The G20 summit took place in Bali, Indonesia, on November 2022…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

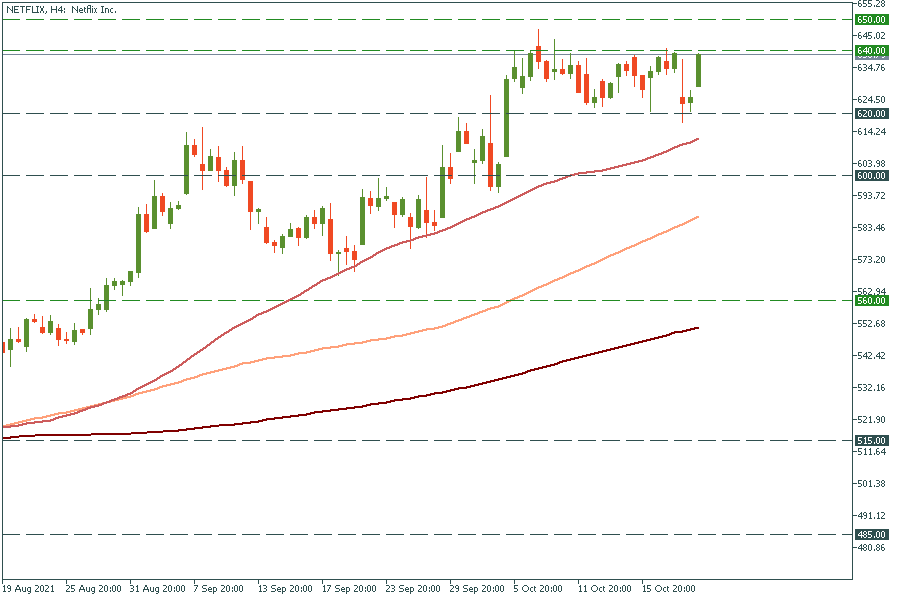

Netflix published better-than-expected earnings results for the third quarter and also surprised investors with the huge subscriber growth due to the popular "Squid Game". Netflix added 4.38 million subscribers, while Wall Street analysts forecasted 3.86 million. Wow! However, the market reaction was mixed. Yesterday's session finished in a goalless draw: nor bears neither bulls took control. The candlestick closed with no shadow, which means the opening and closing prices were equal.

Why did Netflix drop on good results?

In short, ‘buy the rumor – sell the fact’. All investors knew that the “Squid Game” has astonishing popularity, that’s why they were expecting good results from the company and priced in the good outcome well ahead of the release. When the actual number was known, the stock fell.

If Netflix breaks above the resistance level of $640.00, it will rocket to $650.00 – the next psychological mark. Support levels are $620.00 – the recent lows and the psychological level of $600.00.

Tesla has reported better-than-expected earnings results for the third quarter. EPS: $1.86 vs the forecast of $1.52. Notably, the report marked the 9th quarter of profit in a row. Earlier, Tesla announced it delivered 241,300 electric vehicles globally in the third quarter, which was Tesla’s record number for quarterly deliveries.

The Tesla stock tends to rally (look at the long green candles at the chart below) ahead of the earnings releases but then drops when the actual numbers are known. Thus, today, the stock can fall in the short term. However, it is going to gain from such good results in the long term as it showed investors that it is doing its business great.

Tesla was rallying so rapidly as it even broke the upper line of the channel. Now it has broken the resistance level of $880.00. Thus, it can rocket to the psychological mark of $900.00. The support is at $850.00.

The pharma giant Johnson & Johnson published earnings that beat analyst expectations, sending its price soaring (look at the long green candle in the chart). The Covid-19 remains the main threat, that’s why JNJ is likely to gain in the 4th quarter due to its vaccine. Besides, the Food and Drug Administration authorized Covid-19 vaccine booster shots made by Johnson & Johnson, which is really great for Johnson & Johnson.

The stock price of JNJ has failed to cross the resistance zone of $165.00-166.00 (the 200-day MA and the 38.2% Fibo level) and reversed down. It has broken below the support level of $163.00 (the 23.6% Fibo level). It may fall to the psychological mark of $160.00.

Don't know how to trade stocks? Here are some simple steps.

The G20 summit took place in Bali, Indonesia, on November 2022…

The deafening news shocked the whole world yesterday: the British Queen Elizabeth II died peacefully at the age of 96…

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later