The S&P 500 had a good week due to the impressive start of Q1 earnings and favorable inflation data. In March, the consumer price index rose 5%, lower than the previous month's 6%, and met economists' expectations.

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

The well-known space tourism company opened ticked sales to the public. But despite retail traders' frenzy, we think the company still has a murky future. In this article, we're going to crack some of the myths about the company's financial conditions and look for a short- and a long-term prospect.

Since November 2021, when we told you about the possible breakout of the ascending trendline, the company has lost 58% of its capitalization. There are several events leading up to such a plunge:

What happens when you sell part of your company and then issue $500 million worth of notes? Of course, the soar of uncertainty and a sharp decline in stock price. And with the hopes are fading, SPCE makes a statement. It opens ticket sales with a $450 000 fee and $150 000 initial deposit, with 1000 tickets put on sale. Moreover, the price for the tickets will increase as sales go.

For much of the last decade, the company has had about 600 reservations for tickets on future flights, with those tickets mainly sold between $200,000 and $250,000 each. But as for now, only several people went to space, including Brandson himself.

SPCE plans to start the commercial spaceflights at the end of 2022. However, at the time of their IPO, Virgin Galactic targeted space tourism as their first business to generate a profit. Commercial flights were supposed to begin around this time last year. Additionally, the company expected to have another flight vessel done by the end of last year, capable of bringing passengers along the journey to the edge of space. Neither goal was met.

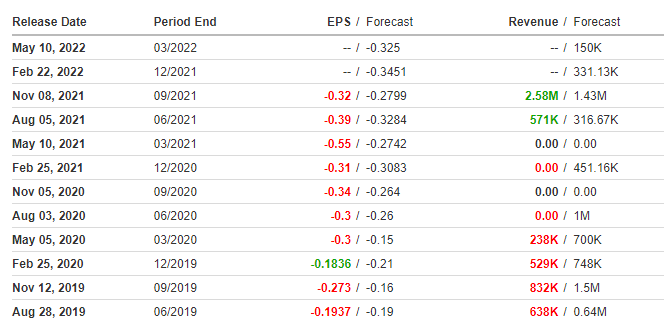

The global Space Tourism market is projected to reach $2.55 billion by 2027, from 0.885 billion in 2020. Fortunately for Virgin Galactic, the market for space tourism is expected to be in a supply constraint, so they will still be able to find customers. However, the company's actions are far from perfect. Delays in spaceflight result in never-ending negative EPS with a net loss of $48 million, considered a good sign (just a quarter ago, net loss was $66 million).

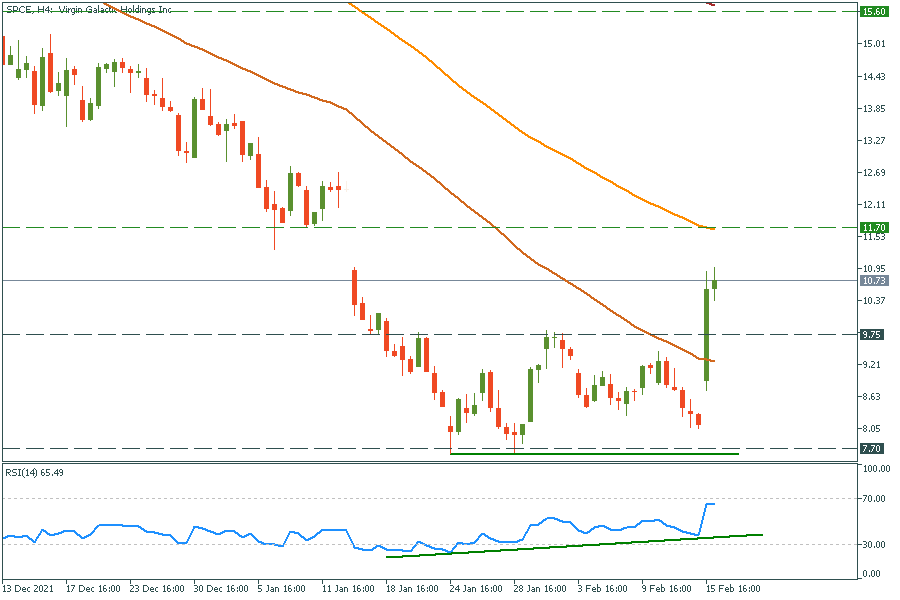

We see a surge in traders' activity on the chart due to positive news and expectations of future earnings. But we wouldn't be so optimistic about substantial further growth; SPCE formed a bullish divergence and, on the positive news, can rise as high as $15.60 per share, which is a 55% gain. Then, we expect a loss of interest and a return to the 8-12 area.

SPCE H4 chart

Resistance: 11.70; 15.60

Support: 9.75; 7.70

Don't know how to trade stocks? Here are some simple steps.

The S&P 500 had a good week due to the impressive start of Q1 earnings and favorable inflation data. In March, the consumer price index rose 5%, lower than the previous month's 6%, and met economists' expectations.

FAANG stocks started recovering. Which ones are the best according to fundamental analysis?

The previous year 2022, was undoubtedly tumultuous for the stock markets, with several stocks plummeting across multiple industries. Analysts have blamed the hard times on inflation, hawkish federal reserve policies, an impending global recession, and the ongoing crisis in Ukraine. This year, however, we're beginning to see some recovery in the stock markets. This article will find a few stocks worth buying this year.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later