Saluti dal lontano 2022! Gli analisti di FBS hanno usato un po’ di magia per viaggiare nel futuro e hanno portato indietro alcune previsioni esilaranti.

Non perdere tempo: analizza l’influenza dei NFP sul dollaro statunitense!

Avviso sulla raccolta dei dati

Manteniamo un registro dei tuoi dati per gestire questo sito web. Cliccando il pulsante accetti la nostra Informativa sulla privacy.

Guida Forex per i principianti

Una grande guida al mondo del trading.

Controlla la cartella “In arrivo”!

Nella nostra email troverai la Guida Forex. Premi il pulsante per ottenerla!

Avviso di rischio: I ᏟᖴᎠ sono strumenti complessi che comportano un rischio elevato di perdere denaro rapidamente per via della leva.

Il 68,53% degli investitori retail perde denaro negoziando ᏟᖴᎠ con questo provider.

Dovresti considerare se comprendi come funzionano i ᏟᖴᎠ e se puoi permetterti di correre il rischio di perdere il tuo denaro.

Le informazioni non possono essere considerate consigli di investimento

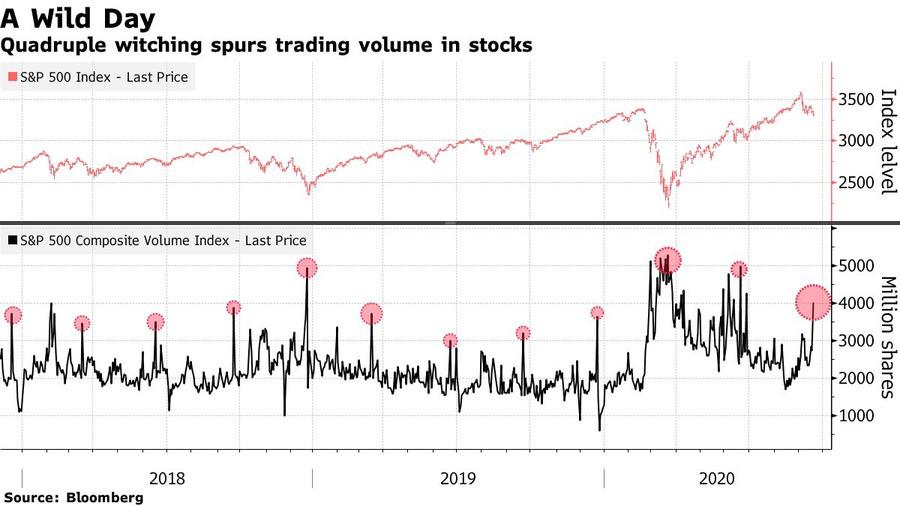

Besides US Retail Sales data, Australian Unemployment Rate and New Zealand GDP this week will bring us Quadruple Witching – one of the four most important days of a year for futures and options!

Quadruple witching refers to four days during the calendar year when the contracts on four different kinds of financial assets expire. The expiration date is the point at which a position automatically closes. In other words, traders will have to decide what they want to do with their open position before the expiry date. The days are the third Friday of March, June, September, and December. The assets are:

Options contracts also expire monthly. Futures contracts expire quarterly. Because traders and institutions run out of time at the close of trading, there is a lot of portfolio re-balancing, contract rollovers, and more. The last hour of the trading session (22:00 to 23:00 GMT+3) is when the volatility really increases, and assets swing dramatically.

Because all four types of contracts expire on the same day, the quadruple witching day is usually accompanied by bigger trading volumes and volatility. On June 18, 2021, a quadruple witching day, a near-record volume of single-stock equity options was set to expire at the end of the day in the amount of $818 billion. As a result, a near-record of single stock open interest of about $3 trillion stood on June 18, 2021. Open interest refers to how many contracts are open during any given point during the day. It is an important metric for traders to watch since a large amount of open interest can move the value of the underlying stock.

But you need to know, that these Freaky Friday days (the second name for the day is even stranger than the first) in general are not bullish or bearish. You cannot just buy or short sell and make guaranteed money. What is guaranteed, however, is that there will be a big surge of volatility. There is on average 40% more volume on this day than the average.

Source: https://www.bloomberg.com/news/articles/2020-09-18/stock-traders-brace-for-quadruple-witching-amid-options-anxiety?sref=qgDWnyMx

Also, note that the last hour of the session is usually bearish because long positions are prevailing against short ones, and closing these trades might cause a plunge in prices.

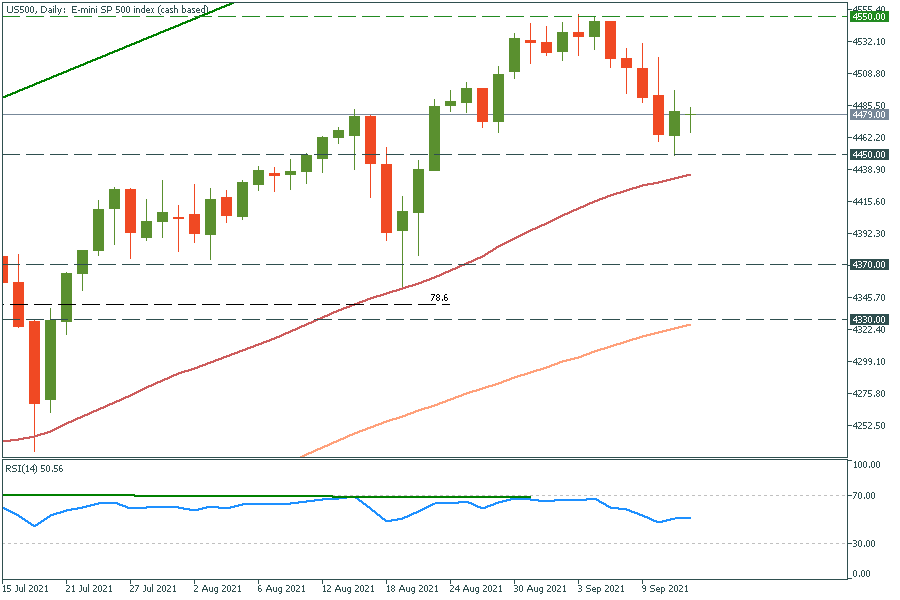

US 500 and US 100 will be more volatile this Friday. Because of trading volumes, US 500 index will be able to reach distant resistance at 4370 or plunge through the 4450 level (if the Index doesn’t do this earlier this week).

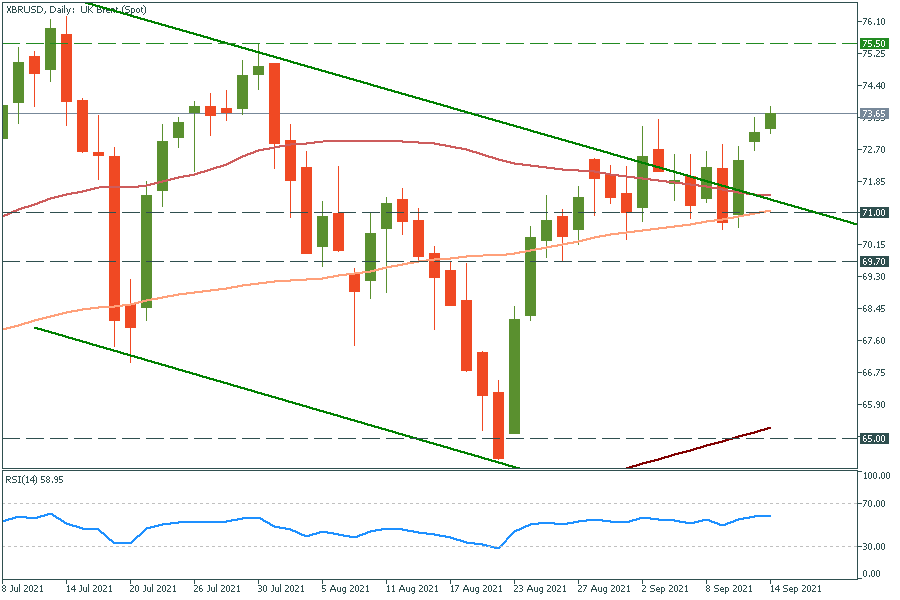

The same goes for oil, gas, and gold, so keep an eye on XAU/USD, XNG/USD, and XBR/USD. Brent oil is surging for several days already, so we may see strong pullbacks to the $71 level.

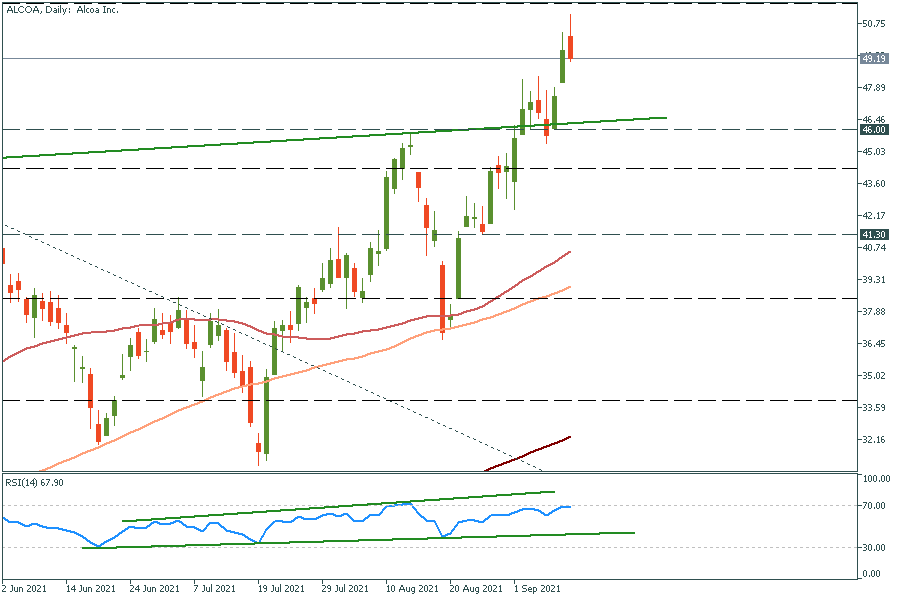

In stock market, consider trading such companies as Tesla or Alcoa because they either have huge options volume or are commodity-based. Moreover, Alcoa is on the rise because the aluminum price is skyrocketing. Both rise to $52 and plunge to $46 levels are possible.

Saluti dal lontano 2022! Gli analisti di FBS hanno usato un po’ di magia per viaggiare nel futuro e hanno portato indietro alcune previsioni esilaranti.

La nuova variante Omicron e i commenti di Powell hanno fatto aumentare la volatilità in EUR/USD. Cosa aspettarsi ora?

La società rilascerà i propri dati questo venerdì. Cosa dovresti sapere?

La pandemia continua a danneggiare l'attività economica in Cina, la guerra in Ucraina sta colpendo l'intera economia europea e gli sforzi della Federal Reserve per controllare l'inflazione minacciano di innescare una recessione.

Ogni volta che l'inflazione supera il 4% e la disoccupazione scende al di sotto del 5%, l'economia statunitense entra in recessione entro i due anni successivi.

BCE accomodante e Fed aggressiva dipingono uno scenario ribassista per EUR/USD. Il prossimo passo sarà un declino a 1,0770?

La vostra richiesta è accettata.

Ti chiameremo durante l’intervallo di tempo che hai scelto

La successiva richiesta di richiamata per questo numero di telefono sarà disponibile in 00:30:00

Se hai un problema urgente, ti preghiamo di contattarci tramite

chat live

Errore interno. Si prega di riprovare più tardi