Padrão diagonal principal

Informação não é consultoria em investimentos

Conforme já sabemos, a quarta onda de qualquer impulso não pode se sobrepor o ponto final da primeira onda. No entanto, sobreposições às vezes acontecem quando esperamos uma onda de impulso, o que não significa que devemos continuar contando um impulso quando houver uma sobreposição das curvas um e quatro só porque há um padrão de ondas de Elliott que se adequa à situação.

Diagonais

Se você espera que a onda um ou cinco se formem como impulso, mas percebe no gráfico um movimento de preço de 5 ondas com sobreposição entre as ondas um e quatro, na maioria dos casos chegará o momento de ter uma diagonal principal ou diagonal final. Qual é a diferença entre esses dois padrões?

Fácil. A diagonal principal pode se formar na onda 1 de um impulso ou na onda A de um zigzag. Ou seja, a diagonal principal é o começo de um impulso ou zigzag.

Ao mesmo tempo, uma diagonal que está se acabando pode ser formada na onda 5 ou C. Neste artigo, descobriremos mais sobre diagonais principais.

Principais regras de uma diagonal principal

- Este padrão se subdivide em 5 ondas;

- A onda 2 nunca acaba além do ponto inicial da onda 1;

- A onda 3 sempre rompe acima do ponto final da onda 1;

- A onda 4 geralmente rompe além do ponto final da onda 1;

- A onda 5 rompe o ponto final da onda 3 na maioria absoluta dos casos;

- A onda 3 não pode ser a mais curta de todas elas;

- A onda 2 não pode ser um triângulo ou uma estrutura do tipo triplo três;

- As ondas 1, 3 e 5 podem ser formadas como impulsos ou zigzags.

Estrutura das ondas motrizes

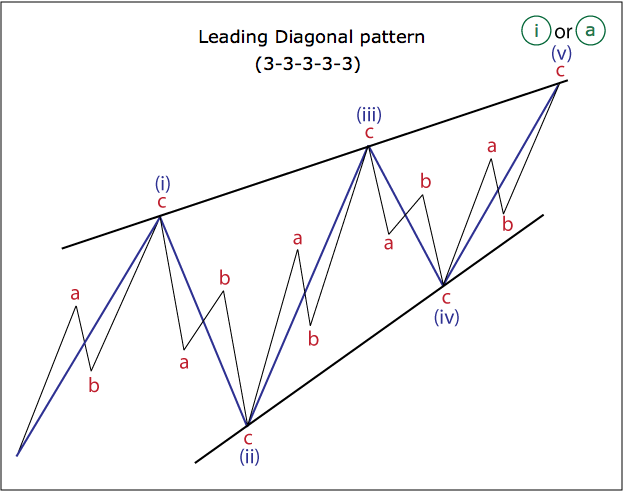

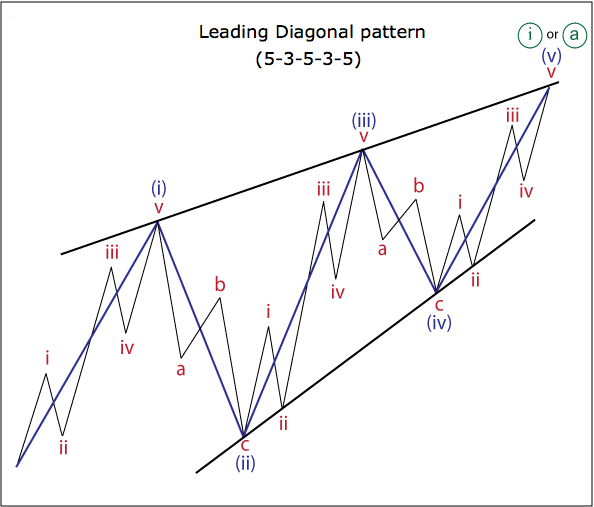

Como você pode inferir das regras acima, podemos ter as ondas motrizes em uma diagonal principal na forma de pulsos ou zigzags. Zigzags são mais comuns, mas às vezes há impulsos no lugar das ondas 1, 3 e 5. Em outras palavras, a estrutura de uma diagonal principal geralmente se parece com o tipo 3-3-3-3-3, mas também podemos encontrar este padrão com a forma diferenciada de 5-3-5-3-5, que tem a mesma forma de um impulso.

Tipos de modelos

Há dois tipos de diagonal principal: em contração e em expansão. Na maioria dos casos, a primeira onda da diagonal principal em contração é a mais longa e a terceira é menor do que a primeira. A quinta onda, por sua vez, é menor do que as ondas um e três. Porém, podemos ocasionalmente encontrar uma diagonal principal em contração na qual a terceira onda é a mais longa.

Cada onda motriz de uma diagonal principal em expansão é mais longa do que a anterior. Logo, a terceira onda deste padrão é mais longa que a primeira e a quinta onda é mais longa que a terceira. Considera-se que uma diagonal principal em expansão é mais arriscada que uma em contração.

Você pode ver no gráfico abaixo um padrão com estrutura 3-3-3-3-3, com todas as ondas se formando como zigzags.

O próximo gráfico representa uma diagonal principal com forma do tipo 5-3-5-3-5, de forma que as ondas motrizes (1, 3 e 5) sejam impulsos e as ondas corretivas (2 e 4) sejam zigzags.

Exemplo real

Como você pode ver no gráfico abaixo, há 3 diagonais principais. Primeiramente, tem-se uma diagonal principal em expansão que provou ser apenas a onda (a) do ((i)) de outra diagonal principal na onda 1.

As ondas motrizes da diagonal principal em contração na onda 1 são formadas por dois zigzags e um zigzag duplo na onda ((iii)). Logo, você agora sabe que às vezes é possível ter algo mais complexo do que um zigzag no lugar das ondas motrizes da diagonal principal.

Outra diagonal principal em contração na onda ((a)) configurou a onda 2, formada como zigzag.

Logo, este exemplo mostra perfeitamente que uma diagonal principal pode ser o começo de uma nova onda de impulso (como o padrão na onda 1) e pode também ser o primeiro passo rumo a uma correção (veja a onda ((a)) de 2). Ademais, podemos ter diagonais principais dentro de uma diagonal principal (veja a onda (a) de ((i)).

Confirmação

Se uma diagonal principal é formada por zigzags, devemos aguardar confirmação, porque se tivermos um movimento de preço de 5 ondas, que se subdivide em 5 zigzags, podemos também chamar esta parte do gráfico como correção, com algumas diferenças conforme o caso particular.

Logo, é bem importante aguardar uma confirmação antes de tomar qualquer atitude no âmbito do trading. Se tivermos uma correção após uma diagonal principal, bem como a formação de uma onda de impulso na direção da terceira onda esperada (ou onda C), então o padrão anterior pode ser dado como confirmado.

Exemplos de diagonais principais em expansão

Há uma diagonal principal em expansão no gráfico a seguir. Como você pode ver, a onda ((v)) não atingiu o lado superior do padrão. Momentos como este acontecem com certa frequência, então não espere o fim de uma diagonal em expansão próxima de seu lado de cima.

Porém, a quinta coluna ocasionalmente consegue romper a linha da onda um à onda três, o que ocorre com considerável raridade — levou algum tempo para encontrar o exemplo certo para esta situação. Geralmente, isto acontece quando se anuncia algum acontecimento político ou notícia. A diagonal principal em expansão que você pode ver abaixo foi formada durante um longo encontro do governo britânico sobre o acordo do Brexit.

Diagonais principais com impulsos dentro

Como citamos acima, as ondas um, três e cinco da diagonal principal também pode ser impulsos. Basta dar uma olhada no gráfico abaixo: há uma diagonal principal na onda a e suas ondas motrizes se assemelham a impulsos.

Vamos examinar uma diagonal em seu fim no próximo artigo, mas você pode observar a principal diferença entre os dois padrões. Uma diagonal principal impulsiona o movimento do preço, enquanto uma diagonal em seu fim termina o mesmo. Ademais, é também possível ter uma diagonal final na quinta onda da diagonal principal, caso este padrão esteja se desenvolvendo com impulsos em ondas motrizes (veja os gráficos acima).

Moral da História

A diagonal principal é o começo de um impulso ou zigzag. Este padrão pode ser formado em dois tipos: 3-3-3-3-3 (mais comum) e 5-3-5-3-5. Acontece uma correção logo após o fim de uma diagonal principal e, após esta correção, podemos esperar por uma terceira onda do impulso da onda C de um zigzag, dependendo da contagem total de ondas.

Outros artigos nesta seção

- Estrutura de um robô de negociação

- Construir um robô de negociação sem programar

- Como lançar robôs de trade no MetaTrader 5?

- Trading algorítmico. O que é isto?

- Trading algorítmico com MQL5

- O que significa “truncamento“?

- Ichimoku

- Padrão de ondas de Wolfe

- Padrão dos Três Avanços (Three Drives)

- Tubarão

- Borboleta

- Caranguejo

- Bat

- Gartley

- ABCD

- Padrões harmônicos

- Introdução à análise das Ondas de Elliott

- Como negociar rompimentos

- Negociando com notícias Forex

- Como colocar uma ordem Take Profit?

- Gestão de riscos

- Como colocar uma ordem Stop Loss?

- Indicadores técnicos: negociação de divergências