Bank of Indonesia Governor Perry Warjiyo announced that Jakarta is following the lead of the BRICS bloc to reduce dependence on the USD and diversify the use of currency in international trade. Indonesia is "more concrete" than the BRICS...

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

Bitcoin is trading above $22 000 on Tuesday as it continues a week-long rally ahead of the US inflation data and a highly anticipated Ethereum network upgrade.

After falling below $19 000 on Wednesday to its lowest level since June, Bitcoin has rallied around 20%.

Bitcoin’s advance is also related to winning last week for US stocks. Bitcoin has been closely correlated to equity markets, particularly the Nasdaq (US100), and often follows the tech-heavy index.

Crypto investors are looking ahead to the August consumer price index report, scheduled to be released Tuesday. They want to see the direction inflation is going, which could give hints about the Fed’s future monetary policy decisions.

Meanwhile, the Ethereum network will complete a long-awaited upgrade called the Merge on September 15. The upgrade will transform the Ethereum blockchain from a proof-of-work to a proof-of-stake model. The update should significantly reduce the amount of energy required for the network to operate, decrease fees, and increase scalability.

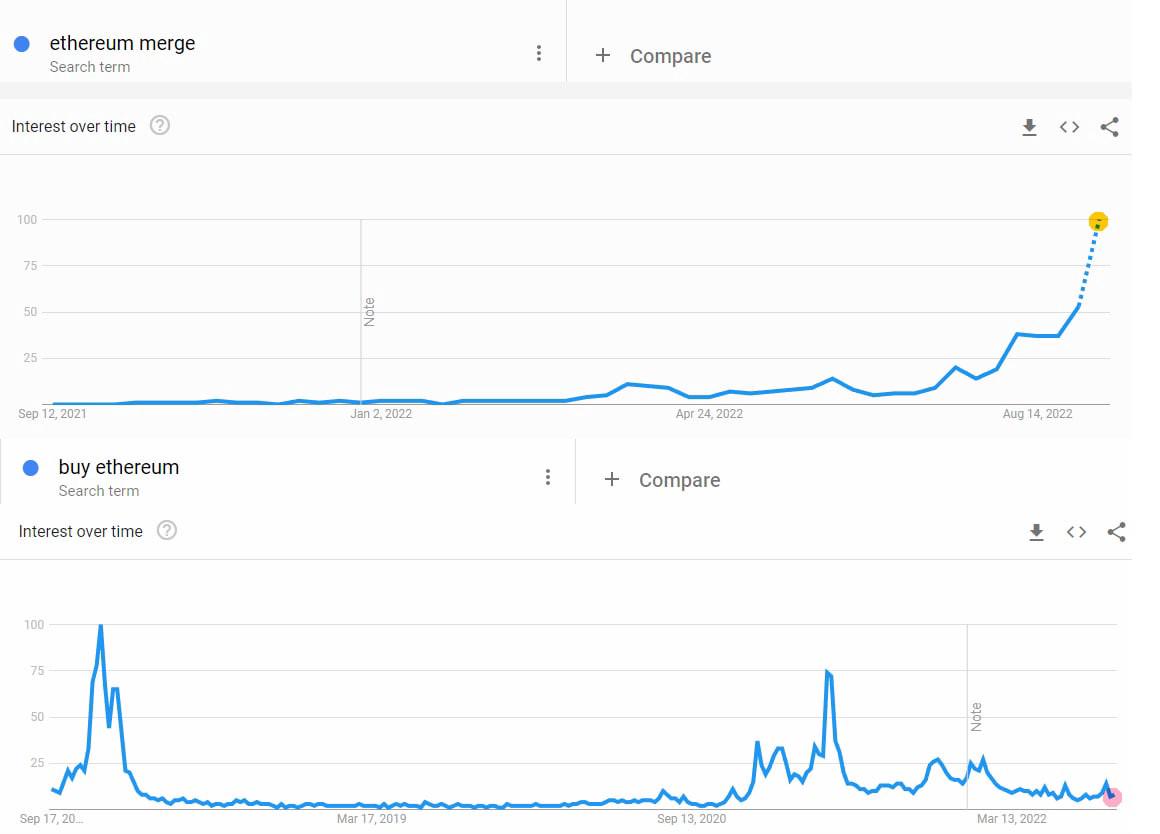

First, "ETH merge" Google requests are on the rise. At the same time, "buy ETH" requests are at their two-year lows, which is quite a negative factor ahead of the vast update. The community either doesn’t believe in the success, or they are following the "buy the rumors – sell the news" rule and waiting for the massive dump after the merge.

The second negative factor comes from history. Few people remember, but a similar event occurred in the bear market of November 2018, after which Bitcoin fell from $6000 to $3000. Back then, Bitcoin Cash split into Bitcoin Cash and Bitcoin SV networks.

Nowadays, Ethereum is the most popular blockchain among developers. Therefore, ETH might drop if any issues appear during the merge, and many other projects built on the Ethereum blockchain might follow it. This dump may cause a wave of liquidations, and the whole market may crash.

However, we believe it isn’t what will happen, and a possible plunge will be just a correction ahead of the huge crypto market rally.

The crypto market always shows a great reaction to the US CPI release. If today's data is lower than expected -0.1%, the crypto market could take a breath of fresh air and increase. On the other hand, higher-than-expected CPI might return Bitcoin to under $20 000.Technical analysis

BTCUSD, Daily chart

BTCUSD is trading close to the global descending trendline. If today’s CPI is lower than expected, the price might break above this resistance and keep moving towards $25 300 and the main target of $28 000.

However, if today’s CPI is higher than expected, BTCUSD might return to $19 000, and in this case, with a high probability, a breakdown of this level is possible and a further decline towards $12 000 after the Merge.

ETHUSD, Daily

Ethereum is also trading close to the global descending trend line. If the price breaks above $2000, you might buy ETHUSD with the target at $2500.

In the pessimistic scenario, the price will bounce off the global descending trendline and decline to the $800 - $1000 support range.

We’ll be looking deeper into the Japanese economy. Subscribe to the @FBSAnalytics Telegram Channel, where I post more daily trade ideas!

Bank of Indonesia Governor Perry Warjiyo announced that Jakarta is following the lead of the BRICS bloc to reduce dependence on the USD and diversify the use of currency in international trade. Indonesia is "more concrete" than the BRICS...

Hold on to your seats, folks! Bitcoin (BTC) is back with a vengeance, soaring past the $30 000 mark on April 11th, reaching its highest point since June 2022. And it's not just BTC - Ethereum (ETH) is also making gains, trading at $1917 and bagging 3.1% gains...

Hey, have you heard about the latest news on de-dollarization? It's the process of shifting away from the US Dollar (USD) as the world's reserve currency for trading...

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later