Oil prices fell to a three-month low following the release of US inflation data which was in line with expectations…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

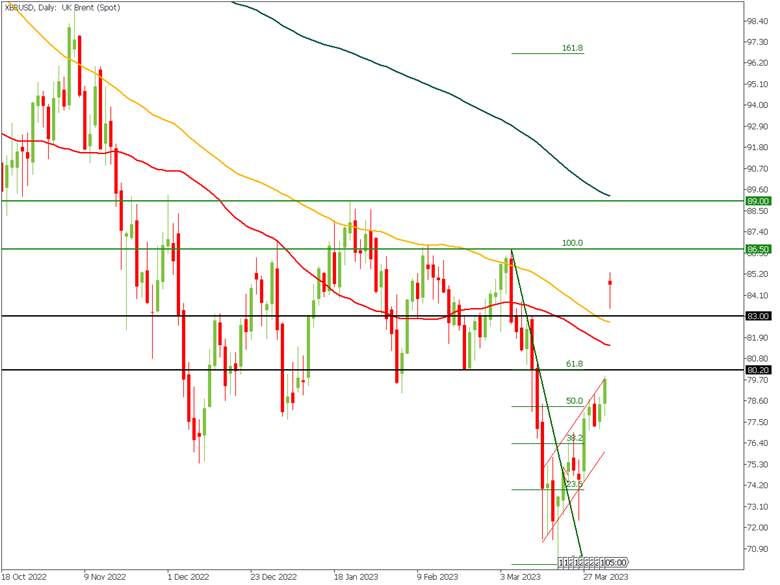

In March Brent crude oil has once again nosedived below $80, levelling all the systematic price growth from December 2022 to March 2023 in one fell swoop.

There are no fundamental reasons severe enough for such a substantial drop in prices. However, fears of a possible recession in the financial sector, which could spill over to other economic sectors and lead to a global slowdown, push energy prices down.

Where is the promised expansion of China’s economy? This article attempts to answer the question.

According to the latest IEA report, oil supply has increased only slightly. OPEC+ added about 170,000 bpd.

As a result oil supply has jumped to 830,000 bpd, mainly thanks to the US and Canada. IEA expectations for oil production this year remain optimistic at +1.6M bpd.

US commercial crude oil inventories have risen to 480.1 mb. The Strategic Petroleum Reserve hasn't changed and remains at 371.6 mb.

The US has been draining its storage facilities for 1.5 years - from June 2020, till December 2022. With the cold winter, energy shortages, and the acute period of overcoming dependence on Russian oil and gas over, the realization that the US will not be left with no oil at all has ushered the market into a new phase.

At the beginning of April, some OPEC+ countries decided to cut oil production by approximately 1.5M bpd. Russia and Saudi Arabia accounted for the most significant reductions by 500K bpd each.

The OPEC was in no hurry to enter a market with supply restrictions. Now mostly, Saudi Arabia gave a signal to the future interference. For OPEC, the most comfortable price is around $90-$100. So, in the worst-case scenario, if prices do not stabilize, OPEC will enter the arena once more.

In reaction to the OPEC+ decision, the price instantly jumped to $85 and broke several resistance levels, including the cluster between $80 and $80.50 and then $83.

For a short-term trader, it’s clear that the price may soon close this gap, but from the fundamental point of view, we may face a bullish reversal.

Image 1. XRBUSD. Daily time frame.

Everything has its price. The growth in oil prices may lead to the following consequences:

Judging by the external macroeconomic backdrop, China's economy is starting to pick up gradually:

The Energy Information Administration expects China's oil demand to grow by 730,000 b/d this year.

However, concerns have been raised that China continues to actively build up its oil reserves, importing mostly Russian grades at a reasonably high discount - imports from Russia to China amount to about 1.94M bpd.

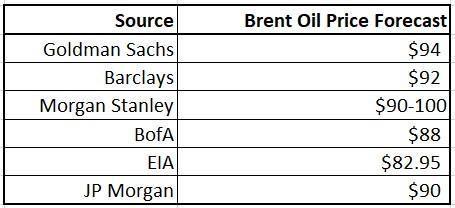

Consequently, most analysts still prefer to lower the average oil price in 2023.

Image 2. Brent oil price forecast before the OPEC+cut

The price value in March should be considered only a market reaction to an unexpectedly surfaced black swan in the form of a bank collapse - a sort of energy market RISK-OFF.

The probability of growth resumption and price stabilization at $80-90 is relatively high. But, given the fullness of Chinese storage facilities, the prospect of reaching $100 per barrel remains murky.

Legal disclaimer: The content of this material is a marketing communication, and not independent investment advice or research. The material is provided as general market information and/or market commentary. Nothing in this material is or should be considered to be legal, financial, investment or other advice on which reliance should be placed. No opinion included in the material constitutes a recommendation by Tradestone Ltd or the author that any particular investment security, transaction or investment strategy is suitable for any specific person. All information is indicative and subject to change without notice and may be out of date at any given time. Neither Tradestone Ltd nor the author of this material shall be responsible for any loss you may incur, either directly or indirectly, arising from any investment based on any information contained herein. You should always seek independent advice suitable to your needs.

Oil prices fell to a three-month low following the release of US inflation data which was in line with expectations…

The US dollar index has lost around 12% since October 2022 till its local low at the end of January 2023.

Western countries are trying to find other options for oil and gas supplies after a 10th package of sanctions, which will put more pressure on Russian oil and decrease global oil supply. Italy, for example, is in talks with Libya.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later