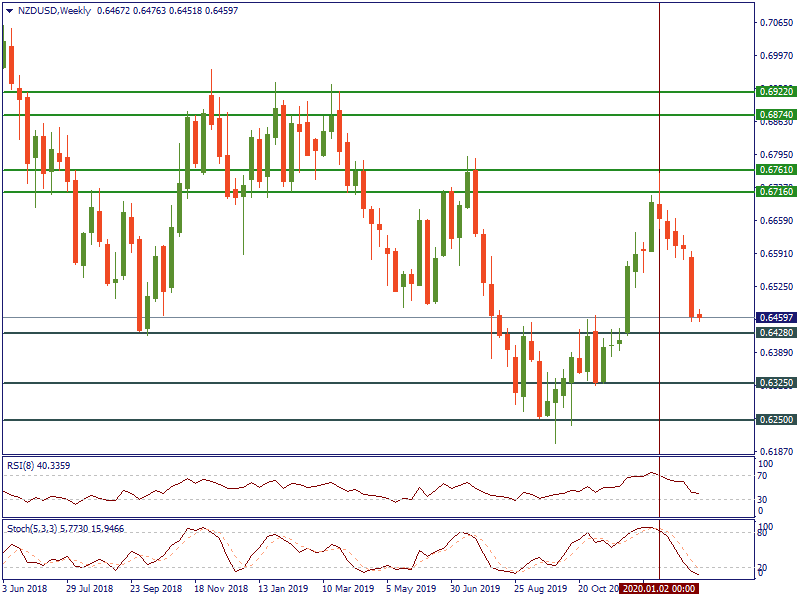

The US-Iran tensions and coronavirus had a negative impact on the NZD, too. The New Zealand dollar has been depreciating against the USD since the beginning of the year. The decline may continue if the effect of the virus extends. A pullback may happen if only the economic data signal economic improvement.

The RBNZ is expected to keep the rate on hold through 2020. Nevertheless, the mood of the bank will be important for the direction of the NZD. Economic figures will either prove or disprove the bank won’t change the rate. Encouraging figures will help the Kiwi to rise.

On the weekly chart of NZD/USD, we see the pair has been moving to the support at 0.6428. The next supports are at 0.6325 and 0.6250. The Stochastic Oscillator is already in the oversold area, while the RSI has been moving to it. If the indicators give signals of the reversal, the pair will get a chance to move up. The first psychological resistance range of 0.6716-0.6761 is far. The pair will form resistances before it.

February 19 11:30 MT time - CPI y/y

February 21, 11:30 MT time - Flash Manufacturing PMI, Flash Services PMI

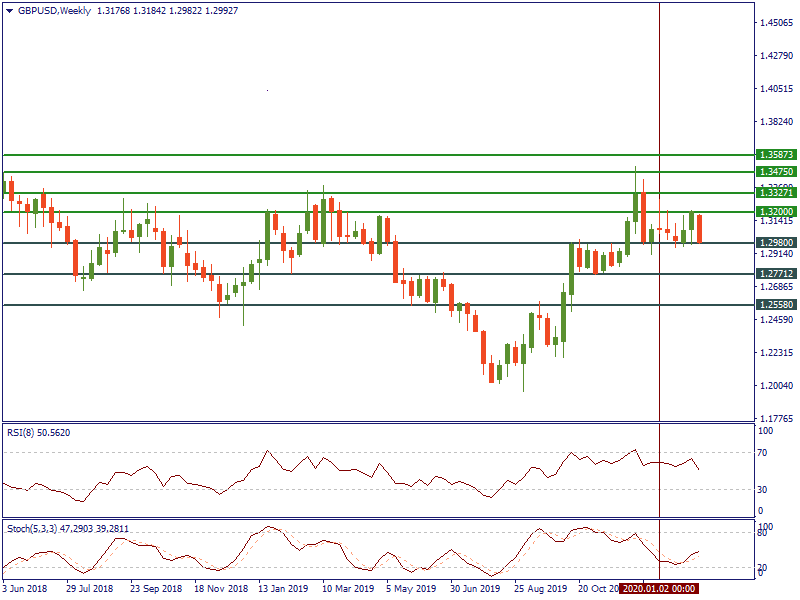

Last month, the GBP was supported by the Brexit deadline. Let us remind you the UK left the European Union on January 31. Although it’s not the end and the transition period will last until December 31, 2020, bringing more uncertainties, the GBP felt well.

In February, Brexit headlines are expected to be one of the key drivers of the currency as the risks of the longer transition period are high. Traders should take into consideration comments from both sides: Britain and Europe. If the investors see any clues on the raised uncertainties between parties, market sentiment will pull the British currency down.

Indicators of the economic environment will have a strong impact on the domestic currency. In its last meeting, the BOE warned of slow growth after Brexit. If the economic figures are bad, the GBP will slide.

On the weekly chart of GBP/USD, the pair has been trading in the consolidation zone of 1.2980-1.32. If the GBP weakens after the Brexit euphoria, we will see the fall to 1.2771, 1.2558. If the pound is boosted, the pair will break above the upper boundary of the zone, rising towards 1.3327, 1.3475, 1.3587.

February 7, 15:30 MT time - Average Hourly Earnings m/m, Non-Farm Employment Change, Unemployment Rate

February 13, 15:30 MT time - CPI m/m, Core CPI m/m

February 14, 15:30 MT time - Core Retail Sales m/m, Retail Sales m/m

February 19, 21:00 MT time - FOMC Meeting Minutes

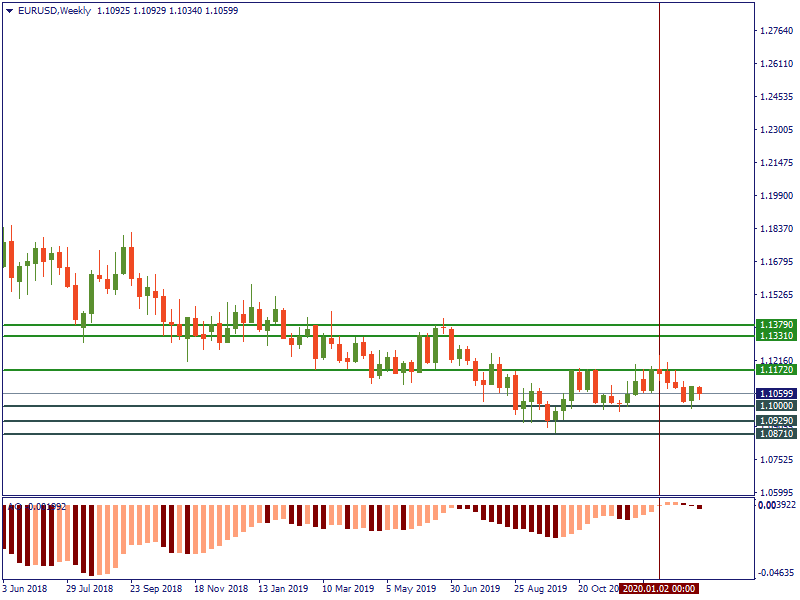

The beginning of the year was positive for the US dollar. The currency managed to pull back from the lows of July 2019. Although the US dollar lost its status of the safe-haven asset, the risk-off sentiment encouraged the strengthening of the USD. Economic releases will affect the strength of the American currency as traders are waiting for any signals on the future monetary policy of the Fed. The Federal Reserve is forecast to keep the rate unchanged. Nonetheless, the decision may change if the economic data are too weak.

On the weekly chart of EUR/USD, the pair has been suffering since January due to the strength of the USD and the risk-off sentiment. EUR/USD rebounded from the support at 1.10. However, the rise was limited. If the pair breaks below 1.10, the next strong supports are at 1.0929 and 1.0871. Nevertheless, the price and Awesome Oscillator has formed a hidden bullish divergence. The pair may rise towards, 1.1172, 1.1331-1.1379.

February 7, 15:30 MT time - Employment Change, Unemployment Rate

February 19, 15:30 MT time - CPI m/m

February 28, 15:30 MT time - GDP m/m

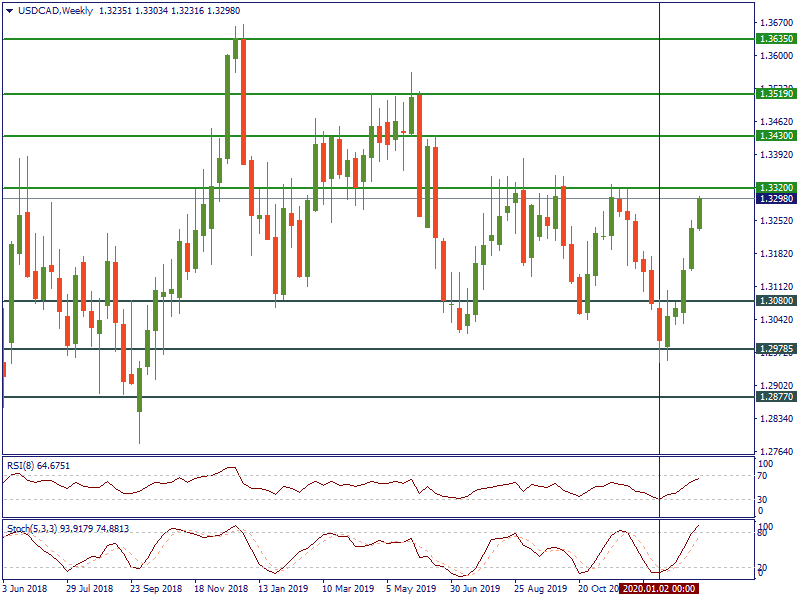

The Canadian dollar that strongly depends on the oil market suffered due to negative market sentiment. The USD/CAD pair has surged since the beginning of the year. The market data may help the CAD to recover, but the strength of the USD will be more important.

Currently, USD/CAD has been moving up to the psychological level of 1.3320. If the rebound doesn’t happen, the pair will increase to 1.3430, 1.3519, and 1.3635. In the case of the fall, previous resistances will become supports. Additional levels are at 1.3080, 1.2978, and 1.2877.

To conclude, the coronavirus will keep affecting markets during the month. If risks of the virus spread don’t decrease, risky assets will suffer more, while safe-haven one will be boosted. Economic releases will be important for currencies too. The effect won’t be long-term. Nevertheless, they may change the direction of the pairs at least for a while.

The G20 summit took place in Bali, Indonesia, on November 2022…

The deafening news shocked the whole world yesterday: the British Queen Elizabeth II died peacefully at the age of 96…

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later