I know we've had quite an amazing run these past few month, with over 78% accuracy in our trade ideas and sentiments, and thousands of pips in profits monthly...

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

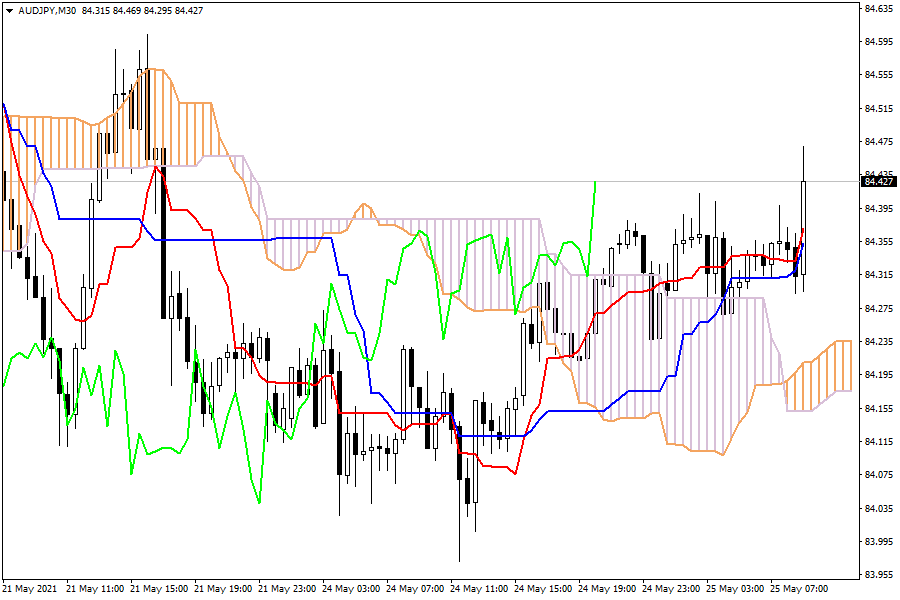

Ichimoku Kinko Hyo

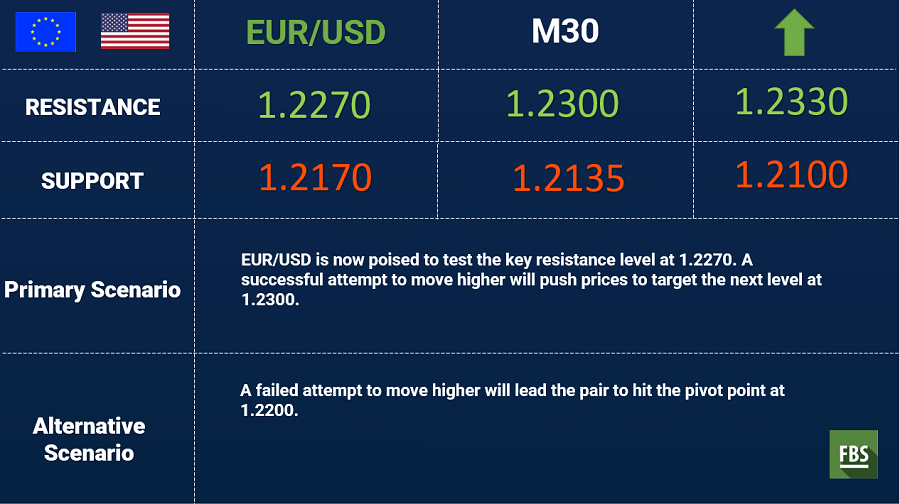

AUD/JPY: The pair is trading above the cloud. An upward pressure would lead the pair to exit further the cloud, confirming a bullish outlook.

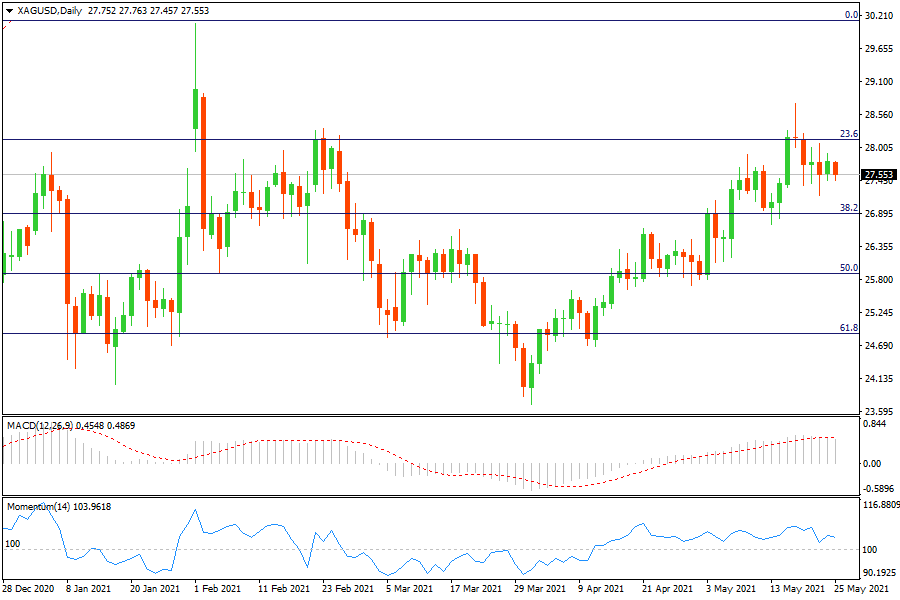

Fibonacci Levels

XAG/USD: Silver continuous to stand above 23.6% retracement area. Silver has entered a consolidation phase.

EU Market View

Asia-Pac stocks traded higher after taking the impetus from the encouraging performance in the US. Looking ahead, highlights include German IFO, US Consumer Confidence, Fed's Evans, Barkin, Quarles, ECB's Lane, BoE's Tenreyro speeches.

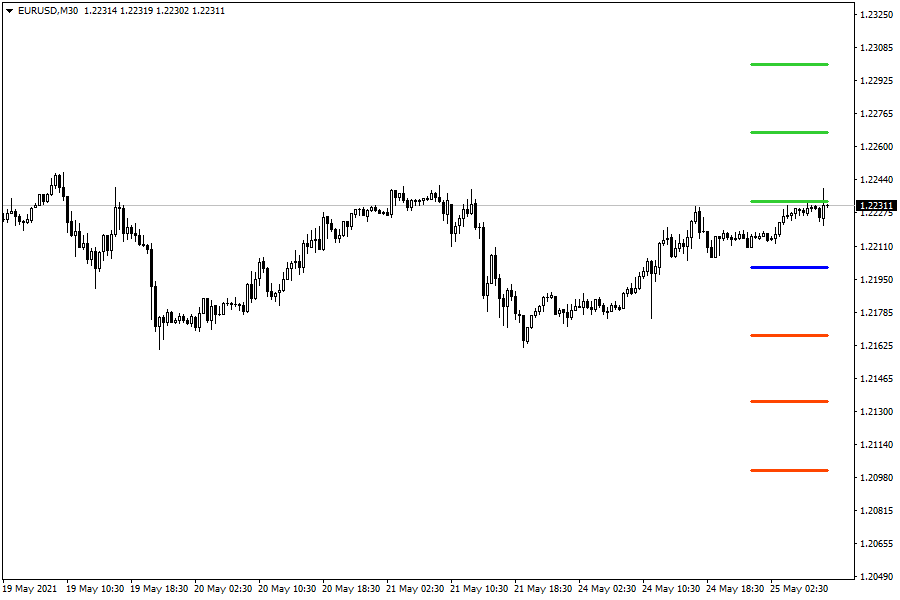

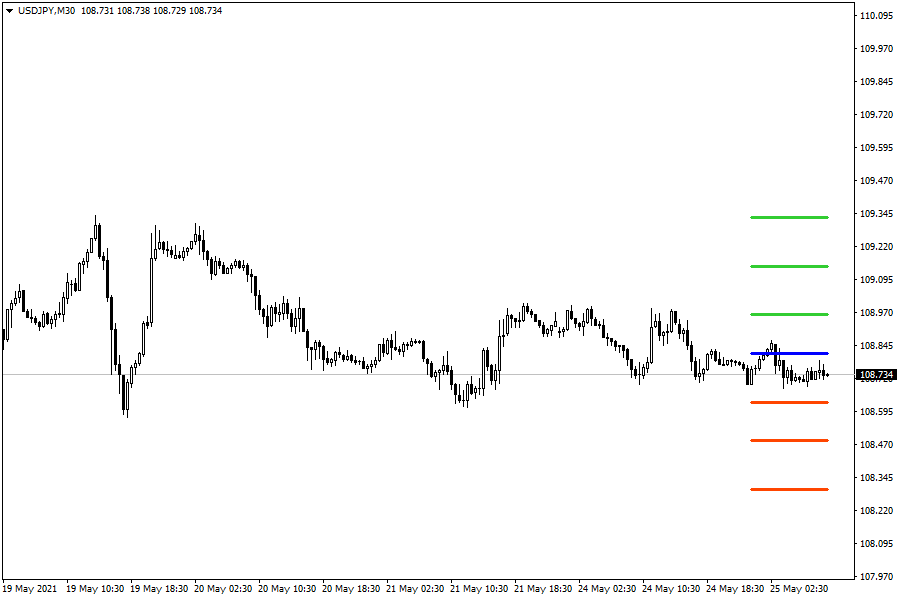

The dollar floated at the bottom of its recent range on Tuesday, as softer-than-expected U.S. data and fresh insistence from Federal Reserve officials that policy would stay on hold allayed investor fears about inflation forcing interest rates higher.

The British pound rose, inching back toward the three-month high reached at the end of last week. The Turkish lira edged slightly lower, largely unfazed by the removal of one of the central bank's four deputy governors.

Investors are heavily short dollars in the belief that low U.S. rates will drive cash abroad as the world recovers from the pandemic. They have become leery of adding to positions after an April leap in inflation cast doubt on the policy outlook, but seemed to find reassurance in data and Fed remarks overnight. Traders have a laser-focus on inflation, the policy response to it and any data or remark that could shed light on either since huge bets on stocks, bonds and currencies are all predicated on the assumption that low rates are here to stay for a while.

The German economy shrank by a bigger than expected 1.8% on the quarter in the first three months of the year as coronavirus curbs crushed private consumption in Europe's largest economy, data showed on Tuesday.Ahead on Tuesday is a German business survey, a series of U.S. housing updates and a handful of policymaker speeches in Europe, Britain and the United States, which will all be parsed for a reading on inflation.

Gold was down on Tuesday morning in Asia, but remained near its highest level in more than four months, as investors digested comments by U.S. Federal Reserve officials that sought to assuage inflation concerns. Fed Governor Lael Brainard, Atlanta Fed President Raphael Bostic and St. Louis Fed President James Bullard said a surge in prices, due to bottlenecks and supply shortages as the number of COVID-19 cases continue to fall, would not be surprising. However, they also reiterated that any price gains are likely to be temporary.

EU Key Point

I know we've had quite an amazing run these past few month, with over 78% accuracy in our trade ideas and sentiments, and thousands of pips in profits monthly...

Futures for Canada's main stock index rose on Monday, following positive global markets and gains in crude oil prices. First Citizens BancShares Inc's announcement of purchasing the loans and deposits of failed Silicon Valley Bank also boosted investor confidence in the global financial system...

Investor confidence in the global financial system has been shaken by the collapse of Silicon Valley Bank and Credit Suisse. As a result, many are turning to bearer assets, such as gold and bitcoin, to store value outside of the system without...

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later