Information is not investment advice

Hey guys! So, April is fast approaching, and there's already an array of over 30 high-impact news releases; that is, almost every single trading day! As a result, in order to be better positioned to 'milk' all of these volatile events in the market, here are a few trade ideas to consider.

Disclaimer: Now, I know we've had quite an amazing run these past few month, with over 78% accuracy in our trade ideas and sentiments, and thousands of pips in profits monthly, you must know I am not a 100% accurate AI. So, do not bet all your money on these ideas without proper risk management!

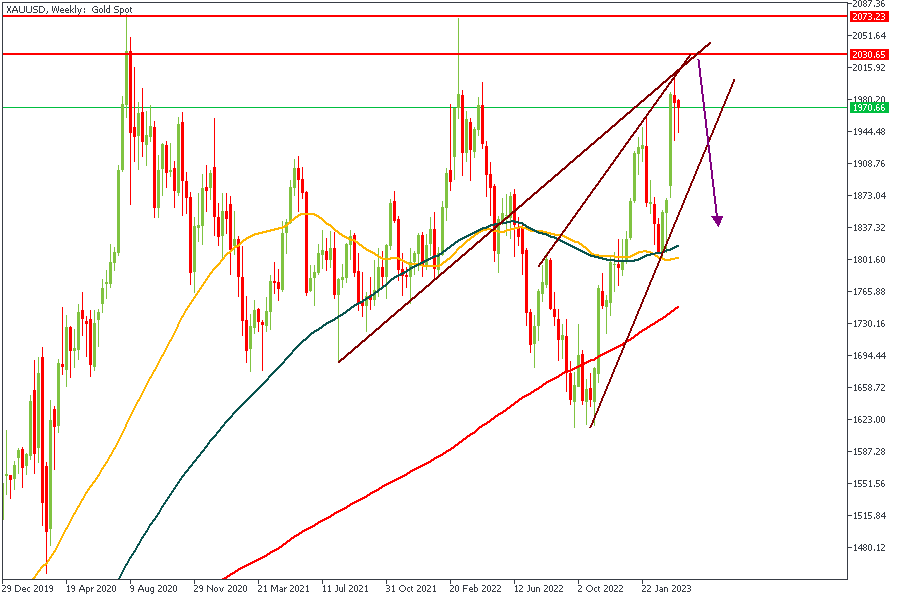

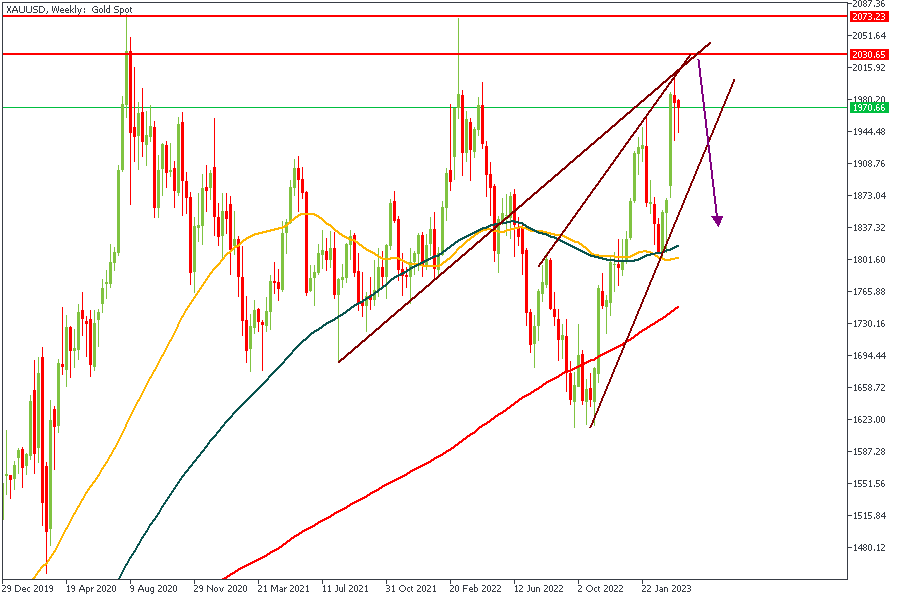

Here is our dear friend Gold, from the weekly timeframe. We can clearly see price confined within a rising wedge, and approaching a major area of resistance (a pivot zone). There is also a supply zone at the peak of the inducement candle (that previous rejection candle with the long wick). Based on the confluence of the two resistance trendlines, the supply zone, the pivot zone, and the 88% Fibonacci retracement level, I am quite confident of this playing out.

Analysts’ Expectations:

Direction: Bearish

Target: $1842

Invalidation: $2074

NZDCAD is currently trading within a rising channel that is inside a bigger descending channel, and has recently been rejected from the resistance trendline of the channel. I expect price to head into the supply zone once more for a confirmed bearish push. Once price breaks through the support trendline, it would sail very quickly towards the 200-Day MA.

Analysts’ Expectations:

Direction: Bearish

Target: 0.83000

Invalidation: 0.85800

EURNZD is at a crucial point on the Daily timeframe. First of all, we have the resistance trendline from the previous high, then followed by the resistance trendline from the rising wedge. Don't forget, we also have the resistance zone and a rally-base-drop supply zone at the site of the price action. All these combined to give me a clear bearish sentiment.

Analysts’ Expectations:

Direction: Bearish

Target: 1.75700

Invalidation: 1.69450

There'a hardly any need for a lengthy explanation of this GPBCHF chart. The major factors to consider here are; the resistance trendline, the rally-base-drop supply zone, the 200-Day MA, and the general overview of the market structure.

Analysts’ Expectations:

Direction: Bearish

Target: 1.11100

Invalidation: 1.15700

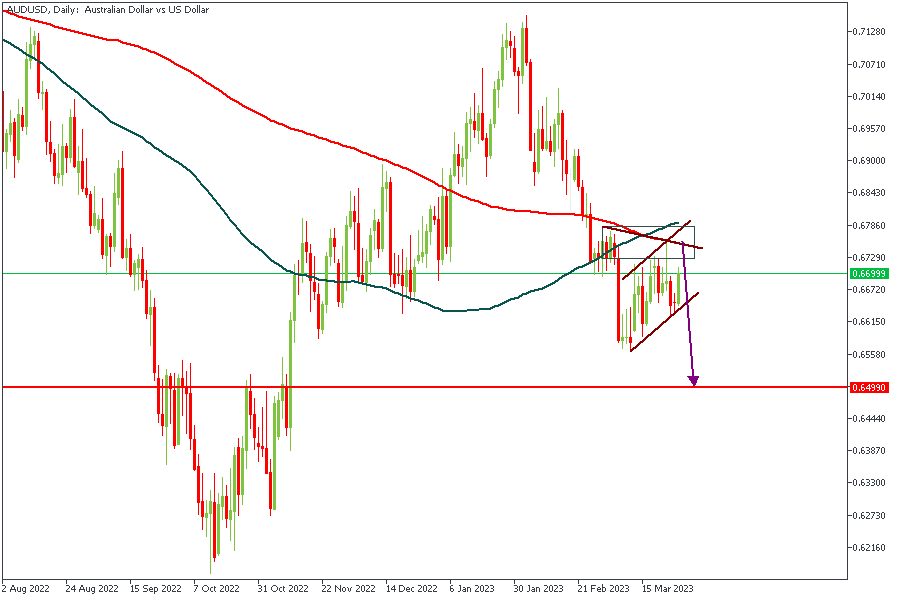

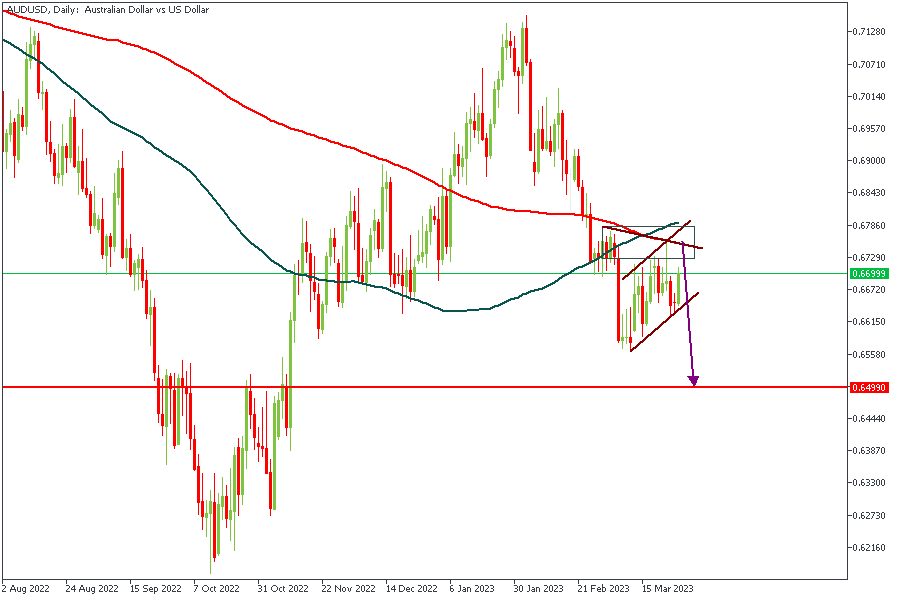

AUDUSD is another interesting idea I found. You see how the resistance trendline aligns with the rally-base-drop supply zone and the 200-Day MA? I see it too! And based on the general overview of the price action market structure, bearish seems the rational way to go.

Analysts’ Expectations:

Direction: Bearish

Target: 0.64330

Invalidation: 0.67860

CONCLUSION

The trading of CFDs comes at a risk. Thus, to succeed, you have to manage risks properly. To avoid costly mistakes while you look to trade these opportunities, be sure to do your due diligence and manage your risk appropriately.

LOG IN

Legal disclaimer: The content of this material is a marketing communication, and not independent investment advice or research. The material is provided as general market information and/or market commentary. Nothing in this material is or should be considered to be legal, financial, investment or other advice on which reliance should be placed. No opinion included in the material constitutes a recommendation by Tradestone Ltd or the author that any particular investment security, transaction or investment strategy is suitable for any specific person. All information is indicative and subject to change without notice and may be out of date at any given time. Neither Tradestone Ltd nor the author of this material shall be responsible for any loss you may incur, either directly or indirectly, arising from any investment based on any information contained herein. You should always seek independent advice suitable to your needs.