The S&P 500 had a good week due to the impressive start of Q1 earnings and favorable inflation data. In March, the consumer price index rose 5%, lower than the previous month's 6%, and met economists' expectations.

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

The first quarter of 2023 is over for the US stock market. The result was quite successful: the Dow Jones Industrial Average gained only 0.4% in 3 months, the NASDAQ100 added 19.4%, and the S&P 500 gained 6.6%.

Market indices fluctuated quite enormously in February, and if it were not for the problems in the banking sector in March, it is likely that by the end of the quarter, we would have seen a change in the trend.

The current situation with the SVB influenced the key rate movement trajectory, which, in turn, led to a market reversal, and the major indices rose significantly in March.

From the FAANG sector, the leaders in the first quarter were the shares of Meta (Facebook). Its capitalization grew by 72.5%. The most substantial growth after the securities collapse was from 2021 to 2022 (the drawdown was 75.5%).

Second place was practically shared between Apple and Amazon, which added more than 20%.

Netflix and Google are up almost 16%.

The company's 2022 report was negative. The company's revenues decreased by 1.1% to $116.6B.

The company's OPEX rose by 16.7%, mainly due to R&D. By the way, the company doesn't hide it, saying that OPEX will keep growing:

‘Operating our business is costly, and we expect our expenses to continue to increase in the future as we broaden our user base, as users increase the amount and types of content they consume and the data they share with us, for example, with respect to video, as we develop and implement new products, as we market new and existing products and promote our brands, as we continue to expand our technical infrastructure, as we continue to invest in new and unproven technologies, including artificial intelligence and machine learning, and as we continue our efforts to focus on privacy, safety, security, and content review.’

As a result, the company's Operating margin shrank to 28.7% from 39.6%, and net income fell 41% to $23.2B.

The company's ROE almost halved to 18.52%.

A fair question then arises: why are we growing?

The answer is layoffs. The company plans to eliminate another 10,000 employees, thereby improving operational efficiency.

For 2022 the company reported decently. Revenue growth amounted to 7.7%; net profit increased by 5.4%.

The company's EBITDA margin increased to 33.76%.

Thus, the rebound in Apple stock is quite fair, considering the most significant drop in capitalization over the past year.

Apple's stock is still in the most bullish solid trend since 2009. Characteristically, 2022 did not reverse the global trend but significantly slowed it down, "zeroing out" the acceleration from 2020 to 2021 inclusive.

Amazon reported strong revenue growth for 2022 (+9.3%). At the same time, the company's net profit was negative, amounting to $2.7B.

As in the case of Meta, the negative financial result was the increased cost of R&D, which significantly affected the company's OPEX (+12.76%).

As a result, the company's operating income decreased twofold.

The company also went down the path of personnel reduction. In March, it became known that Amazon was laying off 9,000 people and suspending construction of its second headquarters in Virginia.

Netflix's revenue growth rate for 2021 - 2022 has slowed—6.5% in 2022 vs. 18.8% for 2021 and 24% for 2020.

The company's net income is down slightly for 2022, at $4.5B, versus $5.1B a year earlier.

In the first quarter of this year, the company announced expansion into Vietnam (the company plans to build its headquarters there) and reduced subscription prices in several countries.

The growth rate of Google's net income in 2022 was negative. Net profit fell by 21.1%.

This year marks the beginning of a major "war" in AI research. Google has so far found itself in the role of catching up.

There was an embarrassment in February of this year - the Bard chat launched by the company gave a wrong answer about the Webb telescope. The result was an 8% drop in capitalization.

Let's do a little comparative analysis of FAANG companies.

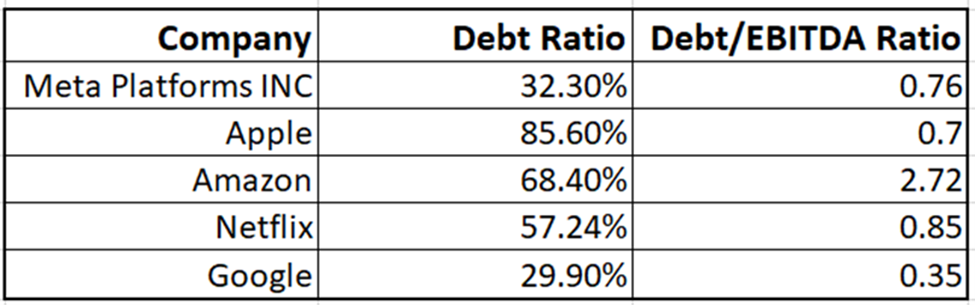

Let's start with the Debt Ratio, which is calculated as the ratio of a company's total debt to the size of its assets.

As you can see, Meta Incorporated and Alphabet (Google) have the lowest debt load - the total debt is at most even 40% of the book value of the companies assets.

Apple has the highest debt load - 85.6%, but this is compensated for by a relatively low Debt/EBITDA ratio.

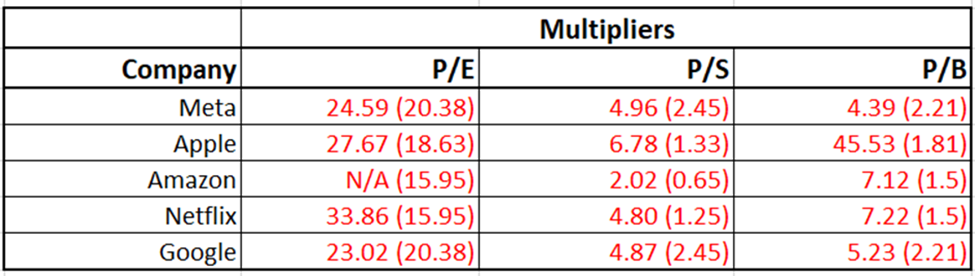

All of the companies' P/E, P/B, and P/S multiples exceed the median value in the industry (the median value is given in parentheses).

At the same time, Alphabet (Google) looks like the most undervalued company from FAANG. With a median P/E of 20.38, the company is not too overvalued.

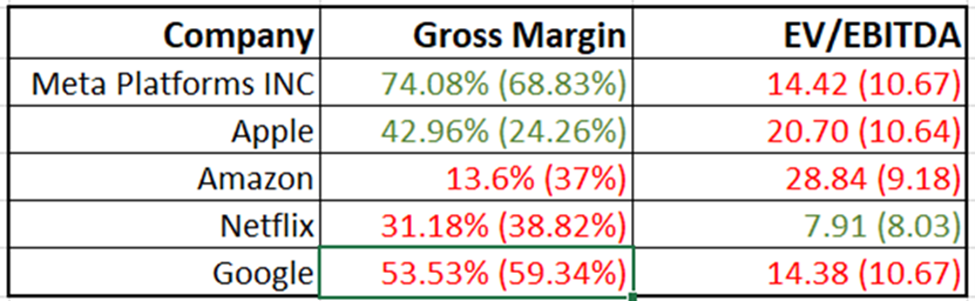

Now let's look at Gross margin and EV/EBITDA.

Meta, Google, and Netflix look pretty interesting here. Although the Gross Margin of Google and Netflix is lower than the industry, they are still close to the median value. Meta's Gross Margin is ahead of the industry.

Regarding EV/EBITDA (the lower, the better), Netflix was the more interesting, outperforming the industry and its fellow FAANG companies.

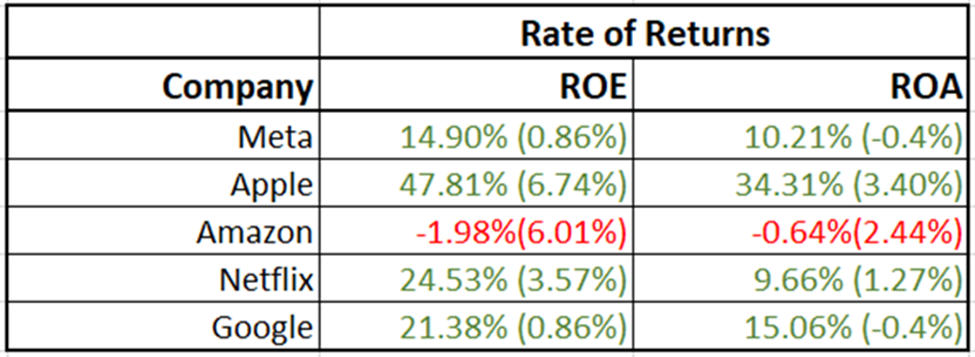

Regarding the Rate of Returns, almost all FAANG companies are ahead of the median value in the industry. Amazon can be disregarded, given the company's negative net income.

Apple has the highest rates, but Netflix and Google's ROEs also break records and demonstrate the effectiveness of company management.

Of all companies in the FAANG sector, only Apple pays dividends. The dividend yield is less than 1%.

Despite the slowdown in revenue and net income growth, Google and Netflix are attractive stocks from an investment perspective. Meta is also worth looking at. Apple's capitalization seems overvalued. At the same time, Amazon still looks frankly weaker than the rest of the FAANG companies.

Legal disclaimer: The content of this material is a marketing communication, and not independent investment advice or research. The material is provided as general market information and/or market commentary. Nothing in this material is or should be considered to be legal, financial, investment or other advice on which reliance should be placed. No opinion included in the material constitutes a recommendation by Tradestone Ltd or the author that any particular investment security, transaction or investment strategy is suitable for any specific person. All information is indicative and subject to change without notice and may be out of date at any given time. Neither Tradestone Ltd nor the author of this material shall be responsible for any loss you may incur, either directly or indirectly, arising from any investment based on any information contained herein. You should always seek independent advice suitable to your needs.

The S&P 500 had a good week due to the impressive start of Q1 earnings and favorable inflation data. In March, the consumer price index rose 5%, lower than the previous month's 6%, and met economists' expectations.

The previous year 2022, was undoubtedly tumultuous for the stock markets, with several stocks plummeting across multiple industries. Analysts have blamed the hard times on inflation, hawkish federal reserve policies, an impending global recession, and the ongoing crisis in Ukraine. This year, however, we're beginning to see some recovery in the stock markets. This article will find a few stocks worth buying this year.

In a call scheduled for January 25, 00:30 am GMT+2, Microsoft will publish the company's earnings for the final quarter of 2022 and comment on the results, projections, and outlook for the nearest future of the company.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later