The G20 summit took place in Bali, Indonesia, on November 2022…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

1. USD/CHF and EUR/CHF are on the bullish rally for over a week.

2. Swiss National Bank (SNB) assessed the franc to be “highly valued” in June, but it affected the price faintly.

We had already seen Gold Flash Crash several days before, and now it’s time to look at the EUR/CHF and USD/CHF pairs. In August Swiss franc has risen against the euro to a nine-month high of 1.072. As for now, it was the lowest point of the EUR/CHF downtrend. Yet the USD/CHF pair shows more flat movements.

The reason is that franc is considered by the majority of traders and investors as a safe-haven asset, putting it on the same level as gold and JPY. Because of low inflation and negative interest rates, CHF is strongly associated with slow but steady growth against all currencies. Investors keep buying CHF and JPY in attempts to hide from Delta’s impact on global economic growth.

Swiss National Bank paid attention to the “unstoppable” growth of franc and assessed it to be “highly valued” in June. However, this statement didn’t stop CHF rise and the currency has only strengthened 1.5% since then. The plunge in bond yields from Treasuries to bunds has also boosted the currencies’ appeal. All this raises the risks of (Swiss) Central Bank intervention with its monetary policy, including negative interest rates, and a pledge to wage currency market interventions if needed.

The question now is at what level the Swiss National Bank might intervene. It could be last year’s low at around 1.05 per euro or a little bit further at 1.03 if the SNB used a real trade-weighted measure as a guide. One thing is for sure, this kind of intervention to the natural order of things will affect badly on Swiss economy.

Maybe there won't be any intervention at all. The Swiss franc has lost about 2.5% over the last week against the dollar to trade at 0.9235 CHF and has weakened against the euro to 1.082 per EUR.

After a strong US NFP report (943K actual vs. 870K forecast) the US Federal Reserve could soon start tapering its massive coronavirus-driven stimulus. The prospect of the Fed's reduced bond-buying pushed down US bond prices, lifting their yields and hitting other safe-haven assets that had benefited from low returns from bonds, such as the Swiss franc and gold.

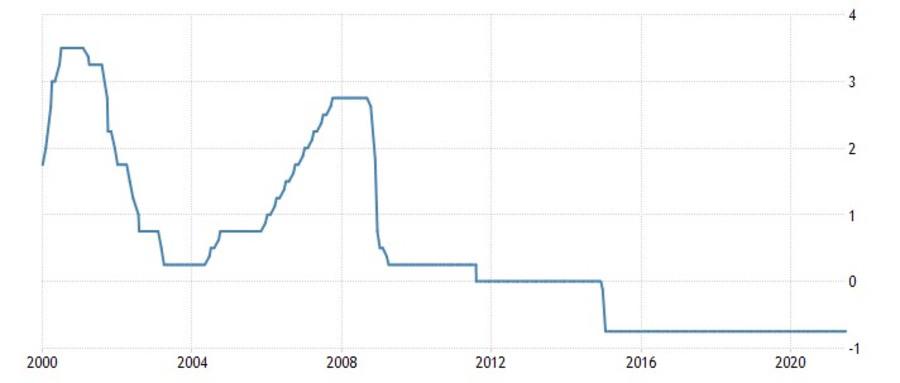

BofA Global Research says that CHF is the most vulnerable among major currencies to a recovery in U.S. bond yields. That’s because Switzerland has the lowest official cash rate in the world and some of the lowest bond yields as well. Look at the Switzerland Interest Rate hereunder.

Source: https://tradingeconomics.com/switzerland/interest-rate

Risks are rising for CHF, and yet they are limited. The European Central Bank’s latest strategy review supports the view that policy in the euro area will remain expansionary for a long time after the pandemic. Expansionary monetary policy works by expanding the money supply faster than usual or lowering short-term interest rates. In a nutshell, that means that the upside potential for the euro against the franc could therefore be limited even once Covid cases start subsiding.

The Swiss Franc is having a major week-long reversal in EUR/CHF pair, with resistances at 1.08184 and in 1.0842-1.08505 area. Beneath there is a strong support line at 1.0721.

Anyway, EUR/CHF downtrend is unlikely to change, with the “death-cross” bearish pattern have occurred a week ago. The main resistance, for now, is 1.0864 and support is at 1.0721.

As for the greenback, in the long-term CHF is rising again USD with resistance in 0.9273-0.9366 area and support at 0.896 level.

The G20 summit took place in Bali, Indonesia, on November 2022…

The deafening news shocked the whole world yesterday: the British Queen Elizabeth II died peacefully at the age of 96…

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later