The G20 summit took place in Bali, Indonesia, on November 2022…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Join Us on Facebook

Stay on top of company updates, trading news, and so much more!

Thanks, I already follow your page!

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

69.21% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

UK private sector companies experienced a sharp slowdown in output growth during August, according to the latest PMI data. Flash Manufacturing PMI performed better with 60.1 actual vs. 59.5 expected. Flash Services PMI report showed worse than expected results of 55.5 against the market's expectation for 59.0. This marks a slowdown on July's reading of 59.6. Although the latest reading was still above the crucial 50.0 level, it was the slowest expansion of output since March 2020. Because of shortages of staff and materials, output reduction was 14 times higher than usual and the largest since the survey began in January 1998.

Although the PMI indicates that the economy continues to expand at a pace slightly above the pre-pandemic average, there are clear signs of the recovery losing momentum in the third quarter after a buoyant second quarter. Rising virus case numbers are deterring many forms of spending, notably by consumers, and have grown via worsening staff and supply shortages. Therefore, prices have risen sharply again. Flash services PMI didn’t hit the expected level for the fourth time in a row, moving closer to the vital 50.0 level.

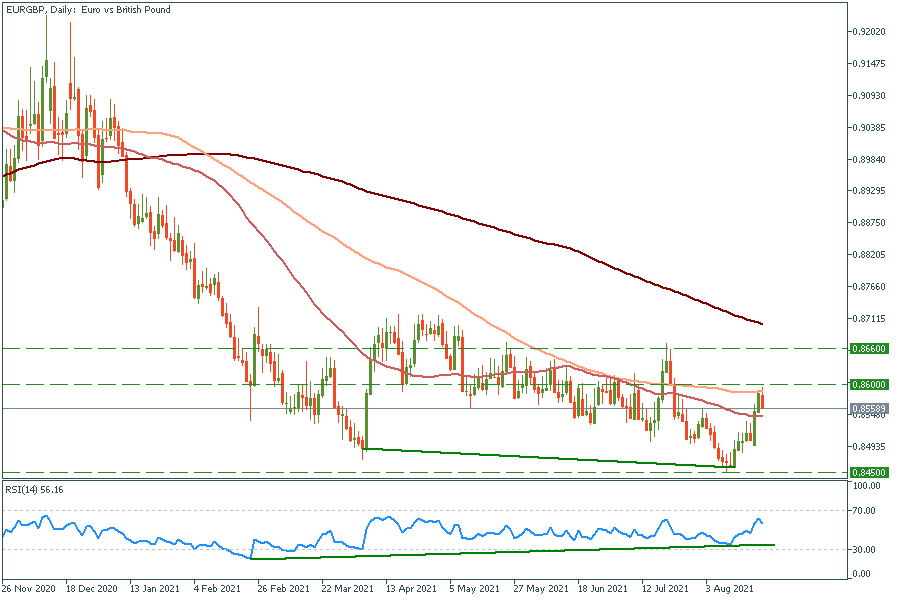

The declines in Sterling coincided with a broader sell-off in global equity markets, a deterioration that confirms EUR/GBP to be highly correlated with broader global trends. MUFG Strategist Derek Halpenny assumes that “The reason for the reversal of the EUR/GBP move lower is the increased risk-off trading conditions as COVID concerns globally increase”. However, amid weak PMI data in the UK and relatively stronger EU data, as well as rising inflation forecasts from the Bank of England (returning to 2.0% over the medium-term) and technical overview suggest that the bearish market for the euro might be over. Bullish divergence in RSI and macroeconomic conditions allude to reversal.

EUR/GBP daily chart.

Support: 0.845

Resistance: 0.86 and 0.866

The British pound had 4 out of 5 red days last week. The dollar surged amid rate hike news. However, tapering is yet to come and now overbought greenback with weak PMI data might cede for the GBP. A potential market-positive shift (for the USD) could be triggered where the Fed signals a delay to the tapering in light of rising covid cases in the U.S. and globally.

Double bullish divergence has formed and a couple of rebounds from the support line is present. All this might signal a bullish movement for the pound sterling.

GBP/USD daily chart.

Support: 1.360

Resistance: 1.370, 1.400, and 1.420

The G20 summit took place in Bali, Indonesia, on November 2022…

The deafening news shocked the whole world yesterday: the British Queen Elizabeth II died peacefully at the age of 96…

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later