The G20 summit took place in Bali, Indonesia, on November 2022…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

US-Sino trade tensions, Brexit uncertainties, the global economic slowdown, and risks of the recession made the world central banks ease their monetary policy significantly.

The Federal Reserve cut the rate 3 times. However, the bank had room to loosen after 4 rate hikes in 2018. While the ECB didn’t have much space to loosen with 0 rate. The monetary policy is supposed to be quiet during 2020. What if the market uncertainties prevail and the risks of the recession renew? The central banks should have more opportunities to stimulate the economy. However, low rates for most of the central banks and negative for some of them mean the banks are at the edge.

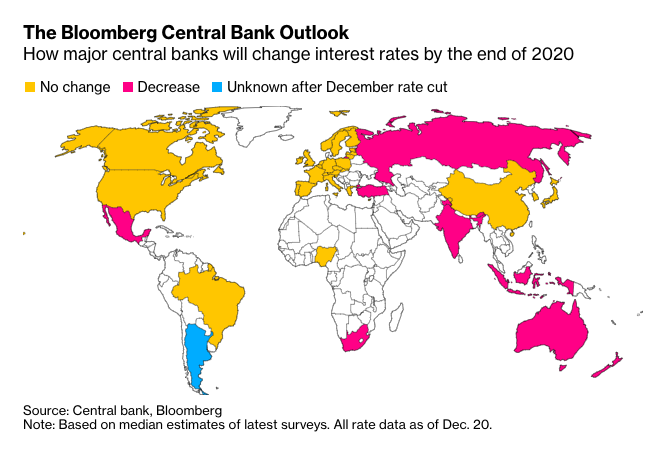

The main mood of the world monetary policy will stay on the dovish side. Although according to Bloomberg, the major central banks are anticipated to keep the rates unchanged during 2020, risks of the too dovish policy exist.

The Federal Reserve feels comfortable keeping the rate on hold. However, other measures are in the arena. The central bank bought Treasury bills to restore sufficient reserves in the banking system. There is an opinion the bank will have to increase purchases to short-term coupon securities. Currently, Mr. Powell is ready for the increase, but the step may be taken if necessary.

Other measures

The former Federal Reserve chairs Ben Bernanke and Janet Yellen called for a big role of the fiscal policy in case of the next economic downturn. Mr. Bernanke declared the purchase of government securities and mortgage-backed assets may push down long-term interest rates. Asset purchases (QE) and the “forward guidance” confirming lower interest rates could provide some stimulus.

The deposit rate is anticipated to stay on hold at the level of -0.50 for 2020. Previously, Mr. Draghi’s contentious stimulus package caused mixed reactions. Policy makers signal squeezed bank profitability and risks to financial stability as the opposite side of such policy. Draghi's successor Christine Lagarde is expected to assess negative rates. However, the stimulus will take place if needed and more likely they will.

Other measures

The new President may launch dual interest rates. Such a policy may be more efficient than the quantitative easing, negative interest rate or forward guidance. Using a dual rate, the central bank will set different rates for loans and deposits.

Although Mario Draghi was the one who kept the rates on the record minimums for long, he warns about the risks of Japanification. The situation may copy the Japanese monetary stance, where the Bank of Japan has to keep interest rates at near to zero level and purchase bonds.

According to Bloomberg, the rate is expected to be held at 0.75. Nevertheless, supporting measures are likely to be used. In March, the central bank will have the new Governor – Mr. Carney will be replaced by Andrew Bailey. The successor will meet with a global slowdown and a constant shortage of investment. Currently, most of the policy makers argue for the additional rate cuts. The future path will depend on the Brexit outcome and economic recovery.

Other measures

In the recent interview with the Financial Times the governor of the Bank of England Mr. Carney warned the global economy might appear in a “liquidity trap”. In such a situation, the monetary policy of the banks loses its effectiveness in producing increased spending and reanimation of economic growth. If the recession happens, the central banks have a limited way to stimulate the economy.

At the same time, the present governor insisted the BoE could still cut interest rates to close to zero and ease banks’ capital requirements to enable them to lend more.

To conclude, we can say that the major central banks will unlikely to turn the mood to hawkish in 2020. The rate cut is not the best way to boost the economy so the banks are expected to implement additional stimulating measures. As for the domestic currencies, they are supposed to be under pressure in the case of the prolonged dovish policy.

Note for investors

All the information above is signaling the change in the way we determine the strength of the domestic currency. If before the rate cut signaled the weakness of the currency, it’s more likely that in 2020, investors will look at other easing measures. In this case, the economic calendar is not the major way to predict the currency moves. Check the news with FBS to get the recent updates on the monetary policy.

The G20 summit took place in Bali, Indonesia, on November 2022…

The deafening news shocked the whole world yesterday: the British Queen Elizabeth II died peacefully at the age of 96…

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later