The G20 summit took place in Bali, Indonesia, on November 2022…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

Sino-US trade tensions, Brexit, global economic slowdown are the main external risks for any economy, especially for the emerging one. In 2019, many countries survived crisis, recession and currency’s plunge. Will 2020 be more productive for developing economies or the situation may become even worse? Let’s figure it out.

Points of view in this article will differ as analysts and leading economists can’t come to a consensus.

Analysts predicting recovery of the emerging markets base their forecasts on the global monetary easing cycle, the weak dollar and the relief in the trade tensions. EM high-yielding currencies will likely to dominate against low-risk investments as economists predict the global economic improvement.

Morgan Stanley believes in the portfolio reallocation to emerging markets in 2020. According to the bank, the world economic growth may slow down in the fourth quarter of 2019, but we will see a recovery in the beginning of 2020. The growth in the EM is anticipated to be higher than in developed markets because of the continuation of the rate cuts. Morgan Stanley predicts central banks of the developing countries to keep decreasing rates in 2020. However, the rate cuts will lead to the depreciation of the domestic currencies.

ING Financial Markets also declared the growth outlook favors emerging markets against their developed peers.

The recovery is expected in Brazil and Mexico. The Brazilian real is assumed to gain the most versus the US dollar. Although Brazil has been still recovering from the currency weakness of 2018 and the long recession, macro measures should support the earnings growth.

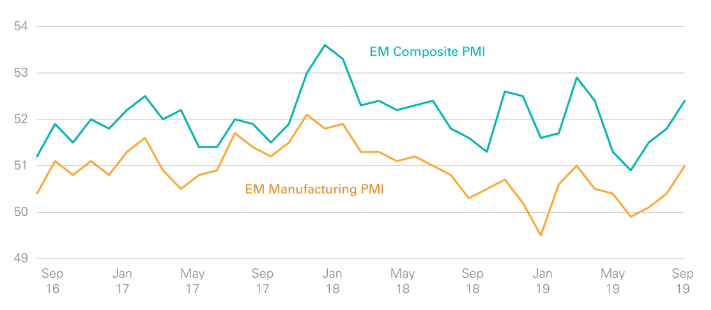

Source: Markit

Not all economists are confident about the global economic stabilization, considering the risk of the recession. However, they still believe it will not affect the larger emerging market economies except Argentina. Moody’s predict the higher economic growth above 4.5% in the emerging markets versus under 1.5% growth in the advanced economies. Nevertheless, the growth figures will be below their historical average rates especially in such countries as Mexico, Russia, and India. Citi also highlights the strength of Mexico and the Mexican peso that is supported by the monetary policy that will be more cautious with smaller rate cuts.

USD/MXN has been consolidating during the last couple of years. 2020 may be a time for the breakout.

Credit Suisse declares good investments in emerging market equities because of their cheapness caused by the trade pressure, China’s economic slowdown, and strong USD.

Let’s sum up. Emerging markets are expected to recover next year. However, the strength of the domestic currencies will highly depend on the monetary policy. If the economic growth is followed by the rate cuts, the domestic currencies will depreciate. In the case of the smaller number of cuts, the currencies will get a chance to rise.

Emerging markets suffered a lot in 2019 and some analysts believe the recovery will not happen in 2020 due to internal factors, uncertainties around trade wars and the possible global economic recession.

Turkey, Brazil, and Mexico are among economies that may go down. Surprisingly, some analysts believe in risks for Mexico and Brazil. Economists consider internal problems, the questionable effectiveness of reforms and trade issues with the US as risk factors. Goldman Sachs put under pressure Turkey and Brazil in case of the further rate cuts.

The ING sees a risk of the recession in the South African economy as the last quarter data showed a contraction by 0.6%. As a result, the rand may decline but stay quite good for the times of the economic slowdown.

In times of lower interest rates of developed countries’ central banks, analysts recommend using the carry trade strategy that allows borrowing money in currencies with low rates and investing in those with higher rates.

To conclude, we can say that the strength of the emerging markets in 2020 will depend on global economic growth, China-US trade truce, and the internal environment. The recovery of the economics will be positive for currencies if only monetary easing measures are not used to encourage growth. Otherwise, the domestic currencies may prolong the slide.

The G20 summit took place in Bali, Indonesia, on November 2022…

The deafening news shocked the whole world yesterday: the British Queen Elizabeth II died peacefully at the age of 96…

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later