eurusd-is-falling-what-to-expect-from-the-future-price-movement

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

A four-day lockdown turned out to be two months of complete isolation. Factories are frozen, supply chains are under heavy pressure, and the future is gloomy. Find out how to trade in times of crisis in this article!

China has chosen a zero-covid policy. This is a set of measures to eradicate the virus in China. To do so, the Chinese government restricted Beijing's citizens from exiting their homes. First, the restrictions were supposed to last four days. But growing infections caused stricter rules. Long story short, 25 million people in Beijing and Shanghai are now in their homes, without a single possibility to go out.

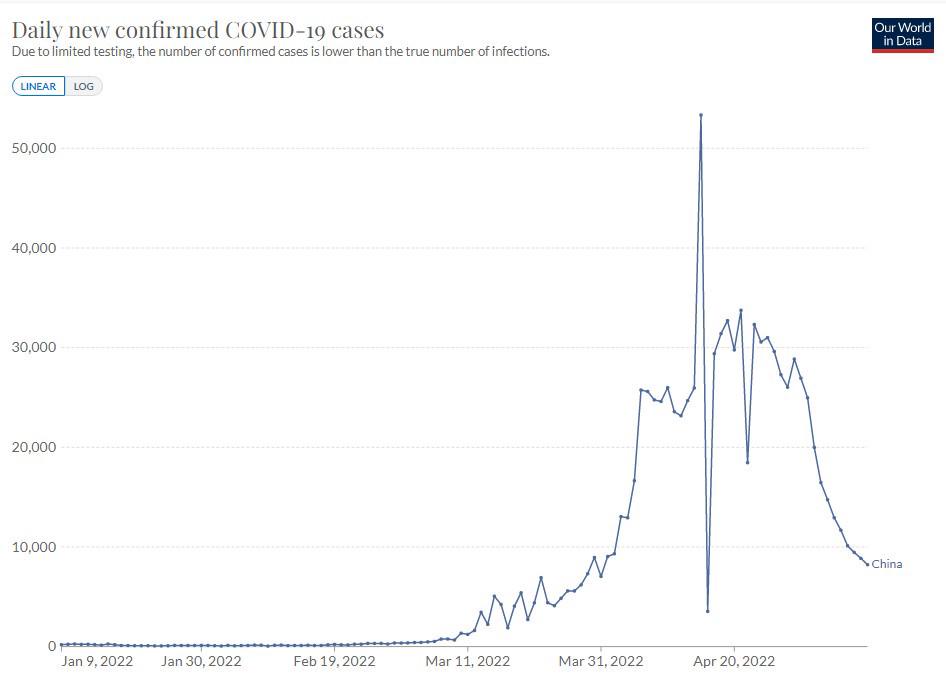

Although covid cases have started to ease from their April peak, authorities once again tightened lockdown measures today (May 11). Now some of Shanghai's districts aren't able to receive non-essential deliveries. Moreover, the lockdown became even stricter, and now about 373 million people are far away from grocery stores and pharmacies.

Now, China has around 8000 Covid-19 cases per day, which is much better than the peak of 50 000 daily cases in mid-April 2022. However, the lockdown may last for another month or even more, rising uncertainty for the economy.

These restrictive measures have created widespread economic disruptions within China. But it's not rocket science that China is one of the world's biggest producers of almost everything. Food, drugs, clothes, cars, technologies – trillions of dollars worth of goods are produced here every year.

Placing hundreds of millions of workers under lockdown has hammered China's factories. Tesla factory stopped working, and the company will lose 60 000 cars due to the restrictions. The International Monetary Fund has cut its forecast for Chinese economic growth in 2022 from 4.8% to 4.4% because of the lockdowns—well below the government target of 5.5% and down nearly half from last year's 8.1%. Some (pessimistic) analysts suppose that China's lockdowns could push the country into a recession this year.

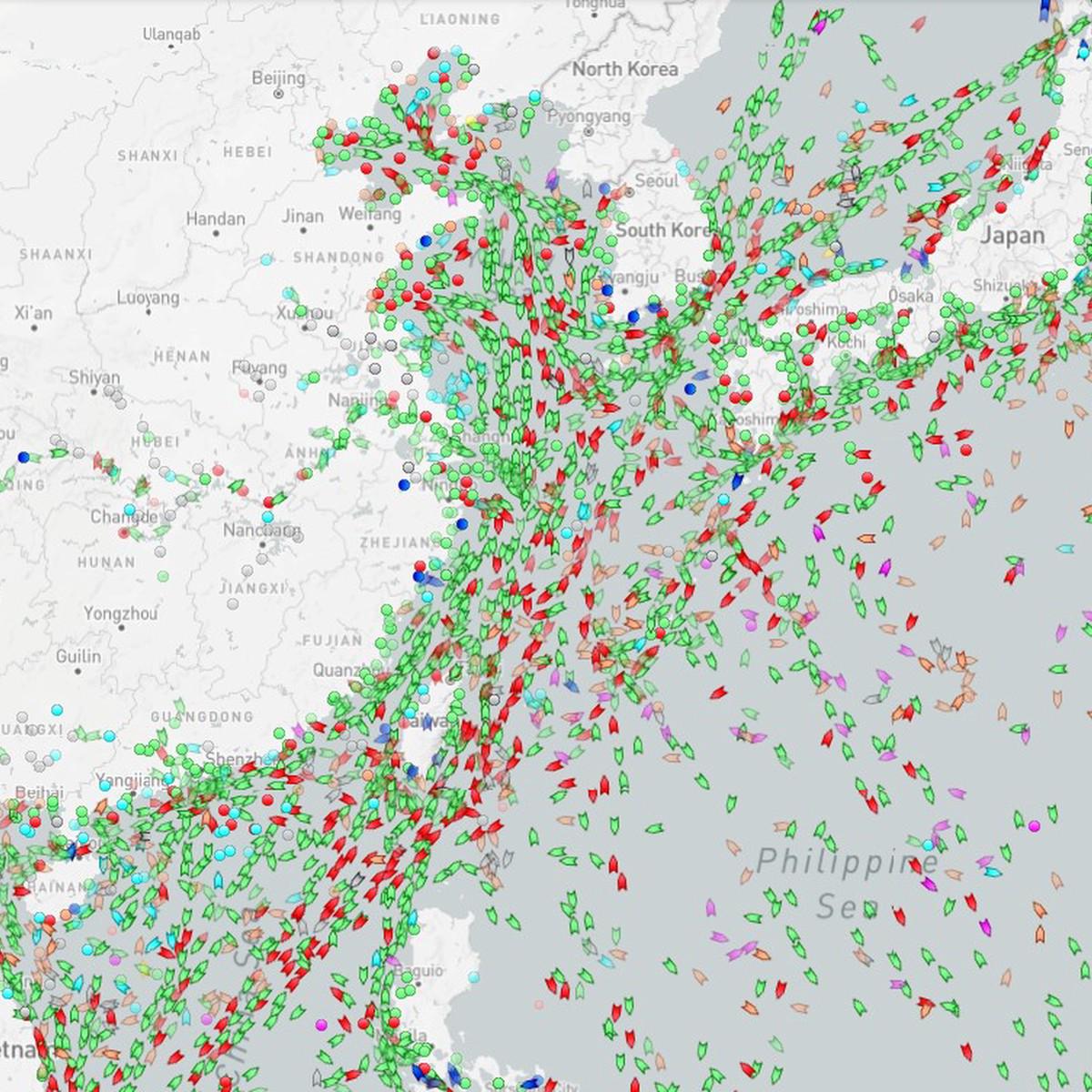

There are thousands of cargo vessels near China waiting for ports to open. How long will they have to wait? Estimations are unclear, but we can assume that the lockdown may last until daily cases reach near-zero levels. It can be a long way since the omicron strain (so far the latest Covid strain) is highly contagious.

You already know the answer, and the chart also hints to you. The Chinese stock market has been moving lower for a year now, and the bearish waves will continue. As HK50 (China's stock index) is below the vital resistance of 21 000 – 21 500, we suggest looking for short trades with several targets. The first is a retest of the historic low at 18 000. Then, in case of a breakout, 17 000 is a decent target for your trades.

HK50 daily chart

Resistance: 21.5K, 22.7K, 23.5K, 25.0K

Support: 18.5K, 17.0K

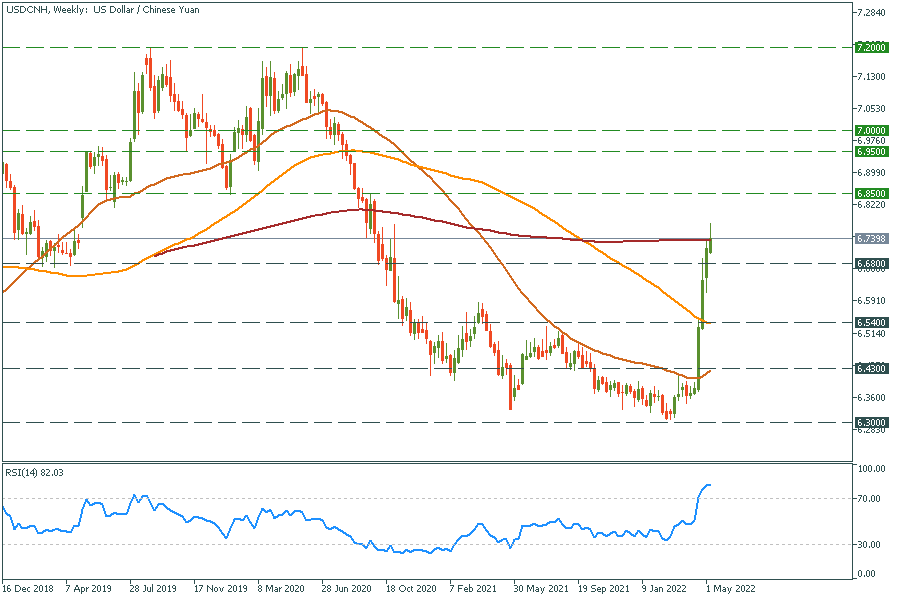

As for the USDCHN chart, Yuan has lost an impressive 4000 points over the last month, so we expect a pullback from 200-weekly MA to 6.680. The USD is about to lose its power, so a further plunge of the pair to the 6.540 support level is possible. In case of a 200-weekly MA breakout and a consolidation above the moving average, technical patterns will signal the extreme weakness of the Chinese Yuan. Thus, the USDCHN pair may reach a robust resistance area of 6.950-7.000.

USDCHN weekly chart

Resistance: 6.850, 6.950-7.000, 7.200

Support: 6.680, 6.540, 6.430, 6.300

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later