We have outlooked several promising Forex pairs and the result can surprise you!

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

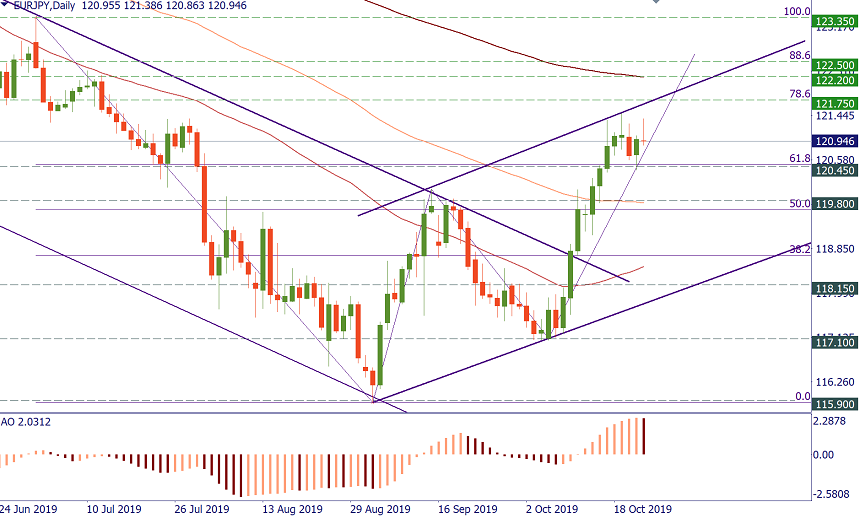

EUR/JPY has been moving up since the start of September. At the beginning of October, it formed a higher low. The pair is currently consolidating between 61.8% Fibo of the July-September decline at 120.45 and the 78.6% Fibo level at 121.75. All in all, EUR/JPY is at the upper edge of its channel. It looks like there’s a need for correction to the downside. The decline below 120.40 will open the way down to the support at 119.80 (100-day MA).

On the upside, the next obstacle above 121.75 is at 122.20 (200-day MA). So far, the price action in line with the bearish harmonic “Bat” pattern: that means that the pair may get to test levels around 122.20/50, but then turn lower. As a result, it may be possible to pursue higher levels on positive news from the euro area, though one will have to be careful with that.

We have outlooked several promising Forex pairs and the result can surprise you!

4H Chart Daily Chart We sent out a signal yesterday to long EUR/USD between 1…

4H Chart Daily Chart EURUSD declined back yesterday after trying to test its 1…

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later