The S&P 500 had a good week due to the impressive start of Q1 earnings and favorable inflation data. In March, the consumer price index rose 5%, lower than the previous month's 6%, and met economists' expectations.

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

It is said that the 2022 holiday season will be different from the previous one. Most shops, restaurants, and entertainment places will remain open. Besides, online capabilities have improved significantly as companies have adapted to extended lockdowns. As a result, customers have a wide variety of things to do and places to go during this Christmas break. Which industries will benefit from a high-spending season? E-commerce, retail, hospitality, and tourism.

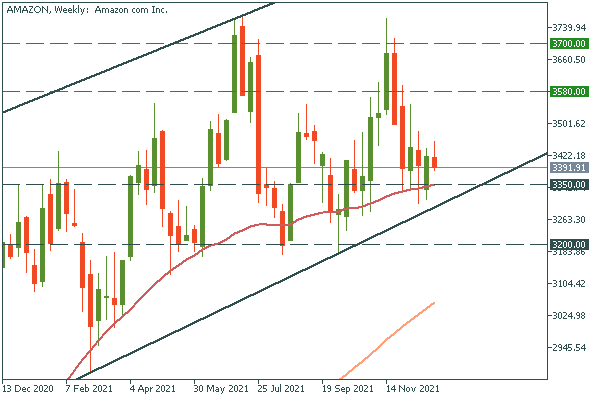

Amazon is the top stock in the e-commerce and retail sector. By the way, Amazon showed record revenue for the post-Thanksgiving sales period as it offered the lowest prices. Thus, we can expect that the Christmas holidays will be successful for Amazon. Besides, this company is engaged in cloud computing, digital streaming, and artificial intelligence. Moreover, Amazon is at the local lows currently. This makes this stock an attractive purchase before the holidays!

The stock of Amazon is in the lower part of the ascending channel. The nearest support level is $3350 (the 50-week moving average). In combination with the lower trend line, this support should constrain the stock from further falling. Thus, the stock is likely to reverse up soon. If it breaks above the $3500 psychological mark, Amazon will rally to the November peak of $3700!

Almost everybody associates New Year with Coca-Cola. But will the stock of Coca-Cola grow in 2022? Let's find out!

First, Coca-Cola revealed impressive third-quarter earnings results, which exceeded analysts' expectations. The beverage giant showed $10.04 billion in net revenue, representing a 16.1% growth rate against the year-ago period. Besides, Coca-Cola's consolidated unit volumes outrun the pre-pandemic levels! It has proved that the company has fully recovered from the negative impact of the pandemic. Moreover, Coca-Cola has a bright future of growth due to its reputation as a Dividend King with 59 consecutive years of payout increases.

Coca-Cola is just under $60 – the peak of 2020. When the stock exceeds this resistance level, the doors will be open to the following round number of $65.00 and then $70.00. Support levels are at the 50- and 100-week moving averages at $54.00 and $52.00.

The S&P 500 had a good week due to the impressive start of Q1 earnings and favorable inflation data. In March, the consumer price index rose 5%, lower than the previous month's 6%, and met economists' expectations.

FAANG stocks started recovering. Which ones are the best according to fundamental analysis?

The previous year 2022, was undoubtedly tumultuous for the stock markets, with several stocks plummeting across multiple industries. Analysts have blamed the hard times on inflation, hawkish federal reserve policies, an impending global recession, and the ongoing crisis in Ukraine. This year, however, we're beginning to see some recovery in the stock markets. This article will find a few stocks worth buying this year.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later