The S&P 500 had a good week due to the impressive start of Q1 earnings and favorable inflation data. In March, the consumer price index rose 5%, lower than the previous month's 6%, and met economists' expectations.

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

For a long time, US Federal Reserve printed trillions of dollars to support the economy. But in the light of the highest inflation in almost 40 years, the stream of stimulus tends to shrink. The rotation of the sectors may increase the money flow in banks. We will talk about three of them in this article, not because they are in some way unique, but because these three will release earnings reports today, on January 14.

Large banks reported a record-high increase in revenues in 2021. As a result, banks stocks are raging into earnings season as their upcoming results are expected to show the US economy continuing to roll even in the face of inflation.

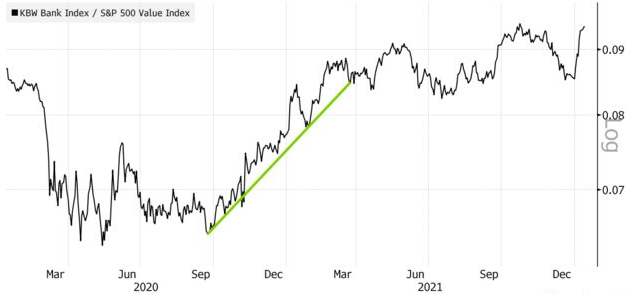

KBW Bank Index relative to the S&P 500 Value Index shows a strong bid for lenders since the start of the year, thanks to bets on rate hikes as soon as March and expectations of strong fourth-quarter results.

The figure above shows that banks have outperformed the stock market since September 2020. Will the tendency remain?

JPMorgan Chase & Co (JPM) will release its earnings report at 14:50 GMT+2. It is expected to have -2.6% revenue growth, with estimated EPS at $2.98 and revenue at $29.71B. JPM is the largest US bank by assets, and it has reported soaring profits over the past year. But most of the earnings came from the release of the loan loss reserves. On the other hand, revenue growth, a key driver of long-term profits, has been weak.

JPM Daily chart

Resistance: 173.0; 180.0

Support: 160.0; 145.0

As for the chart, we see a vast consolidation phase starting from January 2021, and considering upcoming rate hikes (a bullish sign for the banks), we expect the stock to start a strong uptrend in several months. JPMorgan's shares have slightly underperformed the broader market over the past year. Shares of the company rose by 23% over the past year, with US500 total return of 24.3%

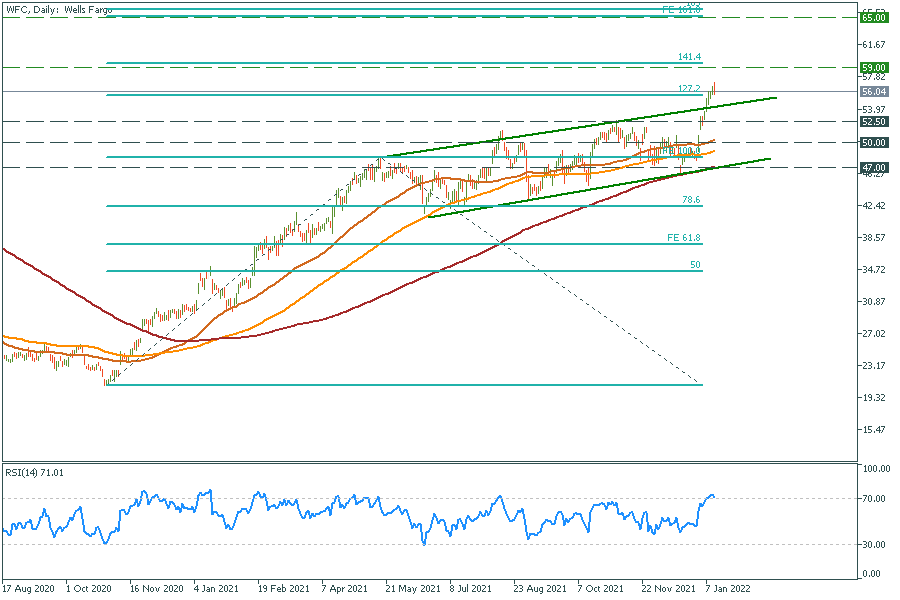

Wells Fargo & Co (WFC) will release its earnings report at 15:00 GMT+2. It is expected to have -3.9% revenue growth, with estimated EPS at $1.09 and revenue at $18.38B. The company has surprised the market with better-than-expected EPS four times in a row.

Nevertheless, there is a thing you should worry about. The stock broke through the ascending channel days before the earnings report. Such movement means that the report is expected to be unusually good. Also, it is often to see an instant plunge after good reports because of the "sell the fact" effect. Luckily, there is plenty of time to prepare for trading WFC because their report comes out 2.5 hours before the market opens.

WFC Daily chart

Resistance: 59.0; 65.0

Support: 52.5; 50.0; 47.0

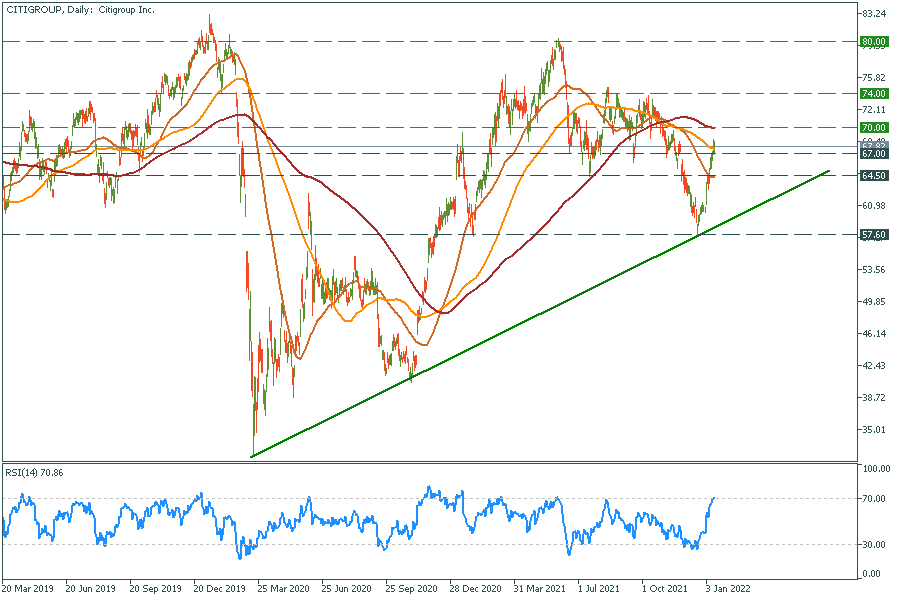

Citigroup, Inc. (CITIGROUP) will release its earnings report at 16:00 GMT+2. It is expected to have -10.7% revenue growth, with estimated EPS at $1.89 and revenue at $17.03B. Citigroup recently agreed to sell its consumer-banking franchises in Indonesia, Malaysia, Thailand, and Vietnam to United Overseas Bank. Its strategy is to exit most of the bank's retail operations in Asia and free up resources. The deal size is $3.7 billion. Although the news is fresh, shares of the company have been skyrocketing since December 21, after the company said it would start the buyback program.

As the RSI is close to the overbought zone and the price is near 100 and 200 daily MA, we expect the stock to correct after the report. The main support lines are $67 and $64.5 per share.

CITIGROUP Daily chart

Resistance: 70.0; 74.0; 80.0

Support: 67.0; 64.5; 57.6

Notice that trading stock with FBS starts at 17:30 GMT+2, so you have plenty of time to prepare yourself. Also, volatility tends to increase right at the beginning of the trading session. Thus, it is better to wait a little bit and understand the stocks' local trend.

The S&P 500 had a good week due to the impressive start of Q1 earnings and favorable inflation data. In March, the consumer price index rose 5%, lower than the previous month's 6%, and met economists' expectations.

FAANG stocks started recovering. Which ones are the best according to fundamental analysis?

The previous year 2022, was undoubtedly tumultuous for the stock markets, with several stocks plummeting across multiple industries. Analysts have blamed the hard times on inflation, hawkish federal reserve policies, an impending global recession, and the ongoing crisis in Ukraine. This year, however, we're beginning to see some recovery in the stock markets. This article will find a few stocks worth buying this year.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later