The G20 summit took place in Bali, Indonesia, on November 2022…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

Throughout the entire year 2020, Brexit has been one of the main headlines in the media. Eventually, during the very last week of December, the UK-EU deal was agreed. A couple of weeks passed since then, and we hardly hear of Brexit since. In the meantime, its effects will start manifesting soon enough. What might they be?

According to Boris Johnson, the finalized Brexit is a big victory for the UK. And the Brexit deal – as opposed to the previously possible option of no deal - is even a bigger achievement. From a human point of view, that’s understandable. Boris Johnson and his supporters long sought the separation from the EU, and eventually, they did it. For them, it’s a reward for a “long day’s march”. They see the restoration of the complete sovereignty of Great Britain as the main outcome of the Brexit process. The UK is no longer obliged to follow any overriding legislation such as the one the EU previously had over it. It’s a completely sovereign and independent state. In this context, even a no-deal Brexit would be a success, just for a higher price. Therefore, making the deal with the EU puts the UK even in a better position. Roughly speaking, Boris Johnson presents the deal this way: the UK can enjoy free trade with the EU almost like it was before while it can also enjoy all the liberties of independence. It’s a “Canada-style” agreement, according to the UK PM’s words. A victory, in other words. That’s the impression you get after listening to the speech Boris Johnson gave in Brussels on December 24.

Most analysts agree now that the UK will suffer more than it gains having left the EU. Therefore, the benefits of the deal do not seem to outweigh the losses that come from the strategic separation of the UK. Yes, the fisheries - as Boris Johnson specifically mentioned in his speech – will gain: the UK’s portion of the catch increases from ½ to 2/3 over a few years, and then becomes completely unlimited. Fair enough: a sovereign state can fish as much as it wants, in its own waters. But fishing accounts for less than 1% of the British economy – and even that one percent is largely coming from selling British fish in the European markets which will be more selective from now on. That very much represents the entire state of affairs with Brexit outcomes for the UK: as long as it wants to make business with the EU, it will need to comply with the EU now-external-for-the-UK rules. In the meantime, many businesses, especially those of finance, already choose to re-base to France or other European countries as they don’t have legal permits to stay in the UK. Strategically, there will be more bureaucracy – and hence, more fees and non-tariff barriers - for every British business that wants to do trade with the EU. The international investment will see it harder to get into the UK, too. Overall, an average estimation of the Brexit outcome is the following: the UK is now free to do what it pleases, but this liberty may cost it weaker international investor interest, lower economic output, slower business activity. So, generally, less of everything. How much less – we are yet to see.

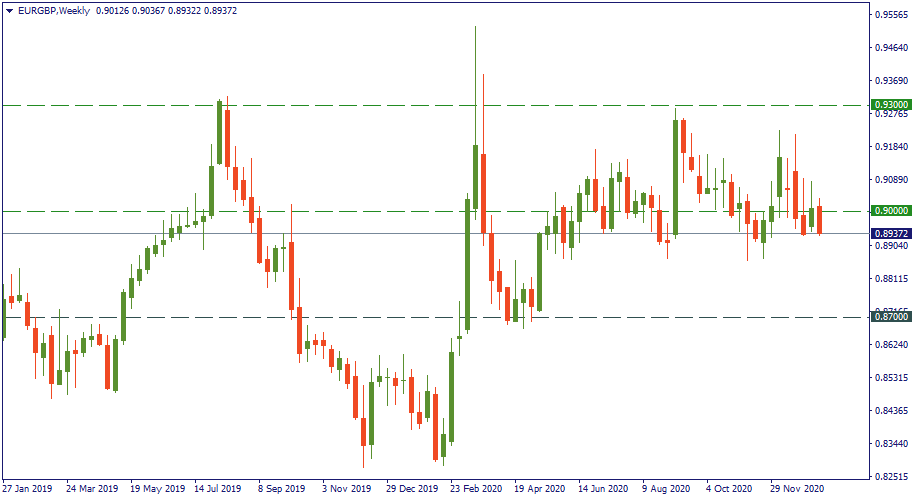

0.90 has been the baseline level for EUR/GBP over the last year. Now, as Brexit tension is over, and the emotional element in the pair’s behavior is weaker, it is likely to follow fundamentals more. In the mid-term, it will be about which one’s economy is weaker against the virus fallout: the UK, or Europe. In the long-term, when the virus will be gone (more or less, eventually), it’s about which one’s economy is more robust and attractive to investors. In the latter comparison, the EU seems to be up for a better outlook. Therefore, in the mid-term, EUR/GBP will possibly fluctuate around 0.90 and may check the depths of 0.87. However, in the long-term, 0.93 may be a very feasible target for bulls.

The G20 summit took place in Bali, Indonesia, on November 2022…

The deafening news shocked the whole world yesterday: the British Queen Elizabeth II died peacefully at the age of 96…

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later