The G20 summit took place in Bali, Indonesia, on November 2022…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

Currently, more and more analysts talk about the impact of the coronavirus on the financial markets. You saw such headlines as “coronavirus is pushing gold and Japanese yen up” or “Asian stocks are down due to the spread of the virus”. Have you thought why global markets react to the non-economic event? Have you found the answers? If you haven’t, read the article to get clues on the correlation between the epidemic and the financial markets; and the forecast for the upcoming market moves.

Coronavirus is a wide range of viruses that cause such illnesses as the common cold. The virus usually applies to animals. However, there are cases when it spreads from animals to people. That is what happened in China. The virus appeared in Chinese city Wuhan on January 31, 2019. Since that time, it has expanded around the world including such countries as Thailand, Japan, the Republic of Korea, and the US. It is a deadly virus that has already taken the lives of 25 people, 830 are infected.

Due to the expansion, the virus has been influencing markets more and more.

It may sound strange that the medical virus has an impact on the financial world. Traders know that natural disasters and epidemics always affect the market. However, usually, it’s the market of the suffering country. This time, the coronavirus has affected not only China but the whole market sentiment. Let’s figure out why this has happened.

Last year, market sentiment was shaken by the risk of the global recession. Chinese economic data was one of the barometers of the global economic slowdown due to US-China trade tensions and the financial power of Beijing. The virus led to the shutdown of three Chinese cities. As a result, analysts think it may affect the Chinese economy in general.

Economists see another risk in the expansion of the virus. It is mostly noticed in Asian countries. However, one case was already registered in the US. If the epidemic spreads around the world, the risks for the world markets will increase even more.

The third point we should consider is the fragility of market sentiment due to the Brexit and geopolitical instability, thanks to Mr. Trump, US-Sino trade war is not among risks for now. As a result, any negative event is considered as a risk factor.

The virus may have a short-term effect if the vaccine is invented soon and the escalation of the virus decreases. In the case of the virus expansion around the globe, more markets will be affected.

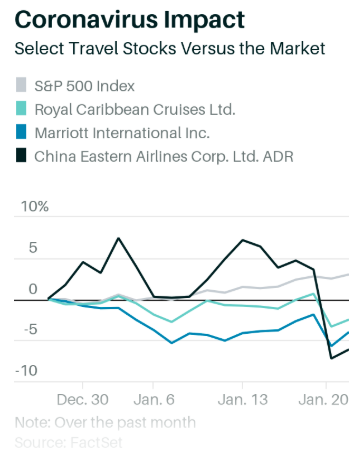

The stock market is a great indicator of risk sentiment. The virus negatively influenced the Asian stocks and stocks of companies that heavily rely on Chinese tourists. As a result, world travel-based companies suffered a lot.

Source: FactSet

On January 23, Shanghai’s stock market fell by almost 2.8% because China’s government closed off all public transportation in Wuhan. Two other cities were also blocked.

Source: Investing

Investors worry that the country’s Lunar New Year holiday that starts on Saturday will increase the spread as Chinese citizens will travel domestically and abroad. The Chinese market will be closed during the week. However, US stocks can stay under pressure.

It seems the Chinese yuan was not affected by the virus that much. The USD/CNH pair had been suffering until January 20, 2020. That means the Chinese yuan was strong enough. The recovery of the pair could be caused by the correction factor that happens every time the pair rises/falls for a long period. As a result, we can see that the impact of the virus on the Chinese currency is not that strong now. If the epidemic increases, the CNH may suffer. Then the pair will target 6.97, 7.0110, and 7.0335. If the effect is limited, the yuan has chances to appreciate, pulling the pair to 6.90, 6.86, and 6.8280.

Some analysts talk about the strong positive effect of the coronavirus on the refuge assets. However, we can doubt the strong effect.

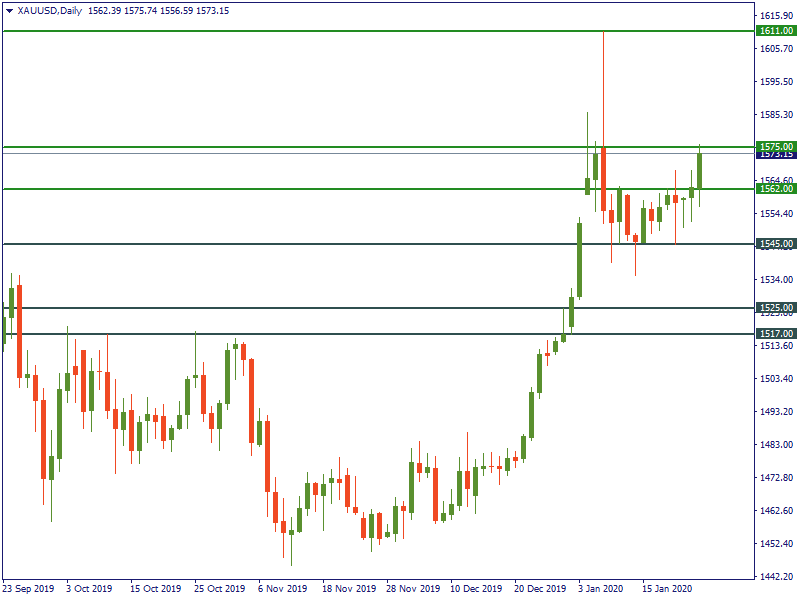

Nowadays, gold is a major safe-haven asset that reacts to global risks. If we follow the direction of the XAU since December 31, 2019, we will see that the XAU/USD pair is not that strong during the past weeks. US-Iran geopolitical crisis was the biggest driver of the pair at the beginning of the year. As a result, the pair reached a high of 1,611. After the crisis passed, the pair rebounded and has been trading within a narrow range of 1,545-1,611. All its ups and down mostly related to the strength of the USD.

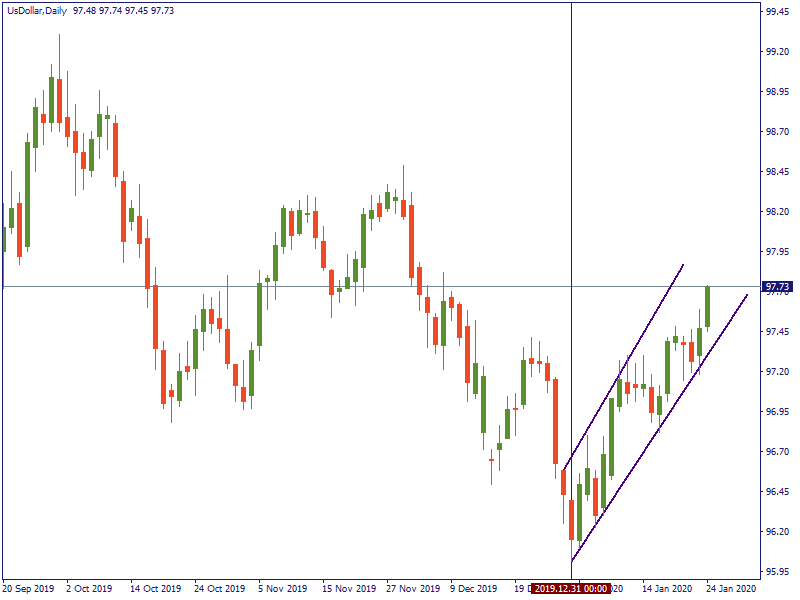

As for the US dollar. The greenback has been recovering since the beginning of the year. And this happened not because of the risks of the virus. The USD is a weak safe-haven asset that means the negative market sentiment could not push the American currency up that much. The US-China war melting and US-Iran tensions were more important factors for the USD.

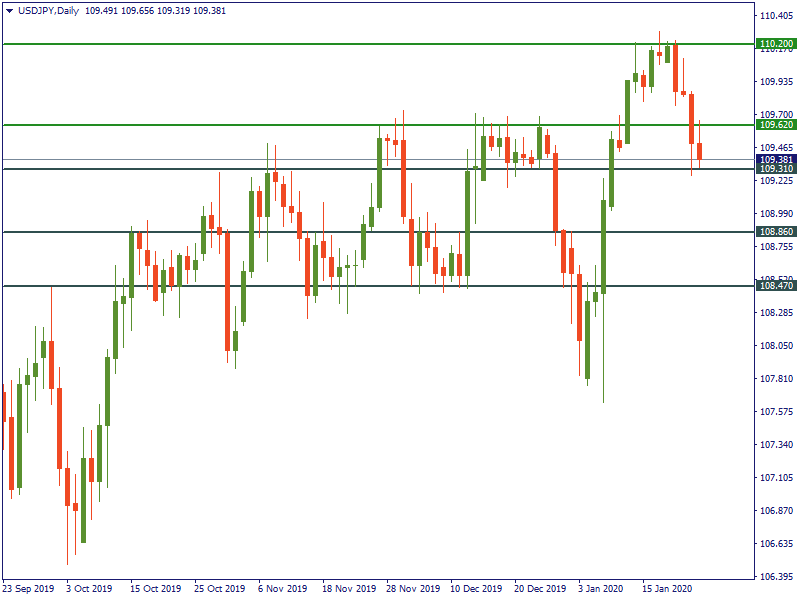

As for the Japanese yen, if you read our article “Gold and Japanese yen: who is not a safe-haven asset anymore?”, you know that the JPY is unlikely can be considered as a refuge. If we take a look at the chart of the USD/JPY, we will see a decline of the pair. Some consider the fall as the strength of the Japanese yen caused by the negative market sentiment, however, we should remember that previously the pair reached highs of May 2019 and the correction was expected. The pair rebounded from 110.20 and fell to 109.31. If the decline continues, the pair will target 108.86, 108.47. In the case of the upward movement, previous supports will become resistances. And additional resistance levels can be placed at 109.62, 110.20.

Talking about the safe-havens, we can say that the market mood will be their driver. Nevertheless, the effect will be short-term and may only arise in the times of the negative news.

We don’t underestimate the impact of the virus on market sentiment. However, it may be not that strong as some analysts claim. The spread of the virus will negatively affect the global market outlook. Until then, we may expect a negative impact on the Asian markets. To catch the market mood, follow the news with FBS.

The G20 summit took place in Bali, Indonesia, on November 2022…

The deafening news shocked the whole world yesterday: the British Queen Elizabeth II died peacefully at the age of 96…

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later