The G20 summit took place in Bali, Indonesia, on November 2022…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

While growth stocks have stepped back in the first quarter of 2021, cyclical stocks have come to the fore. The term ‘cyclical’ refers to a stock in which business generally follows the economic cycle of growth and recession. In other words, cyclical stocks are rising in times of economic expansion but falling during recessions and market instability. Indeed, stocks involved in such sectors as technology, e-commerce, online shopping, and streaming services skyrocketed amid the long Covid-19 lockdowns, but have already started falling amid ongoing recovery.

The travel and hospitality industries have been hit hard by social distancing restrictions amid the pandemic. Since the constraints are easing, people are more willing and able to spend money on traveling. Thus, such stocks as Booking, TripAdvisor, Royal Caribbean, and Carnival are edging higher.

For instance, you can trade TripAdvisor in our app FBS Trader. It is getting closer to the high of March 4 at $55.00. If it manages to break it, the way up to the next round number of $60.00 will be clear. Support levels are at the recent lows of $50.00 and $47.50.

Automakers tend to fall during recessions as consumers save money and keep their old vehicles instead of buying new ones. In opposite, people are more motivated to buy new cars during expansion. Therefore, such stocks as Ford, General Motors, and Ferrari are likely to jump in 2021.

If General Motors manages to break through the resistance of $57.00, the dorrs to the psychological level of $60.00 will be open. Support levels are $50.00 and $45.50.

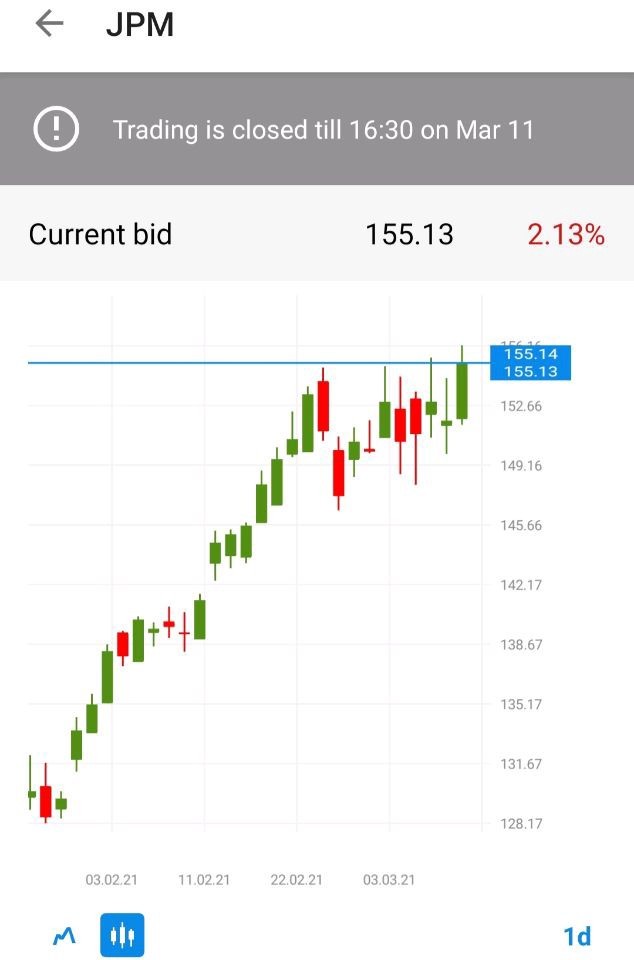

Banks are usually losing their profits during recessions. Most people stop taking mortgages, and loans or even struggle to pay their debts. Besides, interest rates tend to fall before and during recessions, as a result, banks’ profit margins decline. JPMorgan, Goldman Sachs, and Bank of America should rise in 2021 amid the global economic recovery.

JPMorgan is climbing up and up. If bulls keep momentum, it may reach the next round number of $160.00. Support levels are the low of February 26 at $147.00 and the low of February 11 at $140.00.

Remember that with FBS you can make both buy and sell trades. Thus, traders have a chance to profit in case of either outcome!

Note that the stock exchange has a schedule. Trading starts at 16:30 MT time.

Don't know how to trade stocks? Here are some simple steps.

The G20 summit took place in Bali, Indonesia, on November 2022…

The deafening news shocked the whole world yesterday: the British Queen Elizabeth II died peacefully at the age of 96…

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later