Bill Williams è il creatore di alcuni degli indicatori di mercato più popolari: oscillatore Awesome, frattali, Alligator e Gator.

Non perdere tempo: analizza l’influenza dei NFP sul dollaro statunitense!

Avviso sulla raccolta dei dati

Manteniamo un registro dei tuoi dati per gestire questo sito web. Cliccando il pulsante accetti la nostra Informativa sulla privacy.

Guida Forex per i principianti

Una grande guida al mondo del trading.

Controlla la cartella “In arrivo”!

Nella nostra email troverai la Guida Forex. Premi il pulsante per ottenerla!

Avviso di rischio: I ᏟᖴᎠ sono strumenti complessi che comportano un rischio elevato di perdere denaro rapidamente per via della leva.

Il 68,53% degli investitori retail perde denaro negoziando ᏟᖴᎠ con questo provider.

Dovresti considerare se comprendi come funzionano i ᏟᖴᎠ e se puoi permetterti di correre il rischio di perdere il tuo denaro.

2022-08-26 • Aggiornato

Le informazioni non possono essere considerate consigli di investimento

Conosci già alcune nozioni di base. Ora è il momento di scoprire alcune strategie di trading! Oggi parleremo delle tre strategie più popolari e utili. Provale su un conto Demo dopo aver letto l’articolo. Queste strategie ti aiuteranno a capire come funziona il trading e ti forniranno un piano d’azione.

Rimarrai sorpreso da quanto una sola candela possa dirti sul mercato. Questa strategia si basa sulle candele giapponesi.

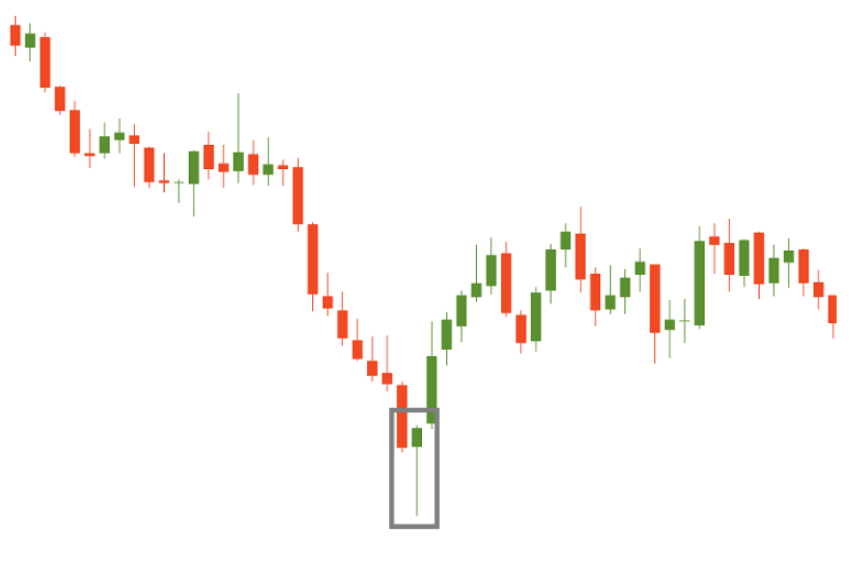

Il miglior esempio è il cosiddetto pattern “Hammer”. Può segnalare la fine di una tendenza ribassista, un fondo o un livello di supporto. È molto semplice individuare questo pattern su un grafico in quanto appare come un martello con un lungo manico e una testa. Il manico o l’ombra di una candela dovrebbe essere almeno il doppio della lunghezza del corpo reale. Cerca questa candela dopo un calo del prezzo: è una condizione importante. Attendi che la candela Hammer si chiuda: prima della chiusura la forma di una candela potrebbe cambiare e potrebbe non diventare un martello.

Acquista quando la candela successiva inizia a formarsi o, se desideri un’ulteriore conferma, quando la candela successiva si chiude sopra il prezzo di apertura della candela a sinistra del martello. Il colore del martello non ha importanza, ma se è verde, il segnale di acquisto è più forte.

Ecco come appare un pattern Hammer in un grafico reale:

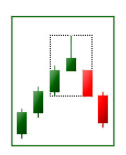

Il pattern Shooting Star è abbastanza simile all’Hammer. Anche questo pattern è composto da una sola candela. Il corpo della candela è piccolo e l’ombra è almeno il doppio del corpo. Tuttavia, a differenza dell’Hammer, il Shooting Star presenta un’ombra sopra il corpo ed è un segnale di vendita. La candela può essere di qualsiasi colore, ma se se è rossa, il segnale di vendita è più forte.

Ecco come appare un pattern Shooting Star in un grafico reale:

La strategia precedente riguardava i pattern a candele. Passiamo ora a pattern grafici semplici, ma efficienti.

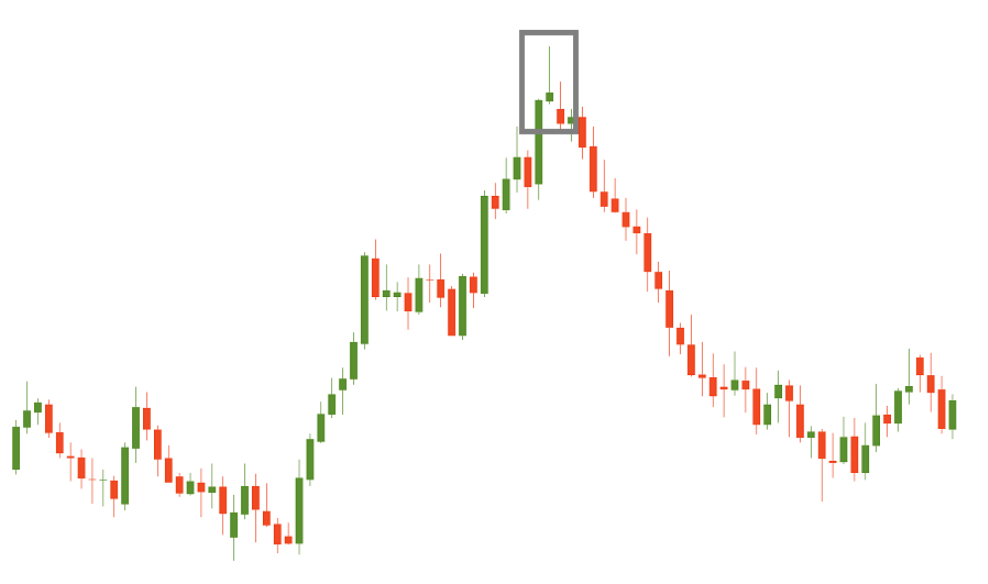

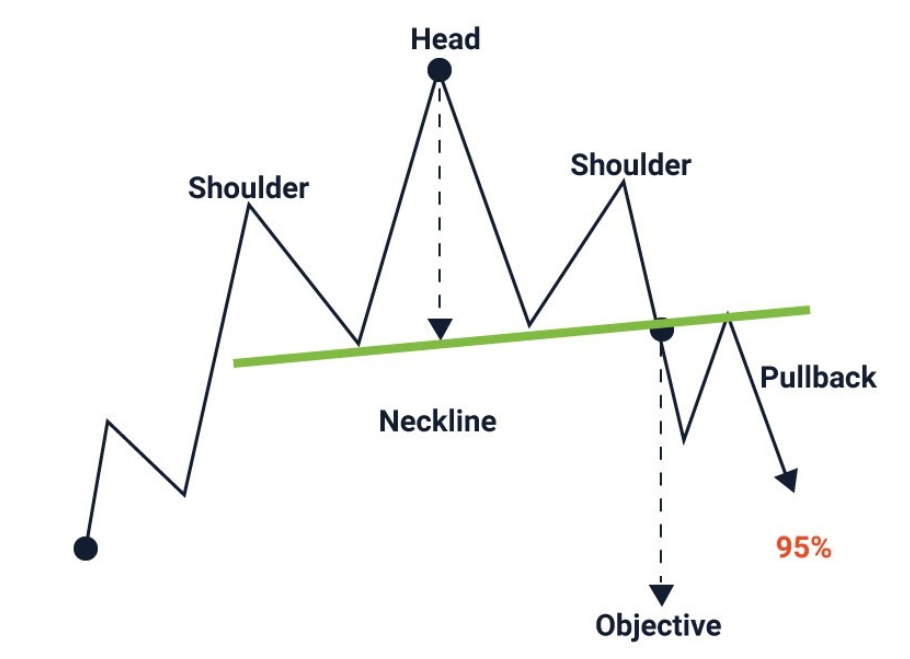

Il pattern Head and Shoulders di solito si verifica alla fine di una tendenza rialzista. È costituito da una testa (il secondo e più alto picco), due spalle (i picchi più bassi) e una neckline (la linea che connette i punti più bassi delle due depressioni e rappresenta un livello di supporto). La neckline può essere orizzontale o inclinata su/giù. Il segnale è più affidabile quando la pendenza è verso il basso piuttosto che verso l'alto.

Il pattern è confermato quando i prezzi scendono sotto la neckline dopo aver formato la seconda spalla. È probabile che dopo questo evento il prezzo inizi una tendenza ribassista. Posiziona un ordine di vendita sotto la neckline. Misura la distanza tra il punto più alto della testa e la neckline. Questa distanza indica approssimativamente di quanto si sposterà il prezzo una volta rotta la neckline.

Attenzione: i prezzi tendono a tornare alla neckline dopo la rottura iniziale. In questo caso, la neckline, che fungeva da supporto, spesso diventa una resistenza.

Un pattern Head and Soulders inverso è l’esatto opposto dell’Head and Shoulders. Si verifica alla fine di una tendenza ribassista e indica un’inversione rialzista.

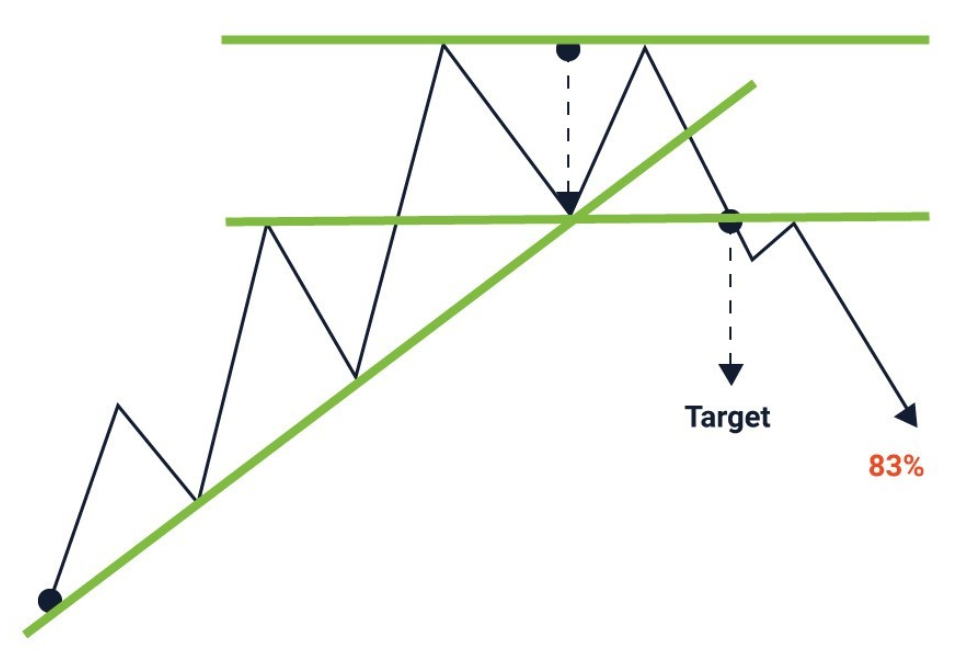

Anche il Double Top di solito si forma alla fine di una tendenza rialzista. I trader lo usano molto spesso. Questo pattern è costituito da due picchi consecutivi di altezza simile (o quasi) con una depressione moderata tra di loro. La neckline è disegnata orizzontalmente attraverso il punto più basso di una depressione.

Il pattern è confermato quando il prezzo passa sotto la neckline dopo aver formato la seconda spalla. Una volta che accade, la coppia di valute dovrebbe iniziare un trend al ribasso. Posiziona un ordine di vendita sotto la neckline. Misura la distanza tra i picchi e la neckline: questa distanza indica approssimativamente di quanto si sposterà il prezzo una volta rotta la neckline. Dopo la rottura il prezzo potrebbe tornare alla neckline per un breve periodo prima di riprendere a scendere: è una buona opportunità per aprire un ordine di vendita a un prezzo più alto.

Il Double Bottom è l’esatto opposto del Double Top. Si verifica alla fine di una tendenza ribassista e indica un’inversione rialzista.

I pattern simili con tre picchi/depressioni sono chiamati Triple Top e Triple Bottom. La logica del trading è la stessa.

Nelle strategie precedenti abbiamo utilizzato solo il grafico del prezzo. Ora è il momento di applicare un indicatore tecnico chiamato Media Mobile (Moving Average - MA).

La media mobile è un indicatore di tendenza. La MA mostra il prezzo medio per un periodo, quindi le sue fluttuazioni sono più uniformi di quelle del grafico del prezzo. Ad esempio, se usiamo una MA di 10 giorni, sommiamo gli ultimi 10 prezzi e dividiamo il risultato per 10. Quando appare una nuova candela sul grafico, quella più vecchia non viene più conteggiata.

Ci sono quattro tipi di MA: semplice, esponenziale, ponderata e adattiva. Ti consigliamo di iniziare con quella semplice.

Nel menu in alto, vai su “Inserisci”, “Indicatori”, “Tendenza” e scegli la Media mobile. È importante applicare le impostazioni corrette.

Il periodo rappresenta il numero di candele che verranno prese in considerazione per il calcolo. Più grande è il periodo, più livellata è la MA. Più piccolo è il periodo, più la MA sarà vicina al prezzo.

I trader preferiscono le MA di 50, 100 e 200 periodi per i timeframe ampi e le MA di 9, 12 e 26 periodi per i timeframe più piccoli.

Ci sono diverse opzioni. Può essere il prezzo di chiusura o di apertura, il massimo, il minimo, il prezzo mediano o tipico o ancora il prezzo di chiusura ponderato. Di solito i trader utilizzano il prezzo di chiusura.

Questa impostazione viene utilizzata per spostare l’indicatore avanti e indietro sulla scala temporale. In questo modo, la MA si sposterà a destra o a sinistra.

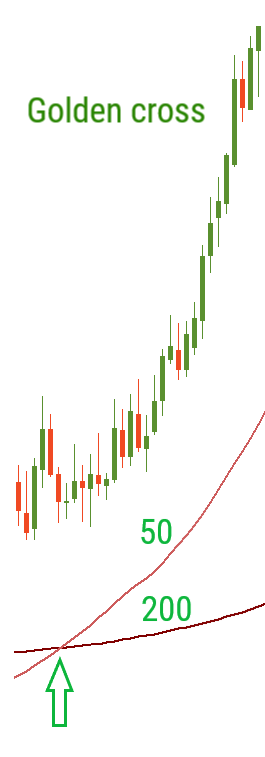

Puoi utilizzare la MA come indicatore di tendenza: se scende, c’è una tendenza ribassista; se sale, c’è una tendenza rialzista. In più, un crossover delle medie mobili può aiutare un trader a decidere quando entrare e uscire dal mercato. Un crossover si verifica quando due MA si incrociano. Ci sono due tipi di crossover: d’oro e della morte.

Quando una MA con un periodo più piccolo incrocia una MA con un periodo più grande dal basso verso l’alto, è un segnale di acquisto.

Quando una MA con un periodo più piccolo incrocia una MA con un periodo più grande dall’alto verso il basso, è un segnale di vendita.

Attenzione: la croce d’oro di solito funziona quando il prezzo si trova sopra la MA o nel caso della croce della morte, sotto la MA.

Riassumiamo ciò che hai imparato oggi:

Fantastico! Ora puoi utilizzare tutte queste strategie di trading. As everybody knows, the best way to digest information is practice. Provale subito!

Bill Williams è il creatore di alcuni degli indicatori di mercato più popolari: oscillatore Awesome, frattali, Alligator e Gator.

Le strategie di tendenza funzionano bene: possono dare risultati significativamente buoni in qualsiasi timeframe e con qualsiasi asset. L'idea principale della strategia ADX di cercare di cogliere l'inizio della tendenza.

Le strategie di trading contro tendenza sono le più pericolose, ma anche le più redditizie. Siamo lieti di presentarti un'eccellente strategia di trading contro tendenza per lavorare in qualsiasi mercato e con qualsiasi asset.

La vostra richiesta è accettata.

Ti chiameremo durante l’intervallo di tempo che hai scelto

La successiva richiesta di richiamata per questo numero di telefono sarà disponibile in 00:30:00

Se hai un problema urgente, ti preghiamo di contattarci tramite

chat live

Errore interno. Si prega di riprovare più tardi