I know we've had quite an amazing run these past few month, with over 78% accuracy in our trade ideas and sentiments, and thousands of pips in profits monthly...

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

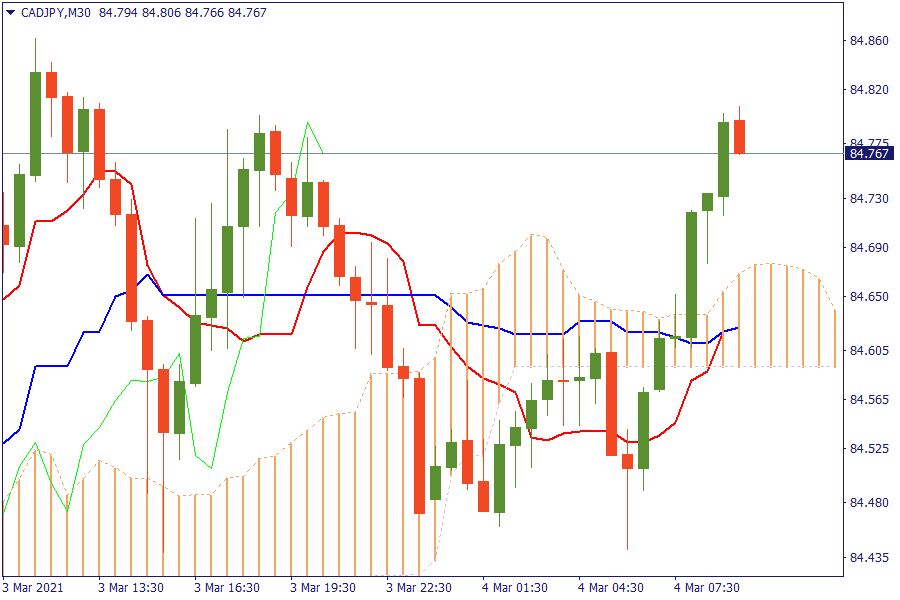

Ichimoku Kinko Hyo

CAD/JPY: The pair is trading above the cloud. An upward pressure would lead the pair to exit further the cloud, confirming a bullish outlook.

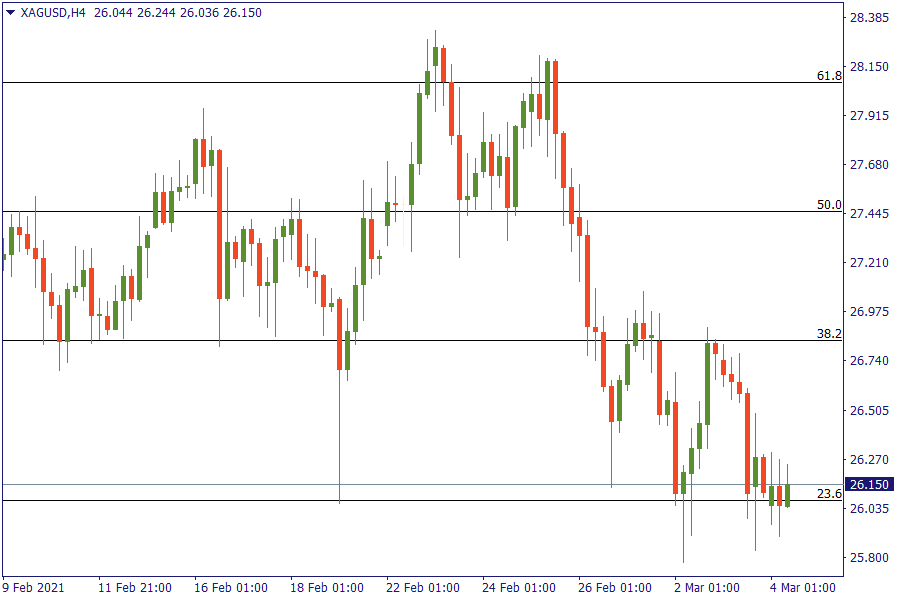

Fibonacci Levels

XAG/USD: Silver continuous to stand on 23.6% retracement area. Bearish pressure is growing day by day.

EU Market View

European stock markets are seen opening lower Thursday, following weakness on Wall Street and in Asia overnight amid resurgent worries over higher bond yields and extended equity valuations.

Looking ahead, highlights from macroeconomic calendar include Eurozone & UK construction PMI, EZ retail sales, unemployment, US IJC, OPEC+ meeting, Fed's Powell, ECB's Centeno, Knot, supply from Spain, France & the UK. Fed Beige Book stated that economic activity expanded modestly from January to mid-February for most Federal Reserve Districts.

Yields of major European government bonds, with German bunds being the main example, have also risen, but by less than their American counterparts, amid some mixed signaling from the European Central Bank over whether or not it needs to react. Many Fed officials have downplayed the rise in Treasury yields in recent days, although Fed Governor Lael Brainard on Tuesday acknowledged concerns over the possibility a rapid rise in yields could dampen economic activity.

Oil prices climbed higher Thursday, as traders positioned themselves ahead of a meeting of the Organization of the Petroleum Exporting Countries and allies, a grouping known as OPEC+.

EU Key Point

I know we've had quite an amazing run these past few month, with over 78% accuracy in our trade ideas and sentiments, and thousands of pips in profits monthly...

Futures for Canada's main stock index rose on Monday, following positive global markets and gains in crude oil prices. First Citizens BancShares Inc's announcement of purchasing the loans and deposits of failed Silicon Valley Bank also boosted investor confidence in the global financial system...

Investor confidence in the global financial system has been shaken by the collapse of Silicon Valley Bank and Credit Suisse. As a result, many are turning to bearer assets, such as gold and bitcoin, to store value outside of the system without...

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later