Happy Tuesday, dear traders! Here’s what we follow:

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

Today, the Bank of England will announce the country interest rate and give a press conference. Hence, the GBP has a big day ahead. What is it going to face? Let’s have a look.

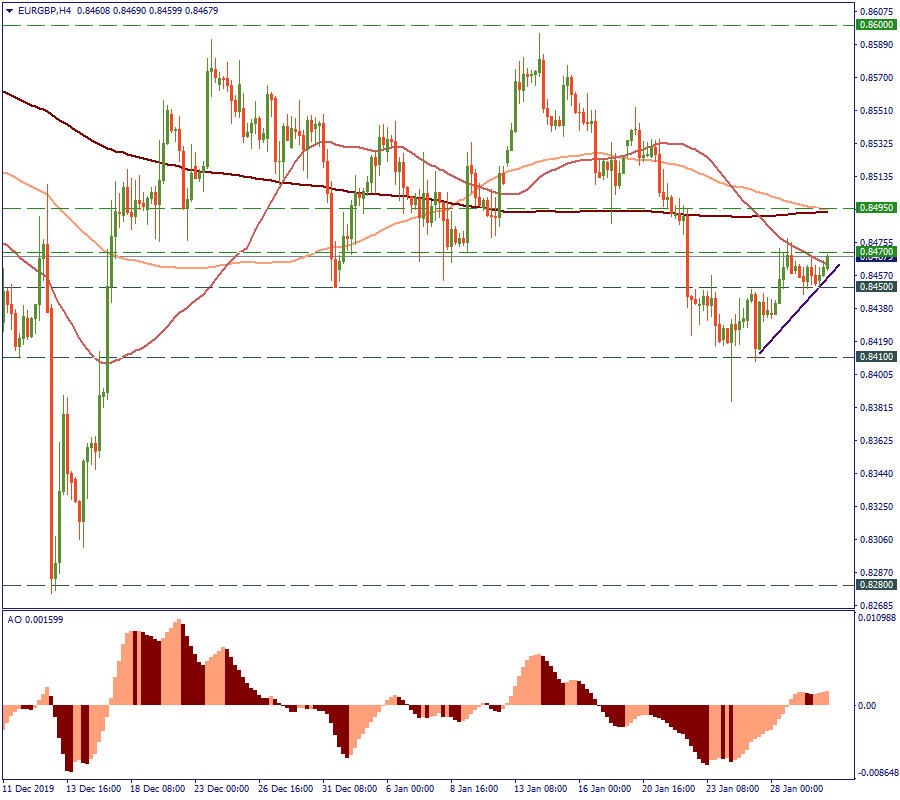

Looking at the H4 chart of the EUR/GBP, we can guess that the market is waiting for the announcement of the BOE to decide on the next step of movement.

Since the middle of December - meaning, since the victory of Boris Johnson - the currency pair has been moving mostly sideways. That movement was confined between 0.8470 and 0.8600. However, last Wednesday the price dropped below 0.8470 to 0.8410 - the latter is now the local mid-term support level. Currently, EUR/GBP is in consolidation at 0.8466 testing the 50-period MA, with support at 0.8450 and resistance at 0.8470. Whether it moves up to break the local resistance and go for 0.8495, where 200-MA and 100-MA come together, depends on the tone of the Bank of England. So what is that tone going to be?

The interest rate has been at 0.75% in the UK through 2019. It seems the question will be: for how long? The economic environment may not have changed much (however, that’s a question for discussion), but the socio-political environment did. Brexit is at hand – the European Parliament already approved it, so it is now just for the EU Council to do the same. Once that is done, Friday will be the day when the UK is no longer with the EU, with only the transition period forcing it to observe the EU regulations.

Internally, the question is whether the Bank of England’s Monetary Policy Committee inclines more to the dovish direction or not. The last time 2 out of 9 members voted for the rate cut. The fundamentals for that were mostly increasing concerns over the British job market and the overall pace of economic growth. If today we have a bigger portion of the rate cut supporters, that would mean that the cut this year is almost inevitable. This inevitability may be carved out even clearer if the BOE policy makers consider that finalizing Brexit on time (until December 2020) is unlikely – they would probably like to price in the GBP’s drop in this case long in advance.

So let’s see what they say: watch the rate announcement (14:00 MT time), read into the details of the press-conference and trade the GBP. For now, LOG IN and prepare your positions!

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

What's going on with the US GDP? Economists think that the first quarter will be pessimistic. Let's check.

The most impactful releases of this week will fill the market with volatility and sharp movements.

Happy Tuesday, dear traders! Here’s what we follow:

Labor Market and Real Estate Market data was published yesterday. Markets are slowing down, so the economy is in recession. Today the traders should pay attention to the Retail sales in Canada.

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later