Bill Williams es el creador de algunos de los indicadores del mercado más populares: oscilador asombroso, fractales, alligator y gator.

¡No pierdas tu tiempo – mantente informado para ver cómo las NFP afectan al USD!

Aviso de Recopilación de Datos

Mantenemos un registro de tus datos para ejecutar este sitio web. Al hacer click en el botón, estás aceptando nuestra Política de Privacidad.

Manual para Principiantes de Forex

Tu guía definitiva a través del mundo del trading.

¡Revisa Tu Correo!

En nuestro correo electrónico, encontrarás el Manual de Forex 101. ¡Solo toca el botón para descargarlo!

Advertencia de Riesgo: Los ᏟᖴᎠs son instrumentos complejos y tienen un alto riesgo de pérdida de dinero rápidamente debido al apalancamiento.

El 68,53% de las cuentas de los inversores minoristas pierden dinero al operar ᏟᖴᎠs con este proveedor.

Deberías tener en consideración si comprendes el funcionamiento de los ᏟᖴᎠs y si puedes darte el lujo de arriesgarte a perder tu dinero.

Esta información no son consejos para inversión

La inflación no viene de la nada. Siempre hay una razón para que ocurra. Además, a menudo sucede debido a errores humanos y sesgos. Todo lo que podemos hacer es prepararnos y soportar los riesgos y las consecuencias de la inflación. Este curso intensivo aborda las razones de la inflación y las formas de protegerse de ella.

La inflación mide el aumento de los precios de los bienes y servicios en una economía. Cuando ocurre una inflación, conduce a precios más altos para necesidades como los alimentos. La mayoría de las veces, la inflación no ayuda a la economía y solo empeora las cosas para las personas. ¿Pero de dónde viene?

Varios factores pueden impulsar los precios o la inflación en una economía. Por lo general, la inflación resulta de un aumento en los costos de producción o un aumento en la demanda de productos y servicios. Además, una de las señales de inflación puede ser el aumento de los precios de las materias primas, como el petróleo y los metales. Sin embargo, diversas investigaciones niegan esta correlación. Revisa nuestro artículo sobre el vínculo entre el petróleo y los precios para mejorar tu comprensión sobre el petróleo.

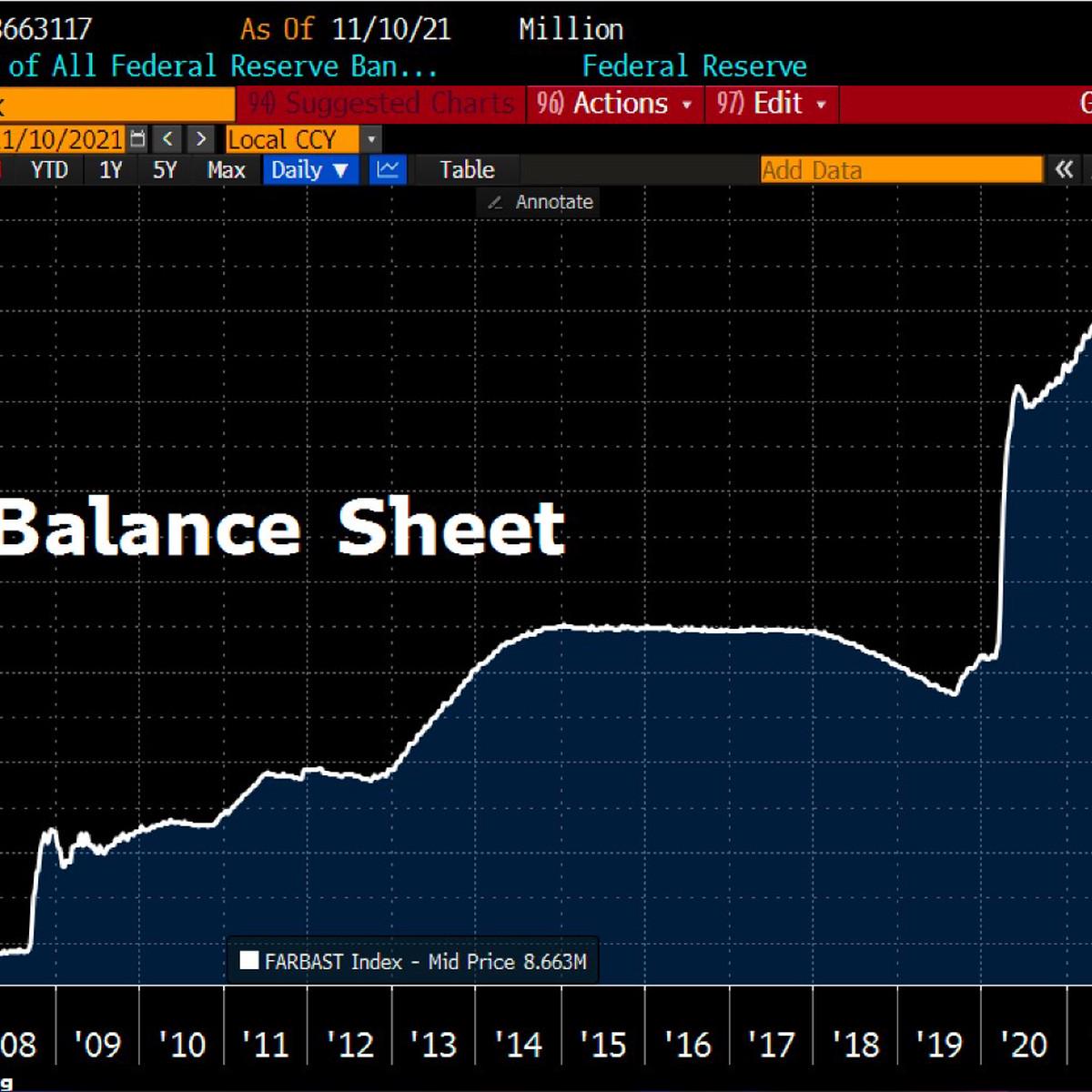

Uno de los impulsores de la inflación más significativos son los llamados "Cisnes Negros". Son eventos improbables que tienen un impacto extremadamente fuerte en una economía. Puede ser una guerra, un desastre natural o una pandemia, como la que comenzó en el año 2020. Los cisnes negros perturban las cadenas de suministro, disminuyen la cantidad de productos en los estantes y aumentan los precios. Tras el inicio de la pandemia de Covid-19, la Reserva Federal de Estados Unidos imprimió más de 8 billones de dólares en menos de dos años. Eso puso al mundo al borde de una crisis económica, y probablemente comenzará en menos de un año.

Fuente: Bloomberg

La inflación disminuye el poder adquisitivo de una moneda debido a un alza en los precios. Una respuesta predecible a la disminución del poder adquisitivo es comprar ahora y no más tarde. El efectivo solo perderá valor, por lo que es mejor dejar de lado las compras y abastecerse de cosas que probablemente no perderán valor. Para las personas, esto significa comprar más ahora para poder comprar menos después. Y para las empresas, significa hacer más inversiones que serán mucho más en el futuro. Aprendamos cómo evitar la inflación de todas las formas posibles.

Hay diversas maneras de sacar ventaja del aumento de los precios. Las evaluaremos una por una.

Estos instrumentos tienen mucho en común con los valores del mercado monetario, así que primero ocupémonos de ellos. Los valores del mercado monetario consisten en inversiones en efectivo, valores de deuda a corto plazo (Tesoro de EE.UU.) y valores equivalentes de efectivo. Los inversores los consideran el grupo de activos más seguro, con alta liquidez y baja volatilidad. Para aclarar las cosas, hagamos una explicación adicional. Un bono es un valor emitido por un gobierno o una corporación para reunir más dinero para sus proyectos y actividades. Los bonos tienen menores riesgos en comparación con las acciones, pero proporcionan menos ganancias.

¿Qué pasa con los bonos a corto plazo? Generalmente son emitidos por un gobierno o una corporación. Los bonos a corto plazo ofrecen un menor rendimiento en comparación con los de largo plazo. Sin embargo, los bonos a largo plazo tienden a ser ineficaces cuando se produce una alta inflación, porque el aumento de los precios reduce el valor de los pagos. Por ejemplo, tienes un bono a largo plazo y te genera $100 cada año. Pero con una tasa de inflación del 10%, comprarías un 10% menos cada año y no puedes hacer nada al respecto. Los bonos a corto plazo son más resistentes a la inflación, ya que se vencen más rápido. Aún así, no recomendamos que te protejas contra la inflación con bonos, ya que a menudo dan rendimientos anuales negativos en medio de una alta inflación.

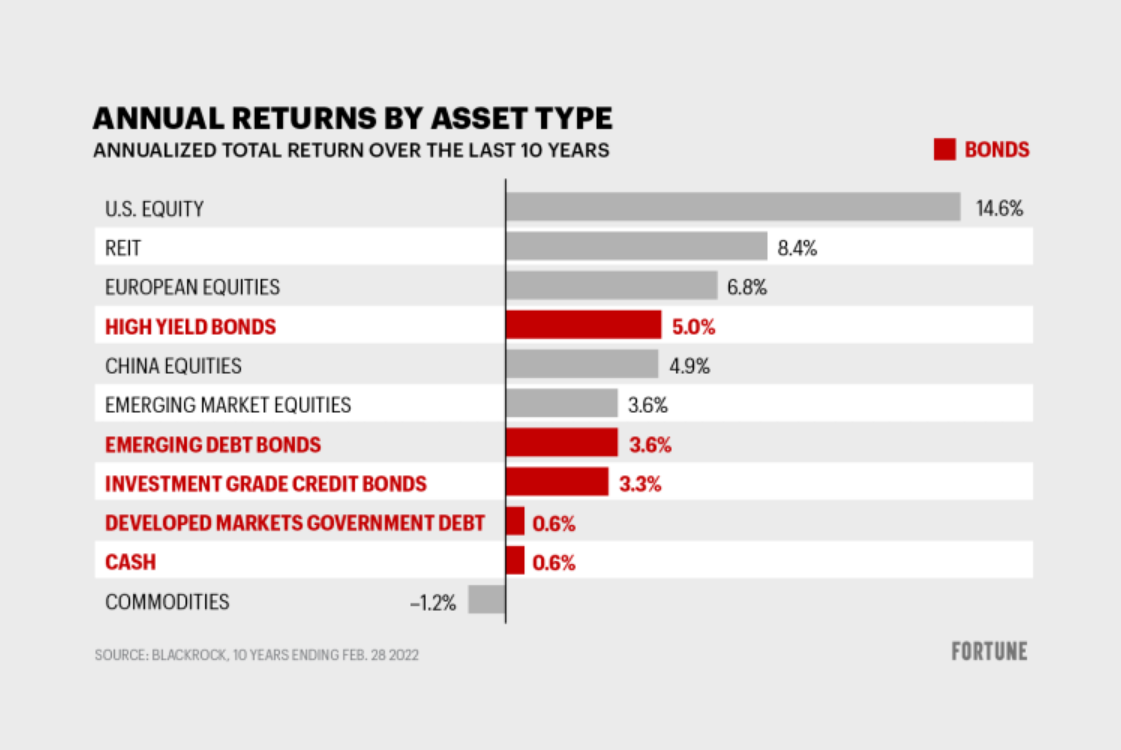

Lo siguiente en nuestra lista son las acciones. Si bien el mercado de bonos puede parecer confuso, el mercado de valores es lo suficientemente fuerte como para protegerte de la inflación. Históricamente, las acciones superan la inflación en períodos prolongados (10 años y más).

Como puedes ver, la renta variable de EE.UU. (mercado de valores) dio el mayor rendimiento total en los últimos diez años. Estamos de acuerdo con la estimación anterior; estadísticamente, las acciones se están desempeñando bien y si deseas proteger tu dinero de la inflación, invierte en acciones. Sugerimos buscar compañías siempre favorecidas por el mercado, como empresas minoristas y extractoras de materias primas y bancos. Con FBS, puedes invertir en Alcoa (ALCOA), 3M (MMM), McDonald's (MCDONALDS), JPMorgan (JPM) y muchas más. Revísalas todas en nuestra página de Trading de Acciones.

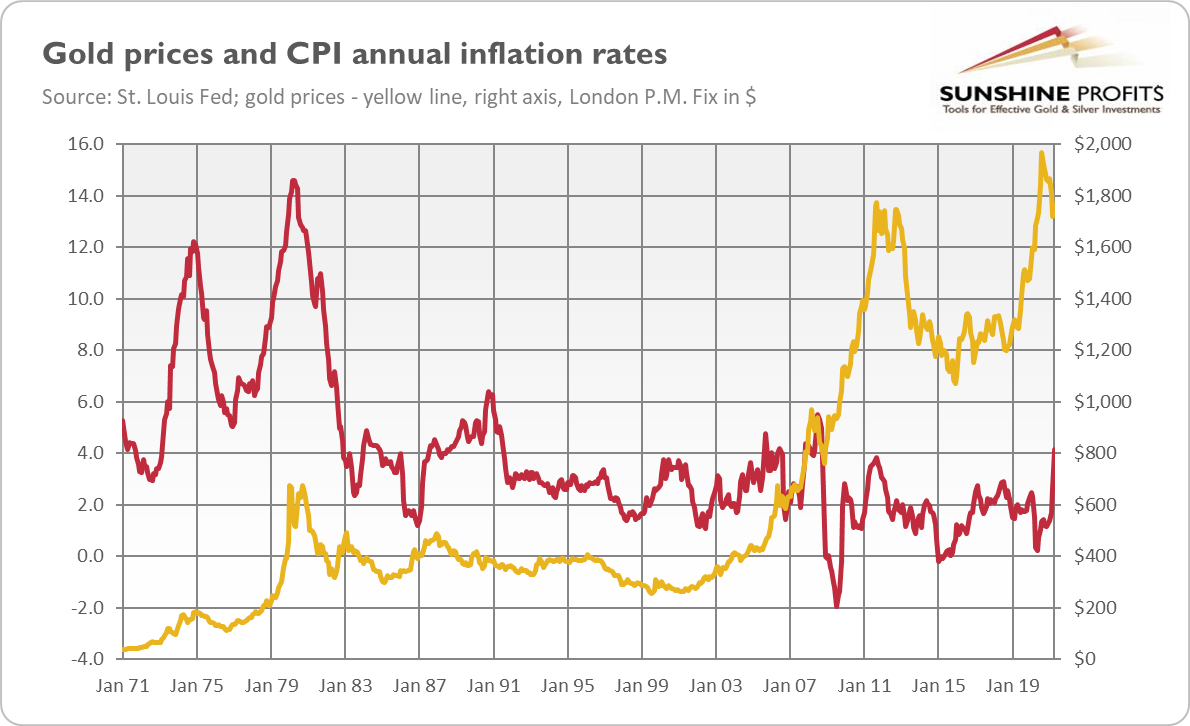

El oro es un activo de refugio, lo que significa que la gente confía en él. Los motivos detrás de esta fe son comprensibles: hay una cantidad limitada de oro en el mundo y una cantidad ilimitada de dinero. Y esta es la razón del constante crecimiento del oro. Es una medida de inflación. La depreciación del dinero significa que puedes comprar menos con la misma cantidad. Y aquí tenemos una referencia cruzada con el oro, cuya cantidad no aumenta tan rápido.

Por lo general, el precio del oro aumenta en línea con la inflación, por lo que es uno de los mejores activos para ti en períodos de aumento de precios. Sin embargo, ten en cuenta que el oro no sube al mismo tiempo que los precios. Hay un lapso de tiempo entre ambos, por lo que el oro es una cobertura eficiente contra la inflación durante largos períodos.

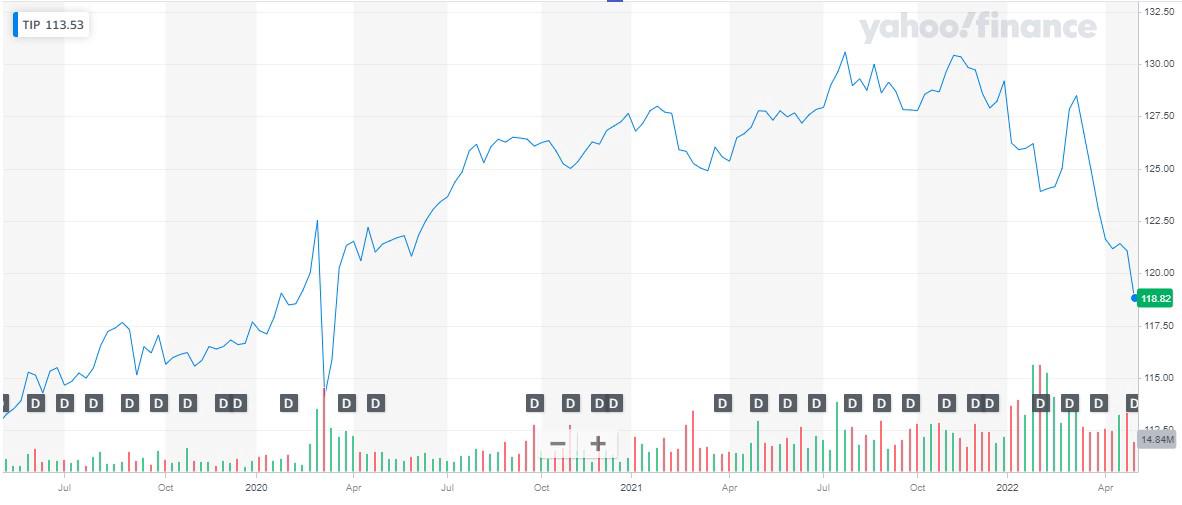

Los valores del Tesoro protegidos contra la inflación (en inglés TIPS – Treasury Inflation-Protected Securities) son un tipo de valores del Tesoro emitidos por el gobierno de EE.UU. Los TIPS están indexados a la inflación para proteger a los inversores de una disminución en el poder adquisitivo de su dinero. Básicamente, es un bono (obligación) que aumenta con la inflación, y los pagos de los bonos varían según el cambio en el valor principal (inicial) del bono.

Recibes pagos de TIPS dos veces al año y puedes comprarlos en un banco. Además, puedes elegir entre conservar tus TIPS hasta que venzan (cierre) o venderlos antes – los EE.UU. emiten TIPS con diferentes duraciones, de 5 a 30 años. Veamos los rendimientos de los valores protegidos contra la inflación.

Incluso los TIPS sufren el aumento de los precios: el gráfico ha estado cayendo durante casi un año. No te recomendamos que busques protección contra la inflación en este activo.

Ya hemos tocado el oro en este artículo, así que concentrémonos en una materia prima diferente pero crucial – el petróleo. Un aumento en los precios del petróleo generalmente reduce la tasa de crecimiento económico esperado y aumenta las expectativas de inflación en horizontes más cortos. Una disminución de las perspectivas de crecimiento económico, a su vez, reduce las expectativas de ganancias de las empresas, lo que tiene como resultado un efecto moderador en los precios de las acciones. Pero eso es en teoría.

No hay evidencia clara de que el aumento de los precios sea un factor alcista para el petróleo. En nuestro artículo "El petróleo puede alcanzar los $100; ¿qué significa esto para los mercados y la inflación?" tocamos el tema, asegúrate de echarle un vistazo.

El petróleo reacciona a la relación entre oferta y demanda, las preocupaciones logísticas y el ritmo del crecimiento económico. Puede ser una opción decente si deseas proteger tu dinero, pero solo cuando la economía se sienta bien. Los precios en aumento como tal no impulsan al XBR/USD o al XTI/USD. Por otro lado, el creciente nivel de consumo de bienes impulsa al petróleo. Es aconsejable invertir en petróleo cuando la economía culmina una recesión.

Las criptomonedas son bastante volátiles y su correlación con diferentes activos cambia a menudo. Aún así, algunas criptomonedas pueden funcionar como una cobertura contra la inflación, pero debes elegirlas con inteligencia. Las criptomonedas mejor protegidas contra la inflación son aquellas con inflación controlable. Por ejemplo, el Bitcoin tiene una inflación anual del 1,25%, que irá disminuyendo con el tiempo. El Ethereum tiene una inflación menos controlable debido a la naturaleza de esta criptomoneda. Sin embargo, el Ethereum es un activo deflacionario la mayor parte del tiempo, lo que significa que el suministro de la moneda disminuye.

El mercado de criptomonedas es relativamente joven y no ha sido testigo de grandes crisis económicas. Este año nos mostrará qué oportunidades ofrecen este tipo de activos.

Un préstamo apalancado es un tipo de préstamo otorgado a empresas o individuos que ya tienen una deuda considerable. Es como el apalancamiento de un broker de Forex pero en la vida real. Más inversores atraen sus fondos al mercado de préstamos apalancados en medio de tasas de interés en aumento. Luego de $27,8 mil millones en salidas de acciones en el 2020, $13,1 mil millones volvieron a ingresar al mercado de préstamos apalancados en el primer trimestre del 2021.

Los préstamos apalancados pueden brindarte una defensa contra la inflación porque se correlacionan negativamente con los bonos del Tesoro a 5 y 10 años. Por lo tanto, son más baratos cuando el mercado está valorando una recesión. Es posible tomar un préstamo apalancado mientras sea barato e invertir el dinero en cualquier activo de refugio que más te guste (por ejemplo, oro). Por favor piénsalo dos veces antes de ingresar al mundo de los préstamos apalancados, ya que son instrumentos de alto riesgo.

¿Es el Oro una Buena Cobertura Contra la Inflación?

El oro tiende a subir cuando el dólar está cayendo. El USD se debilita en medio de una alta inflación. Por lo tanto, el oro puede ser una cobertura contra el aumento de los precios.

¿Las Acciones Protegen Contra la Inflación?

Las acciones son más volátiles que el oro y algunos sectores (por ejemplo, las acciones tecnológicas) sufren de inflación. Por otro lado, los bancos y el sector minorista se sienten muy bien y pueden subir con los precios.

¿Es el Bitcoin una Cobertura Contra la Inflación?

El mercado de criptomonedas es relativamente joven y no ha sido testigo de grandes crisis económicas. Sin embargo, el Bitcoin es una criptomoneda con inflación controlable. Por lo tanto, no es propenso a un rápido aumento de la oferta y se puede utilizar como cobertura contra la inflación.

¿Qué Sucede con el Efectivo Durante una Inflación?

Por lo general, el efectivo se vuelve más barato durante una inflación. La razón de esto es la naturaleza de la inflación que proviene de varios factores, incluyendo la impresión de dinero incontrolable.

Bill Williams es el creador de algunos de los indicadores del mercado más populares: oscilador asombroso, fractales, alligator y gator.

Las estrategias de tendencia son buenas: pueden dar resultados significativamente buenos en cualquier temporalidad y con cualquier activo. La idea principal de la estrategia ADX basada en tendencia es intentar posicionarse en el comienzo de la tendencia.

Las estrategias contra tendencia siempre son las más peligrosas, pero también las más rentables. Nos complace presentar una excelente estrategia contra tendencia para trabajar en cualquier mercado y con cualquier activo.

Escenario bajista: Ventas por debajo de 1.0820 / 1.0841... Escenario alcista: Compras sobre 1.0827...

Escenario bajista: Ventas por debajo de 2200 / 2194 con TP1: 2190, TP2: 2180 y TP3: 2172 con S…

Escenario bajista: Ventas por debajo de 5220 ... Escenario alcista: Compras sobre 5225 (Si el precio falla en romper por debajo de 5220 con decisión)

Su solicitud ha sido aceptada

Te llamaremos en el intervalo de tiempo que elijas

La próxima solicitud de devolución de llamada para este número de teléfono estará disponible en 00:30:00

Si tienes algún problema urgente, contáctanos a través del

Chat en vivo

Error interno. Por favor, inténtelo nuevamente más tarde