The G20 summit took place in Bali, Indonesia, on November 2022…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

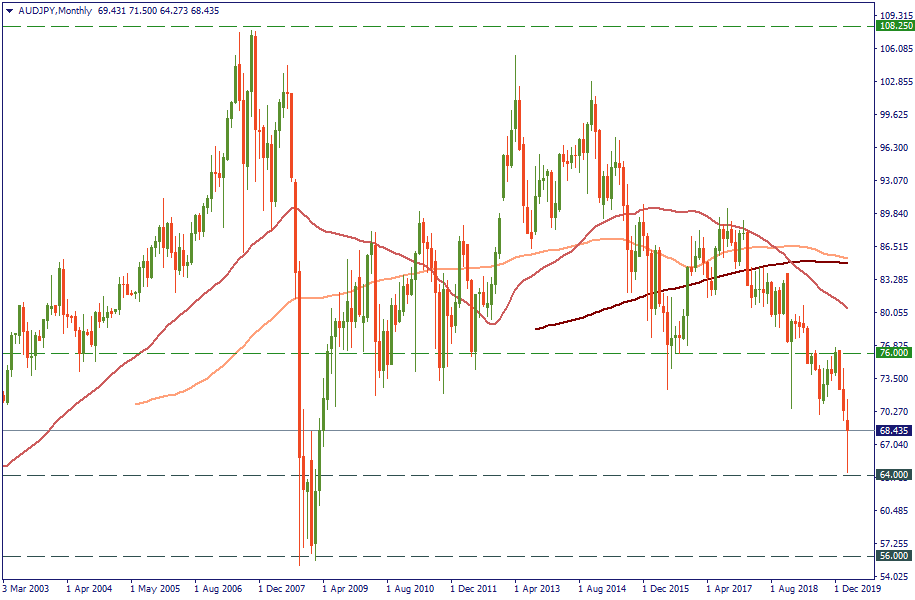

As we have seen before, JPY is the best contrast to observe AUD’s performance. In the monthly chart below, it leaves little doubt. Having dropped to almost 64.00 recently, AUD/JPY has now only 56.00 ahead in the course of the downward movement – that’s the strategic support left in the years 2000 and 2008. Will it be there? Fundamentals say, very possibly.

If you look around, you will probably find another factor pressing on the AUD. First, economic activity in China, the primary trade partner for Australia, has declined. Second, Chinese problems result in global slowdown and hit market’s risk sentiment. The latter is also hit by the new oil price war – a third negative factor. All these factors play against the Australian economy now. Consequently, Bloomberg Economics expects the Australian GDP to drop by 0.4% and 0.3% in the first two quarters this year respectively. That means – recession. And the latter means further pressure on the AUD. The Reserve Bank of Australia is trying to respond with what it has.

The RBA already reduced the interest rate to the record low of 0.5% at the beginning of March. Although that still leaves small room for the rate maneuvers, the monetary authorities are now considering implementing quantitative easing measures to fight off the recession risk. That may be implemented through yield curve control, specifically aiming at three-year bonds. Observers comment this line is more adequate than direct asset purchasing and would more easily stimulate domestic household borrowing keeping the financial conditions more favorable. Needless to say, the AUD would be happy to see the economic pace pick up at home, rather than facing the first recession since 1991.

In the short-term, expectations of the quantitative ease may put pressure on the AUD as in any other case of such monetary policy step. But in the long-term, if the measure proves to significantly improve the condition of the Australian economy, the AUD will inevitably pick up as well. However, we have to assess the actions of the Reserve Bank of Australia against other central banks as the RBA will be surely taking into account their response to the coronavirus’ economic damage: the relative impact of each bank’s policy on their respective currencies will largely define how these perform against the AUD.

The G20 summit took place in Bali, Indonesia, on November 2022…

The deafening news shocked the whole world yesterday: the British Queen Elizabeth II died peacefully at the age of 96…

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later