The G20 summit took place in Bali, Indonesia, on November 2022…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

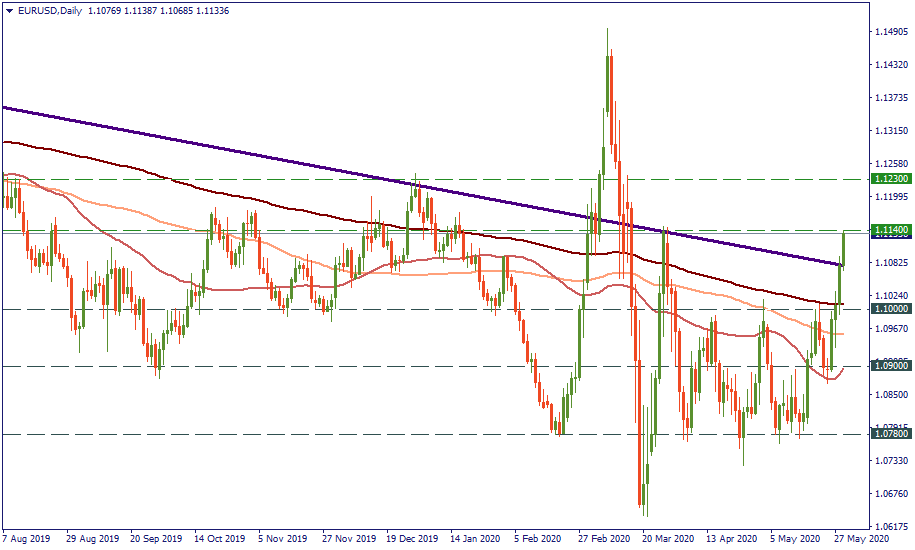

The performance of the EUR/USD has started being pretty interesting. Recently, the price breached the local resistance of 1.1000 clearing the way to the lower 3-month resistance of 1.1140. Technically, reaching there is a matter of just one confident leap, which may well occur throughout the day. But staying there would require a mid-term fundamental tilt in the balance of power between the EUR and the USD. Does it have a chance to happen? It does, but so does a scenario that the USD takes over the ride. Therefore, here is the breakdown of factors that favor one or another so that you can follow them and decide for yourself where this road leads.

The main driver behind the rise of the EUR is the advance that the European authorities are pushing forward in aiding the European economy to recover quicker and smoother from the lockdown period and the virus damage. You hear about the European Commission extending the financial aid, you hear about the German Chancellor and the French President discussing unprecedented stimulus to support the Eurozone, you hear about the European Central Bank’s quantitative ease – all of this, coupled with the decreasing virus infection and increasing economic and social activity brings back hope for the EUR.

On the other side, you have the “American” front. Lately, it has two focus points: Hong-Kong and Twitter. Hong-Kong is a stumbling block in the US-China relations that were on a relatively positive note in the beginning of the year. Now, on the contrary, we hear the Chinese officials warning that the US is igniting another Cold War, while the US President Donald Trump is unhappy with how China is handling Hong-Kong’s democratic rights and lately those of Uyghurs. Obviously, the EU is bound to pick the side, and it is the US as there is no denial of the “true” ideological line of “democracy and freedom” successfully practiced in the Western states. Twitter, on the other side, is more of an internal issue President Trump. However, it challenges the Sino-American relation in the amount of media coverage. That has to do with the November 2020 elections, the war for which has already started in the fields of the Internet comments. Therefore, although quite incomparable to the issue of Hong-Kong in terms of geopolitical importance for the US, Donald Trump cannot afford to lose this battle either. The overall tension produced by both situations is pushes away all confidence from international investors putting them back into the run-for-safety mode and making them demand the USD.

So far, the balance is tilted towards the EUR but that may be merely temporary happiness that the European currency is experiencing finally seeing the cancellation of doom in Europe. However, the long-term perspective remains highly unclear from both currencies. The ECB, for example, recognized recently that the recovery process is closer to the worst-case scenario as commented by the ECB President Christine Lagarde. The emotional impact of that recognition was clearly offset by multiple processes to set the European recovery in the best possible mode. The long-term impact, however, is still to be discovered as investors will be quick to recognize the reality – whatever it is. The same applies to the USD, however, with a more complicated correlation to the news. Generally speaking, a bad international environment would push the USD on risk-off moods. However, the long-term effect of any serious negative scenario like a US-China Trade War 2.0 would also bring the US dollar down eventually if the fundamentals of the American economic prosperity are undermined.

The long-term trend for the EUR/USD is bearish. It is “supposed” to be so as the fundamentals behind the USD are stronger anyway. Fluctuation such as we see, when the Eurozone is trying to get the better side between being on the brink of de facto dysfunctional Union and hoping for better recovery in a sudden strike of European unity only confirms the internal weakness of the Euro. The USD, on the other side, enjoys both privileges of a world reserve currency and the one supported by the strongest and largest economy in the world. Therefore, the question is: does the EUR has long-term potentials to break this trend and not fall to the support of the Moving Averages again? We will discover that soon enough. But for the moment, we can say “enjoy the flight” to the EUR/USD as it may end quite quickly.

The G20 summit took place in Bali, Indonesia, on November 2022…

The deafening news shocked the whole world yesterday: the British Queen Elizabeth II died peacefully at the age of 96…

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later