The G20 summit took place in Bali, Indonesia, on November 2022…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

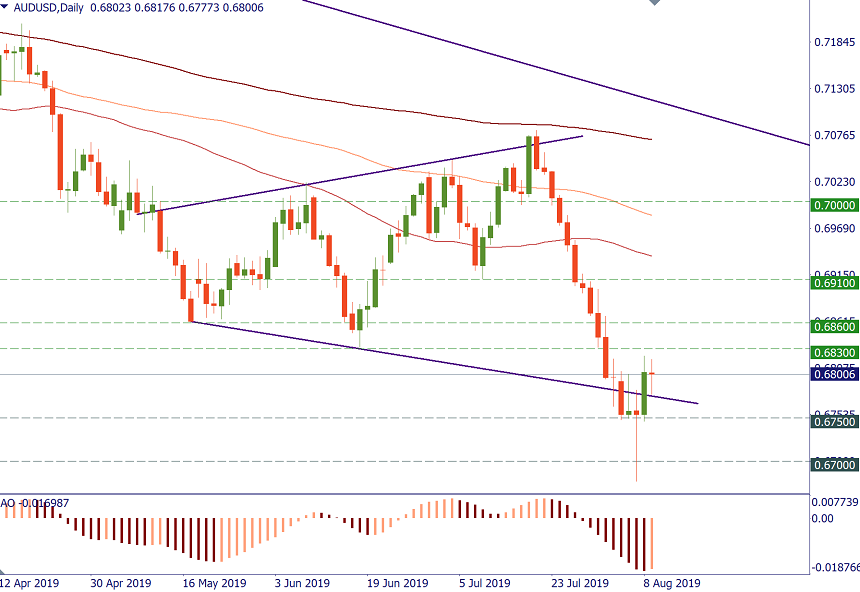

The decline of the Australian currency versus the greenback has been steady since July 19. This week AUD/USD has tested the lowest levels since 2009. By the end of the week, however, the pair managed to recover some of the lost ground and even enter positive territory. What’s the fundamental picture for the AUD?

External factors: a bleak picture

The abrupt escalation of the trade conflict between the United States and China has pulled the risk-sensitive Aussie down. The US President Donald Trump threatened the Asian country with new tariffs starting from Sept. 1. China, in its turn, has let the yuan slide versus the USD. The action made Washington call Beijing a “currency manipulator”. The further the parties get from an agreement, the worse it is for the commodity currencies in general and for the AUD in particular. Still, there may be periods when the AUD is able to take a breath and recover as investors tend to take profit on short positions at some points.

Domestic factors: some relief

The central bank of Australia’s neighbor - New Zealand - has delivered a bigger-than-expected rate cut this week. Such a move made traders expect a similar step from the Reserve Bank of Australia (RBA). Yet, the RBA's August meeting took place before that of the RBNZ, and Australian regulator hadn’t changed the interest rate, even though it had cut rates on two consecutive occasions in preceding months. The next meeting of the Australian regulator will take place on Sept. 3.

On Friday, Aug, 9, the RBA lowered its economic forecasts compared to those it gave in May: it now projects GDP growth of just 2.5% this year and only 1.5% inflation. Inflation forecasts for 2020 and 2019 were also slashed to below the key 2% level. Such view of the regulator will keep the AUD under pressure in the medium and in the longer term.

The short-term picture, however, looks not so dark. The RBA let the market know that it’s not as dovish as its New Zealand’s counterpart. Australian central bank hinted that it would wait a while before cutting its benchmark interest rate from the current level of 1.00%. Apart from providing support to AUD/USD, this also gives some bullish fuel to AUD/NZD.

Next week, Australia will release the quarterly wage price index and employment figures. Another key indicator during the rest of the month will be private capital expenditure due on Aug. 29. No doubts that the RBA will take these data into account when it next time makes its decision, so the releases will have a substantial impact on the AUD.

AUD/USD has room for correction

Market players now expect more rate cuts in the United States this year and this limits the ability of USD to appreciate. The fact that the RBA is more reserved than New Zealand’s regulator gives the AUD a good chance to consolidate versus the USD and even recover during the next week.

AUD/USD is currently struggling around 1.68. The pair needs to return above 1.6830 (June low) to open the way towards 0.6860 (May low) and 0.6910 (July 10 low). Bears will start regaining strength if the Aussie slides below 0.6750.

The G20 summit took place in Bali, Indonesia, on November 2022…

The deafening news shocked the whole world yesterday: the British Queen Elizabeth II died peacefully at the age of 96…

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later