The G20 summit took place in Bali, Indonesia, on November 2022…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

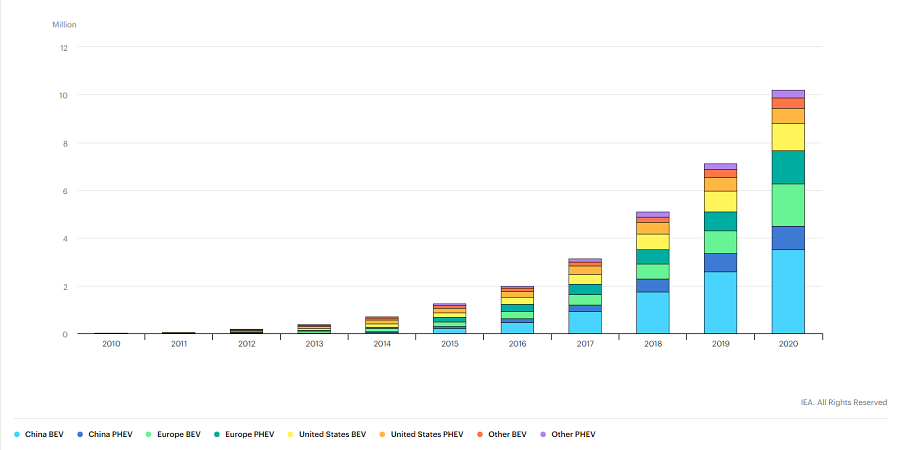

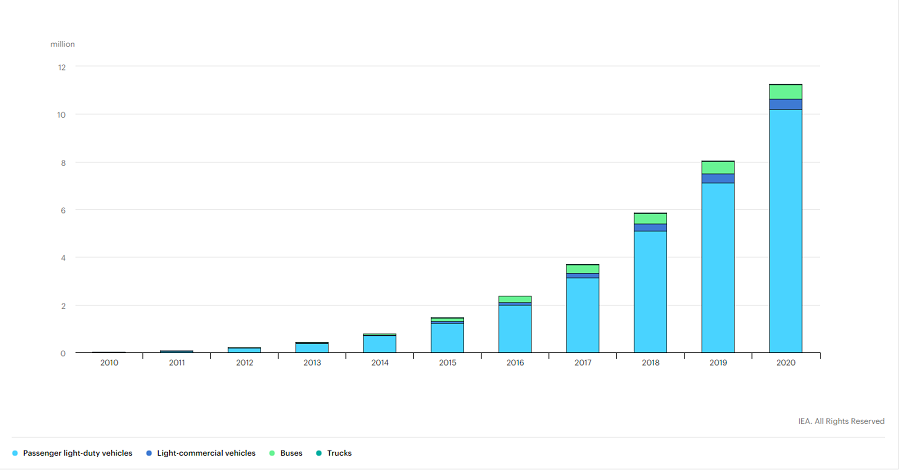

By the end of 2020, there were 10 million electric cars registered in the world. The number of electric cars registrations increased by 41% in 2020. Electric bus and truck registrations reached global levels of 600,000 and 31,000, respectively

Global electric passenger car stock, 2010-2020

Source: https://www.iea.org/data-and-statistics/charts/global-electric-passenger-car-stock-2010-2020

Three factors supported EV markets during the pandemic:

Vehicle manufacturers stay optimistic about the electrification of the car industry. 18 out of 20 announced plans for new electric vehicles models. The availability of heavy electric models is also going to grow together with the four main manufacturers pointing towards the electric future of this segment.

Despite the great support from the government’s campaigns for the EV markets during the pandemic, the amount of stimulus governments spend to support this sector decreases year-to-year. This fact points to the increasing consumer demand: producers are now able to survive on their own.

The near-term perspectives are looking great as, during the Q1 of 2021, global electric car sales grew by 140% compared with the same period of 2020.

In the most common scenario, analysts predict global EV markets to reach 145 million models by 2030, which will be 7% of the road vehicle fleet. However, if governments activate their plans to achieve global ecological plans the global EV market might grow up to 230 million units (12% of the road vehicle fleet).

Global electric vehicles stock by transport mode, 2010-2020

Despite the success of the EV market during the last years, the ecological problem is still far from being solved. Although new technologies in battery and mass manufacture will reduce the costs of EVs, governments will have to cooperate to reach the climate goal by creating and promoting zero-emission EVs.

Electric Vehicles Initiative

In 2010 the Electric vehicles Initiative (EVI) was established under the Clean Energy Ministerial (CEM). The main goal of this forum is to understand the main political problems connected with electric mobility and accelerating the adoption of EV’s worldwide. At 2020-2021 15 countries are taking an active part in this organization, these are Canada, Chile, China, Finland, France, Germany, India, Japan, Netherlands, New Zealand, Norway, Poland, Portugal, Sweden, and United Kingdom.

EV30@30 Campaign

In 2017 the EV30@30 Campaign was launched. The main goal of this campaign is to accelerate EVs deployment all over the world and reach the number of 30% EVs sales in each country member. By 2021 besides 14 countries this campaign is supported by 30 organizations including C40; FIA Foundation; Global Fuel Economy Initiative; Hewlett Foundation; Natural Resources Defence Council; REN21; SLoCaT; The Climate Group; UN Environment Programme; UN-Habitat; World Resources Institute; ZEV Alliance; ChargePoint; Energias de Portugal; Enel X; E.ON; Fortum; Iberdrola; Renault-Nissan-Mitsubishi Alliance; Schneider Electric; TEPCO; Vattenfall and ChargeUp Europe.

Europe

In 2020, the overall European car market fell by 22%. However, the amount of EVs doubled to 1.4 million overall. Germany registered 395,000 new EVs, France reached the level of 185,000 new units. The UK doubled the number of EVs and reached the level of 176,000 EVs over the country.

China

The overall number of new car registration dropped by 9% during 2020 in China. However, EVs sales grew up to 5.7% comparing with 4.8% in 2019. Subsidies aimed at EV market growth were due to expire by the end of 2020, but the government decided to cut them by 10% and extend them till 2022.

The United States

The overall US car market dropped by 23% in 2020, but the electric one felt stronger. In 2020, 295,000 new EVs were registered. Government stimulus decreased in 2020, as the federal tax credits for Tesla and General Motors reached the limit.

Governments across the world spent USD 14 billion on EVs market stimulus during 2020. This is 25% higher than in the previous year, but the overall tendency declines as the total amount of spending dropped by 10% from 2015.

Consumers, on the contrary, spent USD 14 billion, which is 50% more than they did in 2019. These facts describe the global tendency of rising interest from consumers and a great potential for the EVs market in the future.

Tesla

Tesla became profitable in 2020, for the first time since it was founded. Earnings are forecast to grow by 32% per year. Short and long-term liabilities can be covered by short-term assets. Fundamentally Tesla seems to be a strong company, but the giant P/E ratio makes investors feel scared about the future of the stock price.

Daily chart

On the daily chart, the descending triangle has occurred. Moreover, the price “retested” this triangle from the top twice, which means the pattern is strong enough. The closest resistance is $700, which is a strong psychological level. If the price breaks this level, it will fly up to $770 shortly.

GM

General Motors’s earnings grew by 90,6% over the past year. Moreover, earnings are expected to grow by 8.15% per year in the future. GM’s current net profit margins (7.3%) are higher than last year (3.5%).

Daily chart

It looks like GM stock price follows the S&P500 movement since the market crash in March 2020. After the price dropped on Monday, July 19, it shows decent growth. If it breaks the resistance at $58, which is the cross point of 50 and 100-day moving averages, it will have a chance to renew the historical maximum, overwise, it will go down at least to the 200-day moving average at the price range between $51 and $52.

Ford

Company’s earnings are expected to grow 17.3% yearly. Ford stock looks to be undervalued based on the predictions of future cash flows. It has a good PE ratio (13.9x) compared to the US Auto industry average (23.9x), which makes Ford an attractive company for investors.

Daily chart

As well as GM’s, Ford’s price will try to break through the 50-day moving average. In the positive scenario, the price will have a chance to fly up to $16 resistance. On the flip side, it will try to break the 100-day moving average again and go down to the $11.5 price level if it does.

The G20 summit took place in Bali, Indonesia, on November 2022…

The deafening news shocked the whole world yesterday: the British Queen Elizabeth II died peacefully at the age of 96…

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later