The G20 summit took place in Bali, Indonesia, on November 2022…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

To trade the Canadian dollar these days, you will need to have the info about the key fundamentals which are driving it: the upcoming Bank of Canada’s meeting (BOC) and the outlook for oil prices.

The Bank of Canada will meet on Wednesday, July 10. According to the consensus forecast, it will keep the Overnight Rate at 1.75%.

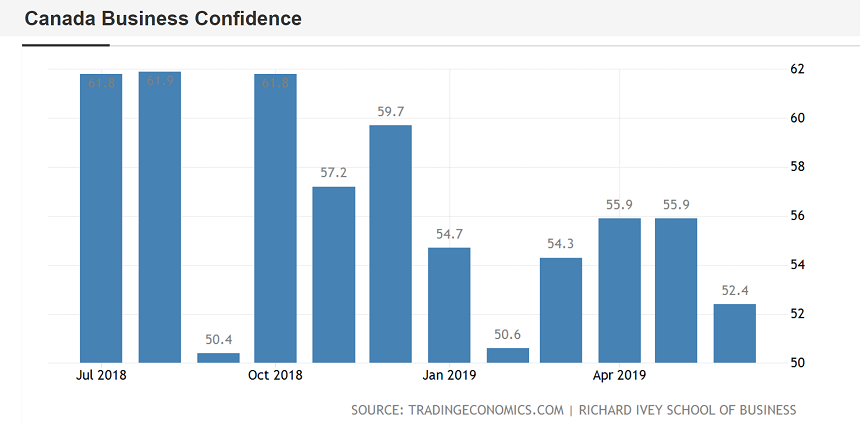

Canadian economic picture is mixed. On the one hand, the Ivey PMI fell in June to the 4-month low of 52.4 from 55.9 in May; the nation’s economy lost 2,200 jobs last month; retail sales growth dramatically slowed down in April from (1.8% to 0.1%).

On the other hand, Canadian GDP growth beat expectations in April (0.3% vs. 0.2%), following a 0.5% increase in March. Wages continued to rise, and the trade balance showed a surplus.

Given the concerns about the global economy, the overall risks are that the situation will develop in a negative way. Yet, for now, Canada is in a better position than many other developed economies and this gives the CAD an edge. Although the expectations of the US Federal Reserve’s rate cuts will diminish after the stronger-than-expected NFP released on Friday, the Fed will still need to support the American economy. As a result, the odds are that USD/CAD will remain in a downtrend.

Notice that the BOC won’t be the only market mover for the pair: the FOMC meeting minutes will be out on July 10, the Fed’s Chair Powell will testify on July 9 and 11.

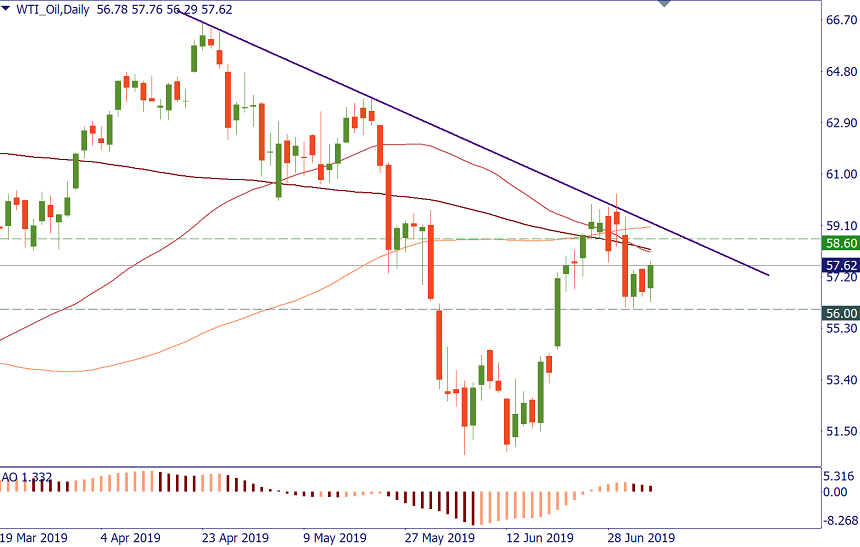

The picture for crude oil is more or less favorable and this is a good piece of news for the CAD.

In June, OPEC’s crude oil production fell to the lowest level since April 2014 of 29.60 million bpd. It happened as cartel members Iran and Venezuela are hit by the US sanctions. The Organization of the Petroleum Exporting Countries agreed to extend oil production cuts by nine months, into Q1, 2020. As you probably know, the smaller the supply, the better for the price.

In addition, Middle East tensions represent a powerful engine for oil prices. The latest development was that Iran threatened to capture a British ship after British forces seized an Iranian tanker in Gibraltar over accusations the ship was violating EU sanctions on Syria. The conflict can escalate further.

That doesn’t, of course, mean that oil prices will take off and rocket sky-high. The main obstacle on the way of that is created by the concerns about the global demand. This is a serious factor that will cap oil limiting its recovery. As a result, the oil market can support the CAD, but it’s unlikely to give it strong fuel.

Conclusion

The CAD has decent chances to strengthen versus currencies the JPY, the EUR, the GBP. It may also retain a positive trend versus the USD.

The G20 summit took place in Bali, Indonesia, on November 2022…

The deafening news shocked the whole world yesterday: the British Queen Elizabeth II died peacefully at the age of 96…

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later