Recently, for the first time in two decades, the euro reached parity with the US dollar…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

The second earnings season of 2022 has almost begun. From banks and tech stocks to cars and the retail sector: in this outlook, we covered the most promising releases of this summer and made several projections on the companies’ prospects. The result will surely surprise you because the bullish market has ended, and it’s now way more complicated for retail traders to raise some funds.

Large banks reported a record-high increase in revenues in 2021. Usually, banks benefit from rising prices and rates because people deposit more money which can be used in loans and investments. Here’s what we have for the bank sector (banks’ reports are delivered before the market opens):

JP Morgan Chase (JPM): July 14;

Morgan Stanley (MS): July 14;

Wells Fargo (WFC): July 15;

Citigroup: July 15;

Goldman Sachs (GS): July 18;

Bank of America (BAC): July 18;

Deutsche Bank AG (#DBK): July 27.

As for 2022, Charlie Munger, one of the wealthiest investors in the world, holds most of his money in Bank of America. Almost 45% of his money is there. Wells Fargo comprises 36%, and US Bancorp is a place for 3.5% of Munger’s funds. Let’s look closer at Bank of America, then.

In a report released on July 1, Mike Mayo from Wells Fargo (interesting overlap, doesn’t it?) maintained a Buy rating on Bank of America, with a price target of $55.00. The company’s shares closed last Tuesday at $30.78, close to its 52-week low of $30.64.

The divergence on the H4 chart hints at a soon reversal to the $33.00. However, the downtrend won’t end until the stock is under the 100-daily MA (the $35.00 level).

Bank of America H4 chart

Resistance: 33.00, 35.00

Support: 30.00, 29.20

Remember the dotcom bubble of 2000? Some technological stocks lost 95% of their capitalization back in the day. We don’t insist on repeating that movement, but most companies may go significantly lower. Their reports will pave the way for the decline. Here’s what you should follow:

Google: July 26, after the market close;

Meta (FACEBOOK): July 27, after the market close;

Amazon: July 28, after the market close;

Twitter (TWTR): July 28, before the market opens;

Apple: July 28, after the market close;

Intel: July 28, after the market close;

Activision Blizzard (ATVI)l August 2, before the market opens;

AMD: August 2, after the market close;

Nvidia: August 24, after the market close.

Keep an eye on Nvidia, as the company may reveal fascinating news about crypto-mining GPU sales. The stock will be quite volatile. However, the report is far away from today, so that we wouldn’t bother you with analysis right now. Don’t forget to check the site, as more news about Nvidia and AMD will be coming closer to the dates of the reports.

Long story short, here are the most important retail reports on this earnings season:

Pepsico: July 12, before the market opens;

Coca-Cola: July 26, before the market opens;

Walmart: August 16, before the market opens;

eBay: August 3, after the market close.

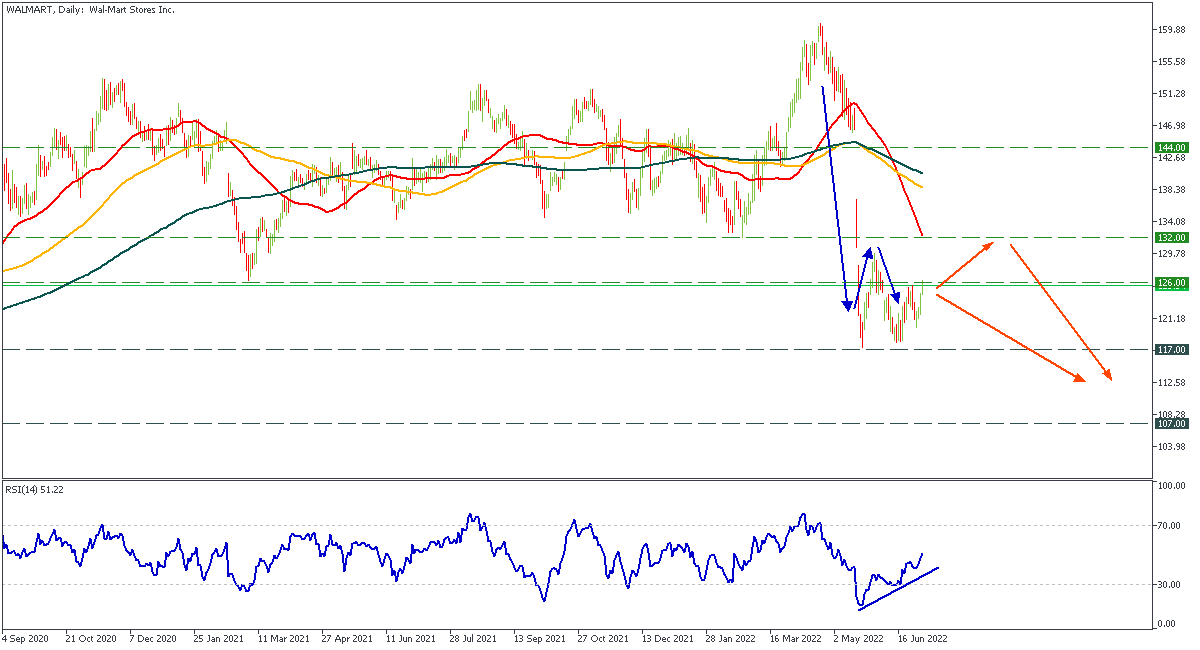

Inflation landed like a thud in the retail sector in May as industry leaders reported on the impact of higher costs on their operations. It wasn’t long before investors responded, and some of America’s largest retailers saw the biggest declines in their stock prices since the market crash of 1987. We predicted the movement with fantastic accuracy, but the time has come to make another one.

Unlike Nvidia, which has enough time to surprise us with crypto, Walmart’s movements are slower. While overall spending remained robust, consumer spending has eased in some previously growing categories, causing them to flatline or even drop.

Much of the year-over-year growth in grocery spending is due to inflation, not greater consumption. Consumers are paying more but consuming less in categories such as gasoline, travel, and restaurants. We expect the trend to continue (and inflation to be present) for the next year, so the mid-term outlook for Walmart is somewhat bearish.

The stock may still reach the resistance of $132.00 in several months due to the RSI divergence and market fluctuations. Despite the short-term bullish scenario, the support of $117.00 is likely to be broken after the report release.

Walmart daily chart

Resistance: 126.00, 132.00, 144.00

Support: 117.00, 107.00

Recently, for the first time in two decades, the euro reached parity with the US dollar…

The stock market has reversed, and now it’s going lower and lower…

Whenever inflation exceeds 4% and unemployment falls below 5%, the US economy enters a recession in two years.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later