The G20 summit took place in Bali, Indonesia, on November 2022…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

Facebook presented an earnings report on July 28. The company showed higher than expected results but mentioned that growth rates might slow down in Q3. The social media giant is concerned about Apple Inc.’s new rules which pinch data collection on mobile devices and advertising gains reduction after the pandemic bump. Facebook’s shares price dropped by 5% in the post-market trading session after the announcement.

Investors are concern that Facebook’s sales growth rates might slow as after the pandemic as people will spend less time on phones and laptops. Moreover, the situation gets worse as Apple’s new restrictions on data collection on iPhones prohibit tracking users’ activity and collect data without permission. This novation could put a negative effect on Facebook’s revenue as targeted advertising is a crucial Facebook tool that has given it an edge with large brands and small businesses looking to reach precise groups. According to Brach, which analyses mobile app growth, only 1 out of 4 users allow tracking their activity.

Facebook noticed that new policies in users’ privacy can make incredible damage to the small business sector, which doesn’t have enough resources to spend on broader marketing campaigns.

Chief Executive Officer Mark Zuckerberg said the company will work on the creation of a “metaverse”, a virtual space where people can communicate with each other using social platforms. Oculus, Facebook’s hardware division, last year unveiled Quest 2, an all-in-one virtual reality headset. The company is also building an augmented reality-powered wristband and glasses.

Facebook’s future also contains creating e-commerce tools for small business advertising. The service will allow potential customers to try on products in virtual space.

Those innovations might be able to solve Facebook’s problem with Apple’s restrictions and protect its digital advertising revenue from being reduced.

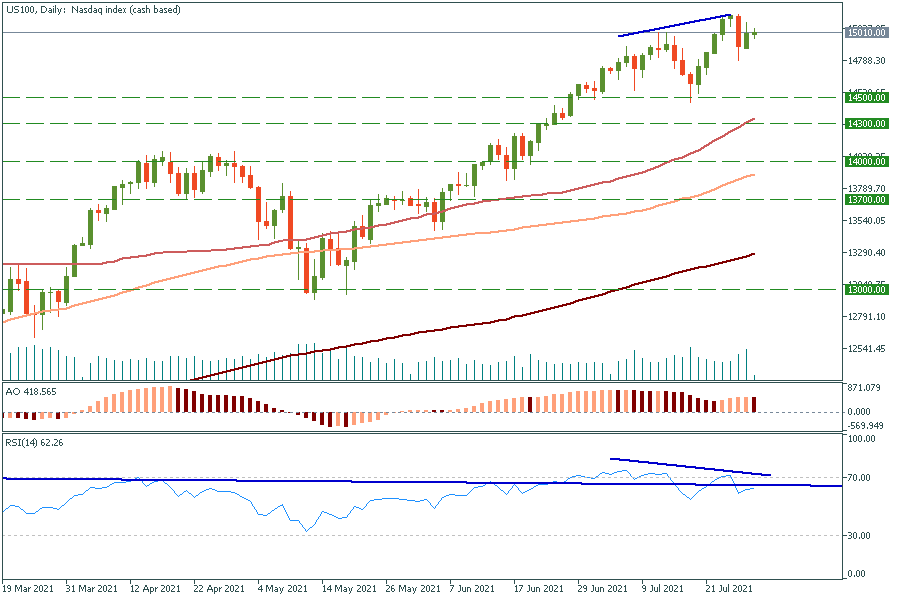

4H Chart

US100 4H Chart

Facebook is trading at $360 on pre-market, Thursday 29. On the US100 chart, the bearish divergence occurred. Facebook’s stock price correlates with the US100 index as it is one of the biggest companies included in NASDAQ. If NASDAQ drops, the Facebook stock price will follow it. In this case, the price will be heading to $341. At this point, it will be very important for US100 and Facebook to hold 14500 and $341 levels respectively. If they do, the price will fly to an all-time high. Otherwise, there will be a good shot trade opportunity with a potential target of $300.

The G20 summit took place in Bali, Indonesia, on November 2022…

The deafening news shocked the whole world yesterday: the British Queen Elizabeth II died peacefully at the age of 96…

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later