eurusd-is-falling-what-to-expect-from-the-future-price-movement

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Join Us on Facebook

Stay on top of company updates, trading news, and so much more!

Thanks, I already follow your page!

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

69.21% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

The year started only a couple of weeks ago, but we already have a lot of fascinating movements in various trading instruments. To help you in trading, we choose several forex pairs that may surprise you and plunge greatly in a short period.

Japanese Yen is a haven asset, that’s no doubt. As a result, the currency strengthened amid omicron spread as investors have been trying to locate their funds in the most stable currencies, usually the Yen and Swiss Frank. As a result, the currency gained almost 2000 points against the GBP over the last week, but now we see bearish figures both technically and fundamentally.

From the fundamental side, Japan has around 0.5% inflation rate. It is much higher than a year ago (Japan is one of the countries with deflation, which means that the Yen tends to become more expensive with time). Nevertheless, 0.5% in Japan is hard to compare with almost 7% in the US or 5% in the EU. As a result, the Bank of Japan will likely keep its dovish tones. Add this to hawkish tones from other countries’ central banks, and you will get the idea. Fundamentally, without rates hikes, JPY looks weaker against other currencies.

Technically we have an unfinished inversed head&shoulders pattern in GBP/JPY. It is a reversal pattern. Thus, we expect the GBP to rise against the Yen and reach 157.7 in the short term.

GBP/JPY H1 chart

Resistance: 156.70; 157.70

Support: 156.00; 155.50; 155.00

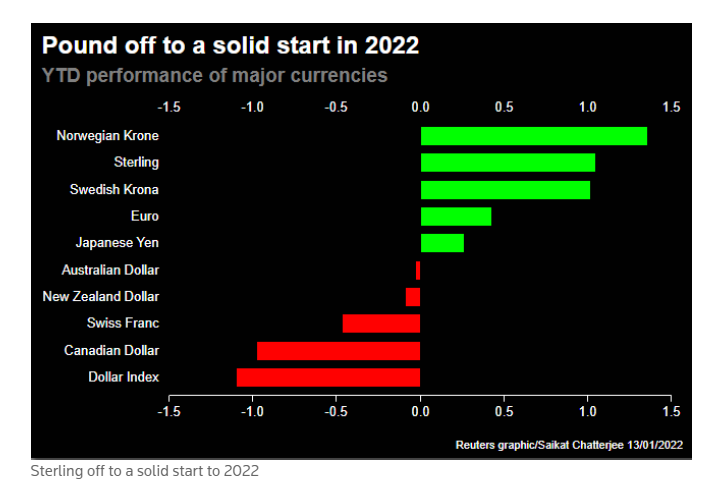

Not only is the Yen weak, but British Pound is solid this year. The currency shows incredible performance against other currencies year-to-date, and amid the weak dollar, we expect a surge in the GBP/USD.

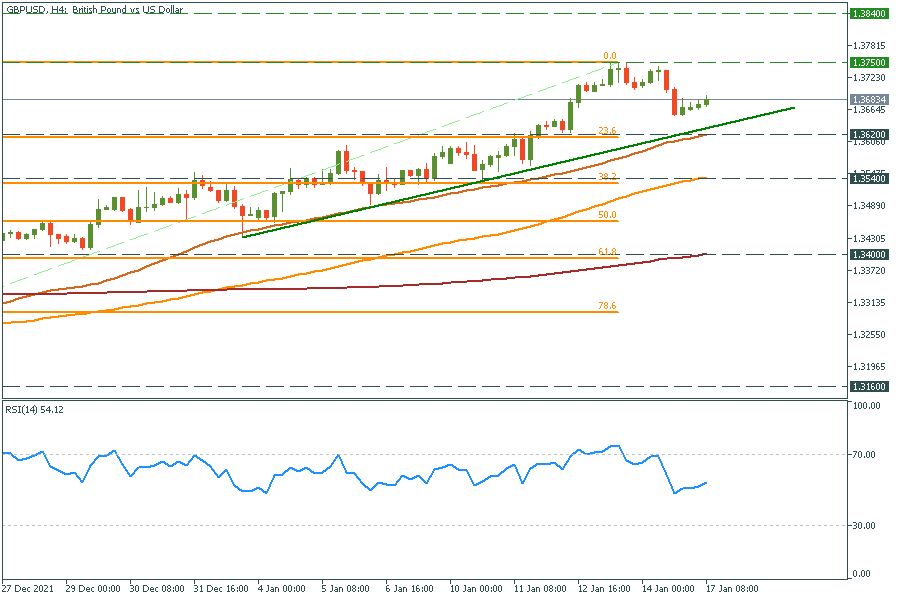

The rally in the pair needs some consolidation. However, technically we have no sell signals except for the RSI divergence. Thus, 1.3620 is a perfect place to put your buy orders.

GBP/USD H4 chart

Resistance: 1.3750; 1.3840

Support: 1.3620; 1.3540; 1.3400; 1.3160

First, it is better to wait for ZEW economic sentiment on January 18, 12:00 GMT+2. This index represents the view of institutional investors and analysts on the current economic conditions. Thus, it will help the pair to determine the direction more accurately.

Despite the upcoming news, the Swiss Franc is another haven asset and tends to be weaker amid hawkish tones from the ECB. Technically we see multiple divergences on the RSI and a breakthrough of the 50-daily MA from below. The pair is now at its lowest from 2015. Thus, 1.0330 is the most solid resistance over there. We may see a double bottom reversal pattern and further bullish movement to at least 1.0600.

EUR/CHF daily chart

Resistance: 1.0600; 1.0730

Support: 1.0330

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later