The G20 summit took place in Bali, Indonesia, on November 2022…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

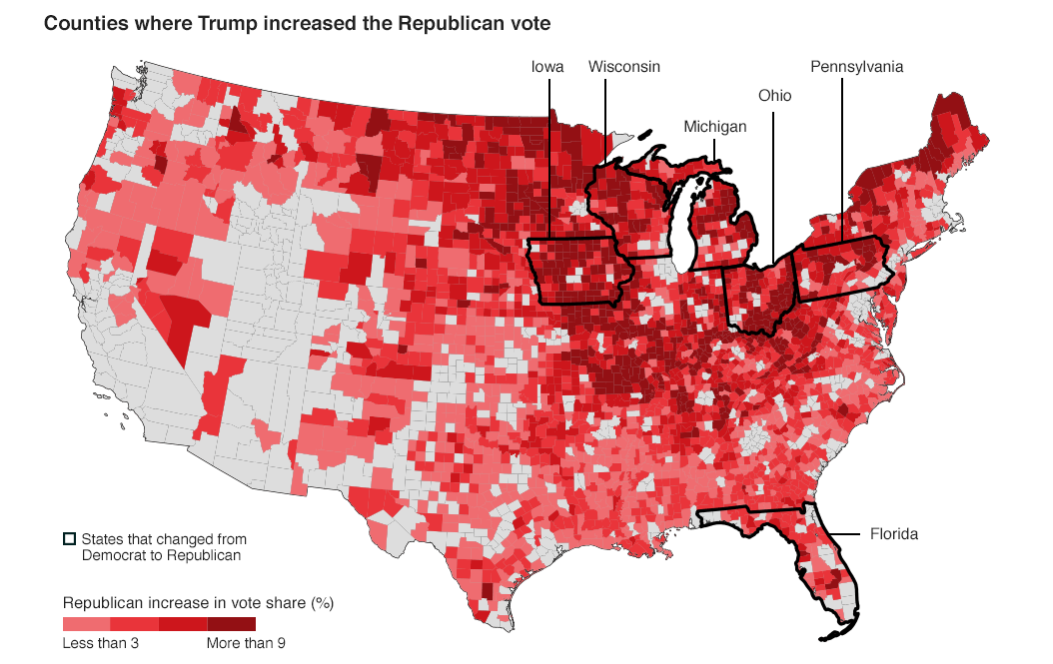

Remember the 2016 election campaign? Back then, the Republican Donald Trump had not won the elections yet, and the main competition for leadership in the Democratic Party was between Hillary Clinton and Bernie Sanders. The analysts expected the smooth victory of Democrats, and the Trump’s plans on “Making America great again” were seen as quite uncertain. Several months after, one November night shook not only the minds of the fellow Americans but the US dollar as well.

Sourced by: BBC News

The US working class liked Trump's straightforward promises more than the words of Hillary Clinton. As a result, the Republican nominee secured his victory with 306 Electoral College votes versus 232 votes for the Democrats. This victory was seen as dramatic for the stock market and the US currency. What were the chances that the scandalous millionaire would strengthen the markets?

But here we are four years after: the grass is still green, the sun shines, and S&P is trading at the all-time highs above $3,300. As for the US dollar, its index has experienced ups and downs since 2016, but the overall performance is still strong.

Now, as we are heading towards the next US Presidential election, let’s have a look at the current candidates and see how their promises may affect the USD after the election. Will the “Trump effect” continue to strengthen the markets?

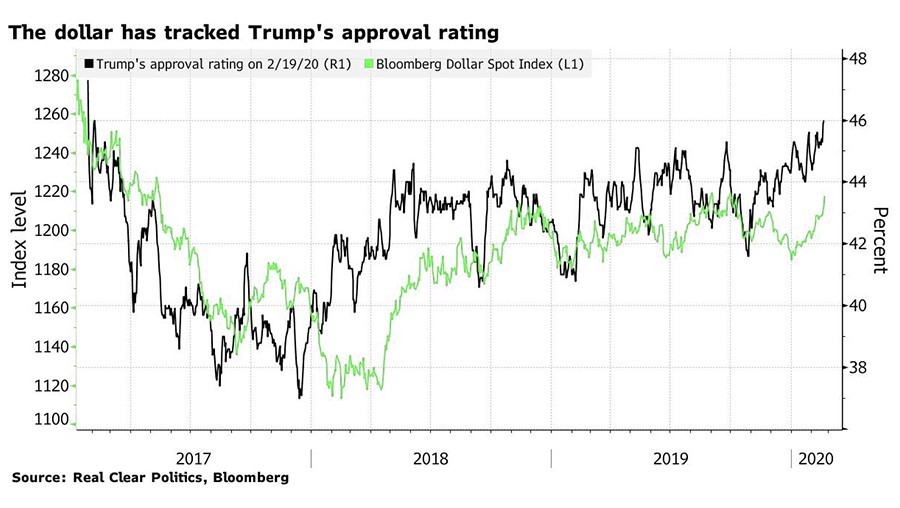

How many times have you heard of Trump's complaints about the US dollar's strength? We guess, quite a lot. The US President judges the Fed policy almost every month, calling for more rate cuts and even asking the Fed Chair Jerome Powell to leave. Surprisingly, despite Trump's rhetoric, the US dollar has been performing pretty well during the period of Trump’s presidency.

The report by Bloomberg even notes a noticeable correlation between the US dollar and the approval rating of Donald Trump.

Well, the charts indeed look similar, and this fact may be discussed from many points of view. Wall Street truly likes Donald Trump’s opinion on lower tax rates and deregulation. As the US and China finally found some common grounds, businessmen will certainly like the US president to go for a second term.

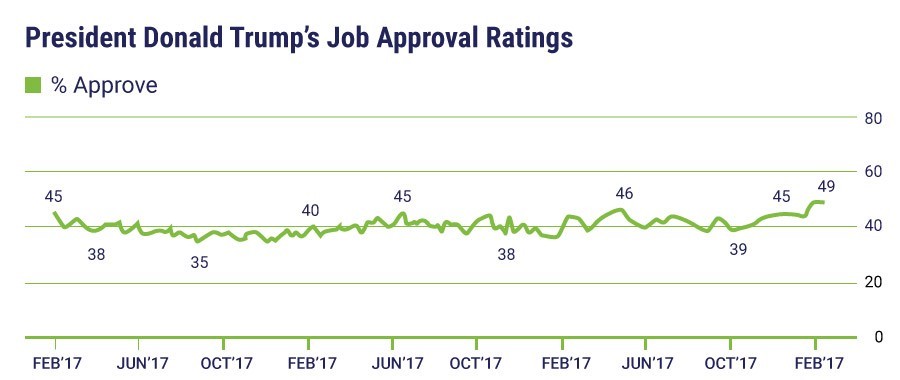

Being the leading Republican candidate after the acquittal in the Senate impeachment deal, Donald Trump enjoys his strengthening approval rating, which has reached 49% in February, according to Gallup poll.

What positive factors drive the approval of the US president so high? The campaign of the current president gives hints on another round of tax cuts and focuses on a large amount of infrastructure package. Mr. Trump also announced an incredible trade deal with India – the countries plan to start selling military helicopter deals. We hope to hear more details of his campaign soon.

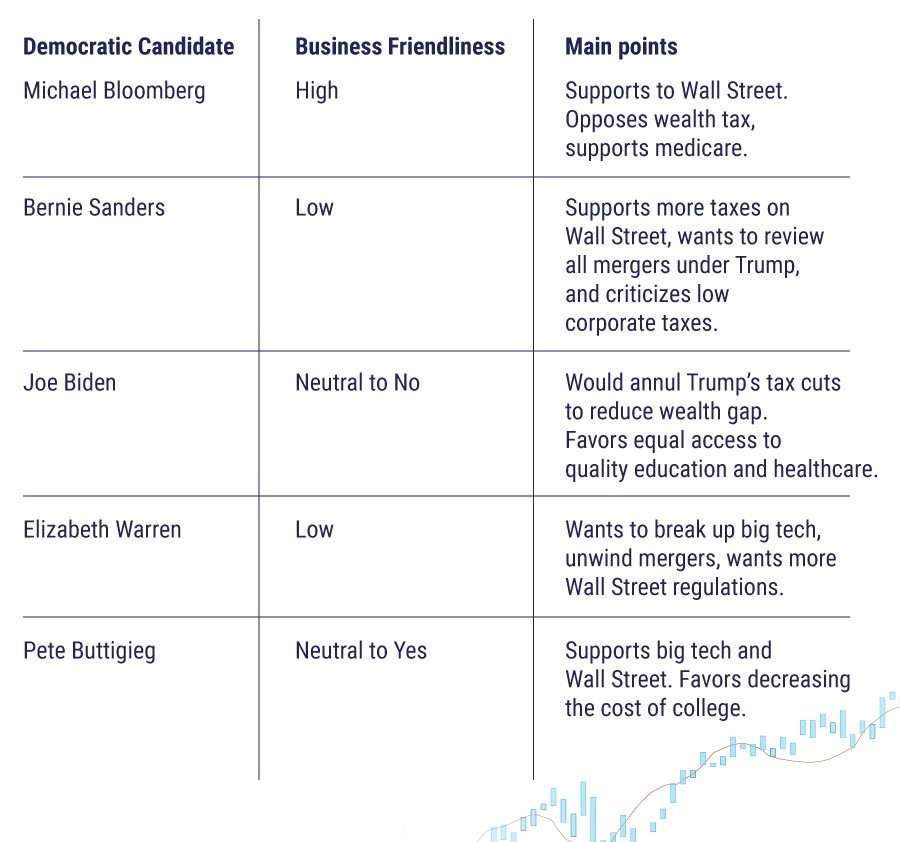

As for the Republicans’ main rival, the competition for a leadership position keeps being tough. For now, we are waiting for more primaries and caucuses. Until then, the national polling averages show Senator Bernie Sanders taking the lead, followed by the former Vice President Joe Biden and the former New York City mayor Michael Bloomberg. What do all of them have in common? All of the candidates propose raising taxes on wealthy Americans and businesses. These tax reforms are aimed to form the new government spending in health care, education, housing, climate change, and other socially important spheres. The biggest plans for raising taxes belong to Bernie Sanders, who is famous for his social-democratic views.

Some analysts doubt the positive effect of these tax measures. According to their views, it will be easier for wealthy people to avoid taxes. At the same time, the bigger taxes may hit average Americans as well, those who invest their money in long-lasting plans.

And what about the financial markets? No matter who takes the lead in the Democratic Party, the switch of the ruling party will weaken the US currency amid the expected uncertainties. In particular, the progressive ideas of Bernie Sanders may cause more risks to businesses, than the ideas of Michael Bloomberg. As a result, the stock market and the USD may weaken in the short term. Though, its further direction will depend on the next comments and disclosure of details in the nominees’ election programs. As for the tax reform, we may refer here to the words by the US economist Hans Sennholz, who said that implementation of the higher taxes on rich people and businesses causes expropriation of capital investments that helps to create jobs and improve production levels. Let’s not forget that the raise of taxes may result in more capital outflows into the offshore zones and selling of the USD. So, it is a factor for the US dollar weakness.

Below we listed the main Democratic Party’s candidates and their potential impact on businesses.

Sourced by Stifel

With more than 8 months until the US election, the things may change pretty fast. Back in 2016, only a small number of analysts predicted the victory of Donald Trump. Others forecast low chances of the USD strength during Trump's presidency. We recommend waiting for the Democratic leader to be elected at first to see whether his/her views may provide a challenge to the Republican ones or not. After that, judging by the details of their election program, we may suggest about the possible impact on the US economy.

The G20 summit took place in Bali, Indonesia, on November 2022…

The deafening news shocked the whole world yesterday: the British Queen Elizabeth II died peacefully at the age of 96…

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later