The G20 summit took place in Bali, Indonesia, on November 2022…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Join Us on Facebook

Stay on top of company updates, trading news, and so much more!

Thanks, I already follow your page!

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

69.21% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

So there was a pre-election debate between the US President Donald Trump and the former US Vice-president Joe Biden in Cleveland last Wednesday. It lasted 1.5 hours… and it was hard. Hard to understand, hard to sort out who said what, hard to match the facts with the words, hard to leave aside the lies and the allegations of lies – and hard to see what’s going to happen with the USD if either of the candidates wins. But still, let’s try.

As orators, Donald Trump was definitely on the offensive, and Joe Biden was keeping defense throughout the conversation. From a humane point of view, of the “word-to-fact ratio” was equal between the two (which one can hardly verify), an impartial observes is probably more likely to favor Donald Trump. Just because he appears more comfortable in the debate – you just see it. He does interrupt, he does play it “dirty”, and that exactly creates an impression that he feels comfortable to go beyond the format of the public discussion. Joe Biden couldn’t pick up with the pace most of the time and partly due to this was looking definitely less aggressive in general. That’s why he looked more like an offended side that is trying to restore some kind of balance and advocating certain ideals of social purity and fairness. For that reason, it felt like Joe Biden was addressing and appealing to those in the American society who feels abused, mistreated, offended, belittled, forgotten, etc. That’s why, and Donald Trump didn’t hesitate to use that stigma, Joe Biden was coming as a far-leftist, socialist-like candidate who was going populist in this line (socialist populism presses on “defending the offended” most of the time – and wins hearts with that). In the meantime, Donald Trump was trying to portray himself as a centrist, support by power structures, a strong businessman in the highest rank of power who knows how to sort things out... and how to talk himself out of problems as well. Joe Biden was accusing his opponent of that most of the time: his central argument against Trump was that a lot of words were said, and very few actions really took place.

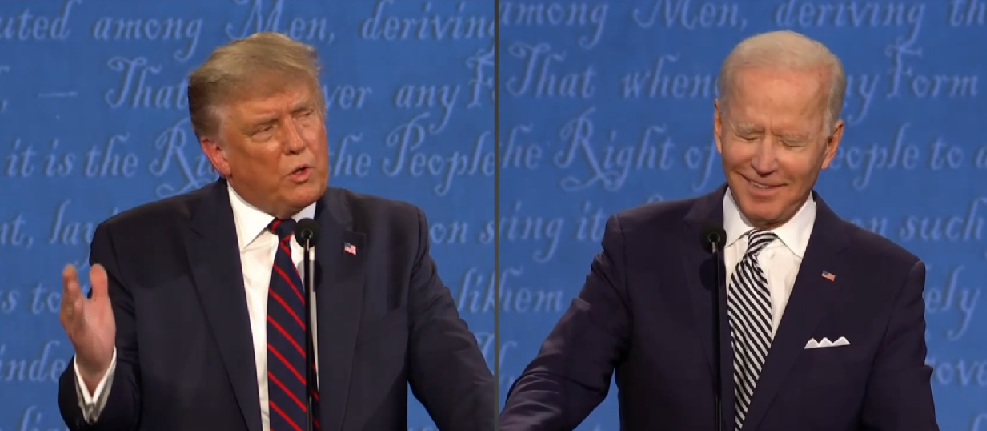

Source: Bloomberg (very often during the debate, the only thing that was left to Biden while his opponent was going all-out on him, was smiling)

Trump’s argument against Biden in economic talks was that what Biden suggests is unrealistic and unfeasible most of the time. Everything from what is related to climate change to taxes and “making America great again”. Biden’s argument is that Trump only defends big businesses and never thinks of the fundamentals of any economy – small businesses. Hence, the different views on tax policy: Biden wants to increase the corporate tax, Trump doesn’t. Speaking in Marxist ideology (which none of the speakers would probably like), Biden suggests the way to redistribute social wealth in favor of the lowest classes, while Trump relies on the corporate tycoons. What was apparent, though, is that Trump’s thinking is more economic-like, in general. Biden’s is more ideological and politics-based. You know it when you see it: if a person has a “business grip”, you feel it. Trump has it. Biden – hardly. But who knows. Anyway, the first impression that comes to one’s mind is that Trump is more “familiar” with the USD just because he is a businessman in the first place: he knows how to make money, he knows what can be done with the money, he knows tax code like a local church pastor knows Testament. So wherever the USD goes with Trump, it appears that Trump will just be more comfortable driving it in either direction. Whereas with Joe Biden, the USD will always be an economic consequence of political actions. Furthermore, even when Joe Biden says that Trump has no plan for basically anything, somehow it feels like if a Trump, who supports big businesses, is in power, there will be more dollars in circulation. In the end, one of his stances was that America has long been waiting to see cheap US dollar to compete with other – particularly, Chinese – cheap national currencies. That would attract foreign investment to the US and expand the American economy. Otherwise, international businesses would leave to other countries, such as China, Mexico, or even Russia – that’s another argument Trump has against Biden. So in general, Trump appears “more economic” and more about the USD than Biden. Biden appears more about “the abused” which, taken technically, is no less populist than Trump’s making America great again, etc.

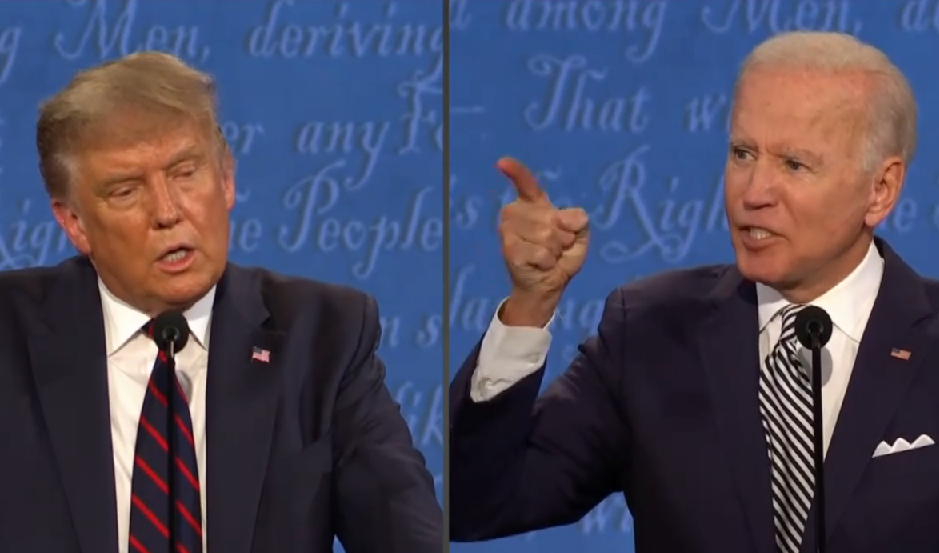

Source: Bloomberg (this time, Trump went really personal on Biden, and Biden was visibly pushed out of his normal balance)

One of the primary issues that loom on the horizon for the USD is actually not who wins the election, but whether he (we can say only “he” now as both candidates are male – Americans chose it so) will be accepted as the winner. As Nouriel Roubini rightly stated, the schism in the American society, the intensity of the polemics, the rise of urban crime, and lack of control of situation over Covid-19 – even with Trump’s law enforcement measures – all point to a serious possibility of a prolonged effect of the elections process on the USD as an indicator of the American domestic well-being. In other words, the USD will definitely have prolonged pressures if there is a chance that the voting before, on, and after the planned day of election sees any kind of impediment for being carried out on time and – very importantly – recognized. Not only the USD, of course, - the stock market will have a big downside potential if either candidate with his supporters disagrees with the outcome of the election. And that possibility seems to be gaining momentum. That’s why, while we don’t know where the USD goes with either candidate, expect higher volatility and unpredictability within the next five weeks.

The G20 summit took place in Bali, Indonesia, on November 2022…

The deafening news shocked the whole world yesterday: the British Queen Elizabeth II died peacefully at the age of 96…

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later