The G20 summit took place in Bali, Indonesia, on November 2022…

Don’t waste your time – keep track of how NFP affects the US dollar!

Data Collection Notice

We maintain a record of your data to run this website. By clicking the button, you agree to our Privacy Policy.

Beginner Forex Book

Your ultimate guide through the world of trading.

Check Your Inbox!

In our email, you will find the Forex 101 book. Just tap the button to get it!

Risk warning: ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage.

68.53% of retail investor accounts lose money when trading ᏟᖴᎠs with this provider.

You should consider whether you understand how ᏟᖴᎠs work and whether you can afford to take the high risk of losing your money.

Information is not investment advice

Over the last 18 months, governments have printed an unbelievably large amount of money. And while these measures help the economy to rise and thrive, the consequences can be severe for everyone. Let’s discuss, what role do banks have in all this and how can we forecast their future actions and stock price’s prospects.

As one of the crucial members of society, financial institutions have several main functions to maintain the economy in a good state. During the pandemic, banks have been active on a number of fronts. Among them are:

In a nutshell: banks were trying to help SMEs amidst lockdowns and sharp reduction of economic activity. Their goal is to maintain as many payrolls as possible and keep the unemployment rate under control. That’s why we are watching after NFP data closely, it reflects broad market conditions.

Banks’ stocks have risen for the last year and a half because of:

Moreover, there are prospects for banks to gain even more. Accelerating economic recovery contributes people to borrow more money, though, not as much as expected. As the result, banks gain the potential to increase their buyback programs. Morgan Stanley and Wells Fargo were among the banks that said in June they would increase dividends and buy back more of their stock. Collectively, JPMorgan, Bank of America, Wells Fargo, and Morgan Stanley have announced they’ll repurchase $85 billion in shares.

It would be weird not to mention the consequences of rate hikes. As the banks now have enormous sums of money in loans, and floating rates are used widely, raising the federal funds rate by 1% will result in billions of dollars profit in a matter of a year. And we know that rate hikes are just a matter of time.

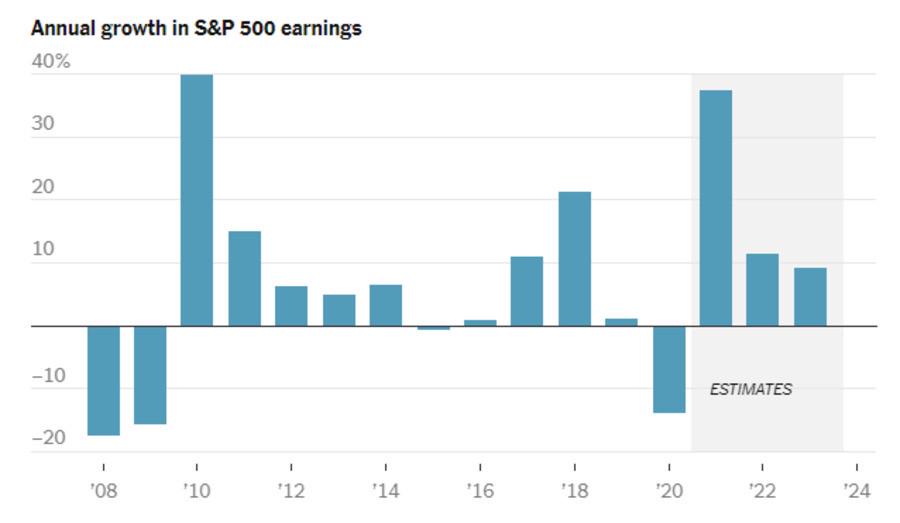

The nation’s biggest banks are about to report profits, and for behemoths including JPMorgan Chase and Goldman Sachs they are expected to fall when the banks report third-quarter results this week. As we can see, rapid growth in S&P 500 earnings will decrease over time as tapering comes into full strength.

Source: https://www.nytimes.com/

This week, 6 biggest banks will release their quarterly earnings report, including:

Notice, that you can trade these banks’ stocks with FBS!

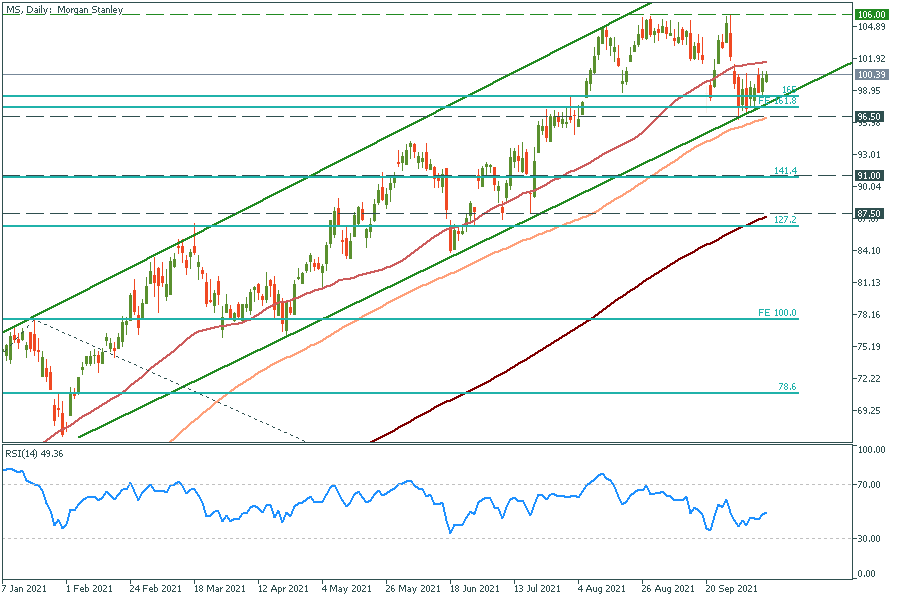

It’s understandable for banks to lose the pace of growth. Previous reports were positive due to stimulus, but the time of trillion-dollar money printed out of thin air is gone. Current supportive measures just aren’t strong enough to increase banks’ revenues compared to last quarter. What is in our sphere of interest, though, is Morgan Stanley, which is expected to increase revenue. We suppose the following reasons:

If to say for the whole financial industry, the end of the pandemic will keep the Covid-19 legacy. We are talking about the transition to online banking and the increase in the number of retail investors and traders, who are trying to deal with the market by themselves. This, in turn, will help the banks to refrain even against tapering and rates hikes.

Resistance: 106.0; 109.0; 125.0

Support: 96.5; 91.0; 87.5

At the end of the day, banks anticipate rate hikes, so future tapering doesn’t seem to be so crucial for them. For now, expectations from the reports are mostly negative (Morgan Stanley is a reasonable exception) due to stimulus reduction. What’s more important is the bank’s forecasts of their future revenues. We will hear from them shortly. As for now, it is a perfect opportunity to consider increasing the bank’s share in your investment portfolio.

The G20 summit took place in Bali, Indonesia, on November 2022…

The deafening news shocked the whole world yesterday: the British Queen Elizabeth II died peacefully at the age of 96…

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

eurusd-is-falling-what-to-expect-from-the-future-price-movement

Greetings, fellow forex traders! Exciting news for those with an eye on the Australian market - the upcoming interest rate decision could be good news for Aussies looking to refinance or take out new loans. The Mortgage and Finance Association Australia CEO, Anja Pannek, has...

Hold onto your hats, folks! The Japanese yen took a nosedive after the Bank of Japan (BOJ) left its ultra-loose policy settings unchanged, including its closely watched yield curve control (YCC) policy. But wait, there's more! The BOJ also removed its forward guidance, which had previously pledged to keep interest rates at current or lower levels. So, what's the scoop? Market expectations had been subdued going into the meeting, but some were still hoping for tweaks to the forward guidance to prepare for an eventual exit from the bank's massive stimulus

Your request is accepted.

We will call you at the time interval that you chose

Next callback request for this phone number will be available in 00:30:00

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later