China's economy is rocketing. On the other hand OPEC+ countries take the decision to cut the production. What will be the impact on the oil price?

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

Bloomberg reported that ‘the S&P 500 Energy Index has outperformed the broader S&P 500 by 21 percentage points so far this year, with the top-performing stock, Devon Energy Corp., gaining a whopping 167%’.

Now, energy stocks have outperformed the broader market for the first time since 2016! Moreover, analysts believe that this trend will continue despite the global shift to renewable energy resources.

“There’s a massive appetite to invest in it because it’s just spewing out cash right now,” said Rafi Tahmazian, whose energy producer-focused fund is up 91.2% year to date.

As usually, opinions are divided. Some experts predict that oil prices may experience a correction. WTI oil (XTI/USD) is expected to drop to $66 per barrel by the end of the first half of 2022 and $65 per barrel by the year-end. Still, Tahmazian claimed energy companies could continue to be profitable with lower oil prices.

However, the OPEC+ alliance has upgraded the global oil demand forecast for the first quarter of 2022. The OPEC members believe that the omicron impact will be mild and short-lived. Indeed, the outlook for more robust demand in combination with the current supply limits can keep oil prices afloat.

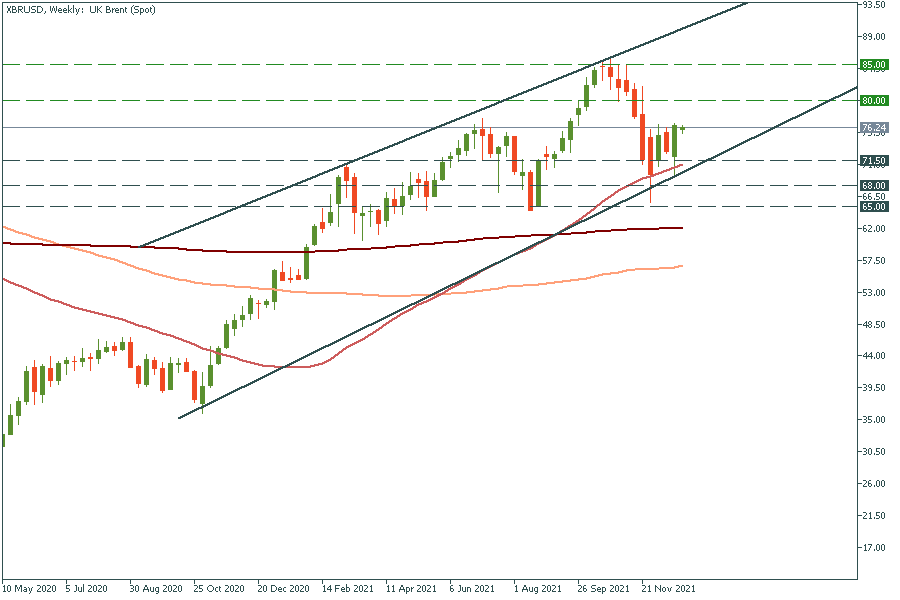

XBR/USD is moving inside the ascending channel. The key resistance level lies at $80.00. If crude oil manages to break above this level and close there, then oil has all chances to rally further to the October peak at $85.00. Support levels are at the intersection of the 50-week moving average and the lower trend line at $71.50 and $68.00.

Royal Dutch Shell #RDSB

Linde Plc #LIN

Anglo American Plc #AAL

XTI/USD (WTI oil)

XBR/USD (Brent oil)

XNG/USD (Natural Gas)

China's economy is rocketing. On the other hand OPEC+ countries take the decision to cut the production. What will be the impact on the oil price?

Oil prices fell to a three-month low following the release of US inflation data which was in line with expectations…

The US dollar index has lost around 12% since October 2022 till its local low at the end of January 2023.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later