The S&P 500 had a good week due to the impressive start of Q1 earnings and favorable inflation data. In March, the consumer price index rose 5%, lower than the previous month's 6%, and met economists' expectations.

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

China’s stock market performed well last week amid weakening lockdown measures. Traders are becoming bullish and greedy. Should we follow the crowd and buy HK50? This article will help you break it down.

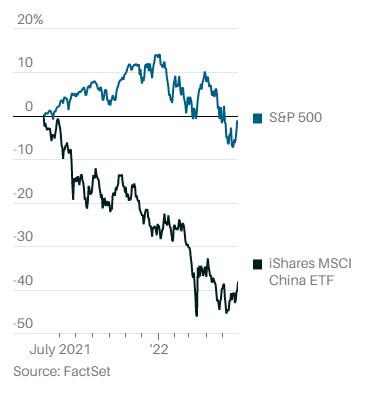

The iShares MSCI China (MCHI) index plunged year-to-date compared with the US stock market (US500 or S&P500). It had lost 25% over the last 12 months, and the US500 is only 2% down.

You need to know that the divergence between these indices is not a miracle or a random fluctuation. The US Federal Reserve printed trillions of dollars and injected them into the stock market. At the same time, China had many difficulties, starting from the Evergrande crash. One of the most prominent developers with over $340 billion worth of assets has been on the brink of collapse. Step by step, China saved the day, and Evergrande is still alive.

However, Covid-19 stroked again, putting the Chinese government in a precarious position. The “zero covid-19” policy made the country lock down its citizens, crashing the supply chains and shrinking production. The damage from those policies is in the billions of dollars. As for the start of Summer 2022, lockdowns are easing, and China is getting back to business. Is it the end of bad times?

A lot of the negatives are priced into share prices. Also, investors are paying insufficient attention to the potential of improving the Covid-19 situation and medium-to-long-term earnings growth prospects. The MSCI China Index is trading with low multiplicators. It signals about potential underestimation of the Chinese stock market.

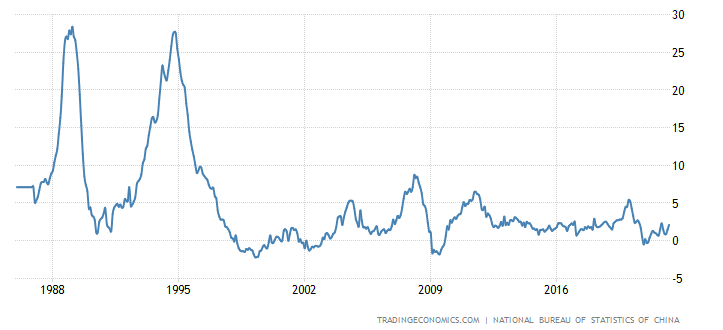

Moreover, inflation in China is at the bottom (it’s near an all-time low).

Once China gets rid of lockdowns and starts producing as much good as it did several years before, the HK50 is likely to soar with immense speed.

It will be a long way for HK50, but the expectations are worth them. On a macro scale, the index is near its 7-year low. Also, a bullish divergence occurred on the monthly chart. The consolidation may last for months or even a year, but we expect HK50 to skyrocket.

HK50 monthly chart

Resistance: 21.5K, 25K, 30K

Support: 20K, 18.5K

We see that HK50 is trying to move closer to the resistance trendline on the daily chart. As soon as the breakout happens, the uptrend will officially start.

HK50 daily chart

Resistance: 21.5K, 23K, 25K

Support:20K, 18.5K

The S&P 500 had a good week due to the impressive start of Q1 earnings and favorable inflation data. In March, the consumer price index rose 5%, lower than the previous month's 6%, and met economists' expectations.

FAANG stocks started recovering. Which ones are the best according to fundamental analysis?

The previous year 2022, was undoubtedly tumultuous for the stock markets, with several stocks plummeting across multiple industries. Analysts have blamed the hard times on inflation, hawkish federal reserve policies, an impending global recession, and the ongoing crisis in Ukraine. This year, however, we're beginning to see some recovery in the stock markets. This article will find a few stocks worth buying this year.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later