Suddenly, the US Dollar Index fell 6.70% over the last two weeks, marking the biggest decrease in the currency since 2020.

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

Gold is one of the most popular trading assets in the world, with a several age history and an unbelievably large market capitalization of $11 trillion. There are 100 ounces of gold in 1 lot, and it is a $1.8 million order size. Therefore, if you want to control your trades in the FBS trader application or Meta Trader 4/5, you can trade as little as 0.01 lot of gold (which is only 1 ounce of the metal). This article will guide you through the possible outcomes for the current gold movement after the US reveals their economic data and clarifies the amount of future rates hikes. So get yourself comfortable, and let’s start!

Gold had dozens of fruitful movements in both 2020 and 2021. When the world thought the economy was about to recover, our shiny friend lost 19% of its capitalization in several months. But then, another coronavirus strain emerged. So it doesn’t matter whether you are a bull or a bear trader; gold movements in 2021 gave opportunities to everyone, with 13% surges and 11% plunges.

Next week we will have a couple of events that will affect the gold price. The first is the US core retail sales on February 16, 15:30 GMT+2. It shows a change in the total sales value at the retail level, excluding automobiles. High numbers mean economic strength. Thus, gold might slide lower after the release. The second is FOMC meeting minutes, where we will get more information on rate hikes and monetary tightening. The record will be available on February 16, 21:00 GMT+2. Hawkish tones from the Fed members will press on the gold. You can get the data first in FBS economic calendar; it is fast, convenient, and easy to use.

Expectations of rate hikes, inflation concerns, and coronavirus pressure the gold price. The market is about to decide the fate of the metal for 2022. As far as we know, this year, five rate hikes are expected to fight inflation both in the US and in other countries. Due to relatively slow economic recovery, money flows not to the gold but to even more defensive assets, like the Japanese Yen and Swiss Franc. We expect that if the inflation stops at current levels (7-8%), XAU/USD will struggle to rise and may slide down to 2020 levels ($1700-1600).

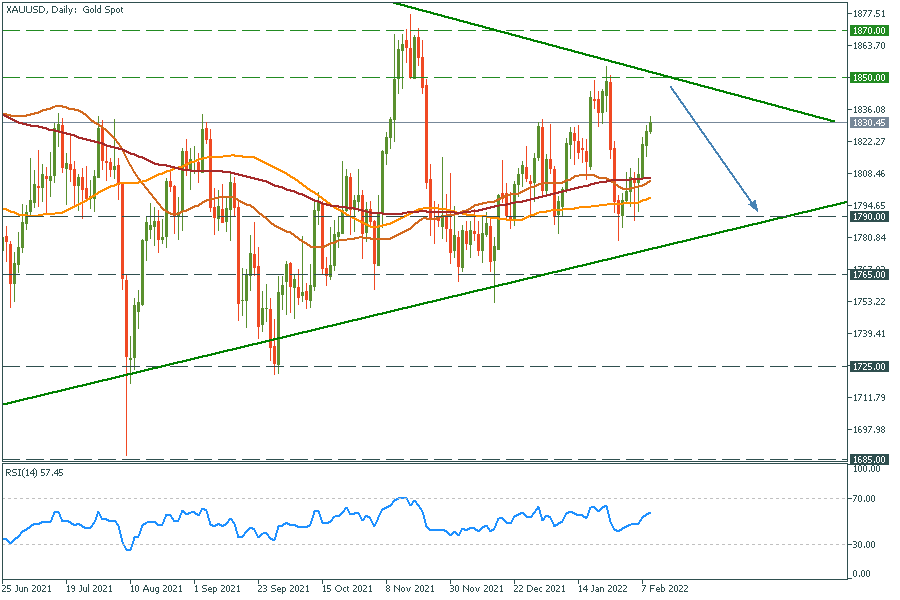

As for February, gold may reach the upper border of the descending trendline at $1855, and it is the perfect opportunity to wait for a reversal or a breakout of this level. (Enter the trade only after the confirmation from the chart).

XAU/USD daily chart

Resistance: 1850; 1870

Support: 1790; 1765; 1725

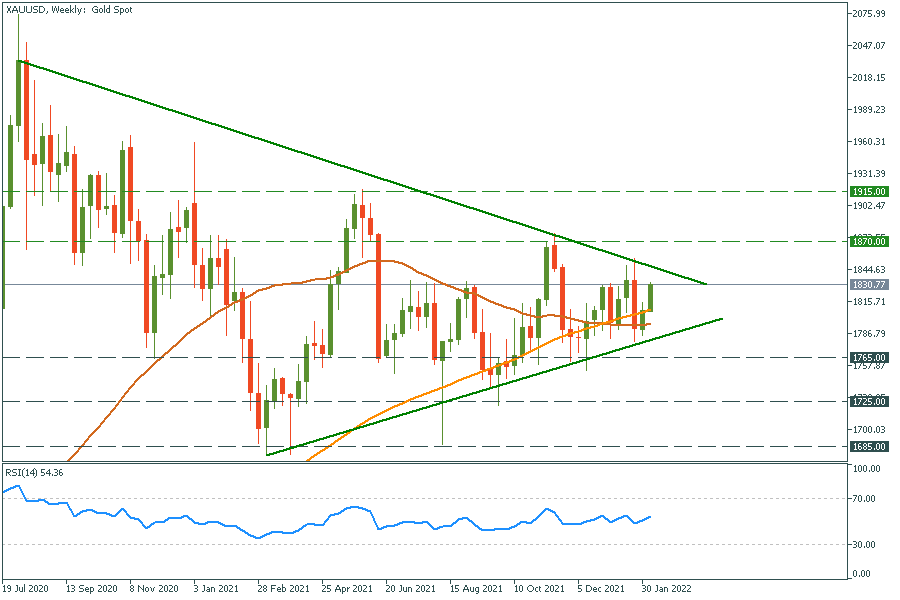

On the bigger timeframe, gold is moving sideways in the symmetrical triangle. Triangles are tricky price formations as they often work poorly. The best way to predict the future price movement is to wait for a breakout and then trade in the breakout direction. Apart from technical indicators, we think gold will be weak for the next several months due to rates hikes and economic recovery. We expect the metal to reach $1725 and $1685 levels in the 2-3 months. To learn more about technical analysis and get trade ideas daily, visit the FBS website; we post our daily thoughts on the market and are sure you’ll find them helpful.

XAU/USD weekly chart

Resistance: 1870; 1915

Support: 1765; 1725; 1685

You can trade XAU/USD contract for difference with FBS. It doesn’t matter whether you are buying or selling; you have the same sweet conditions for all your trading desires. And the best time to open a trade is now. Good luck!

Suddenly, the US Dollar Index fell 6.70% over the last two weeks, marking the biggest decrease in the currency since 2020.

Many investors treated gold as a protection against inflation. However, last week, gold lost its major support and dropped despite rising inflation. Why did it act like this?

US dollar gains ahead of the US CPI data on July 13th, pressing gold to new lows!

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later