Momentum

Informação não é consultoria em investimentos

Existe na análise técnica o termo “momentum”, que se refere à força por trás de uma tendência. O momentum é medido por diversos indicadores técnicos (RSI, Oscilador Estocástico, MACD). Cada indicador emprega uma abordagem ligeiramente diferente e tem sua própria fórmula. Aqui apresentaremos outro indicador deste grupo — seu nome é simplesmente Momentum.

O indicador técnico Momentum quantifica a variação do preço de um ativo em um dado intervalo de tempo. Sua fórmula compara o preço de fechamento mais recente a um preço de fechamento anterior.

Como implantar

Para adicionar o Momentum ao gráfico, clique em Inserir - Indicadores - Osciladores e você verá o Momentum.

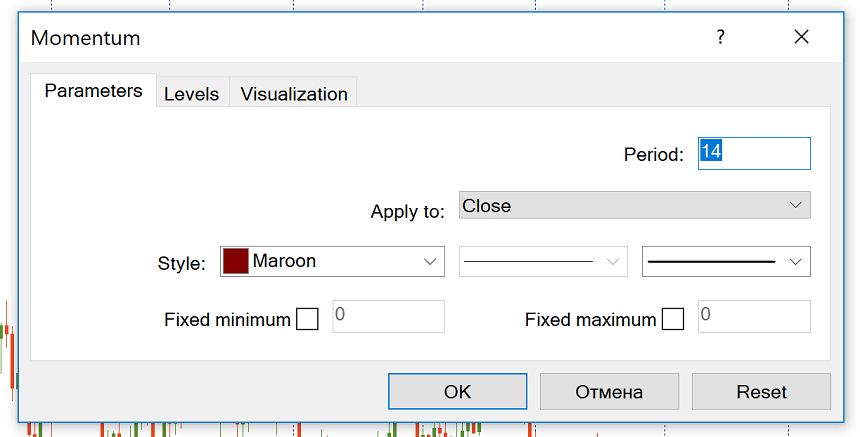

O parâmetro padrão para o Momentum é 14 no MT4, mas você pode defini-lo no valor que desejar. O indicador pode ser usado com êxito em qualquer timeframe (intervalo de tempo). Note que, quanto menor o timeframe usado, mais sensível será o desempenho, mas o indicador terá maiores chances de gerar mais falsos sinais em comparação com seu funcionamento em timeframes maiores.

Como interpretar

O Momentum oscila em torno de um valor central de 100. Este nível não é marcado automaticamente no MetaTrader, mas você pode desenhá-lo. Quando o valor do indicador vai acima de 100, isso sinaliza que os compradores estão dominando. Por outro lado, movimentações abaixo de 100 sinalizam o domínio dos ursos.

Se o Momentum atingir valores extremamente altos ou baixos (relativos aos valores da série histórica), é provável que a atual tendência de alta/queda continuará. Níveis extremos reportados pelo indicador mostram que por trás da tendência há momentum (“fôlego”) suficiente para seguir movimentando o preço.

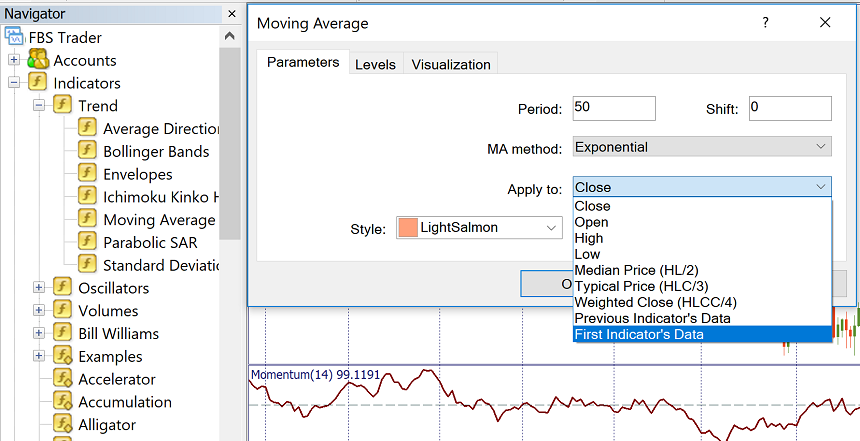

Ao mesmo tempo, o indicador Momentum também pode ajudar a identificar quando o mercado está em estado de sobrecompra ou sobrevenda (excesso de compras ou vendas, respectivamente). Quando um mercado em queda está em sobrevenda, ele pode estar prestes a rebater e subir — se o Momentum chega a um ponto mínimo e vira para cima, trata-se de um sinal de compra. Analogamente, quando um mercado em alta está em sobrecompra, ele pode estar prestes a rebater e cair — se o Momentum chega a um pico e vira para baixo, trata-se de um sinal de venda.Você pode aplicar uma média móvel de curto prazo ao indicador para que fique mais fácil determinar seus pontos de virada. Para fazer isso, no painel Navegador, seção Indicadores, subseção Tendência, selecione a opção Moving Average, arraste-a e solte-a no gráfico do indicador Momentum. Na janela que aparecerá, encontre a aba Parâmetros, abra o menu “Aplicar a:” e escolha First Indicator’s Data.

A estratégia então será comprar quando o Momentum cruzar a MA de baixo para cima, e vender quando ele cruzar a SMA de cima para baixo. Desta forma, o timing (a exatidão do tempo) dos sinais ficará um pouco melhor.

É aconselhável escolher os sinais que estejam alinhados à tendência que você observar em um timeframe maior, ou usar outros indicadores de tendências. Entre no mercado apenas depois do preço confirmar o sinal gerado pelo indicador. Se o Momentum chegar ao topo, por exemplo, espere o preço começar a cair e então venda.O Momentum frequentemente começa a virar antes do preço. Quando o Momentum estiver divergindo do preço, isso pode ser tratado como um indicador apontando o pico potencial (quando o Momentum estiver caindo enquanto os preços estiverem subindo) ou o a mínima potencial (quando o Momentum estiver subindo e os preços estiverem caindo).

Conclusão

O oscilador Momentum ajuda o trader a notar mudanças sutis na força das compras ou das vendas. É possível utilizá-lo para gerar sinais de trading, embora neste caso recomendamos fortemente certificar-se de combinar o indicador com sinais de price action (ação do preço). Note que o indicador Momentum pode oferecer vantagens ainda maiores se for utilizado para a confirmação de sinais fornecidos por outras ferramentas.

Outros artigos nesta seção

- Timeframes

- Gráfico Renko

- Tipos de gráficos

- Heiken Ashi

- Política de relaxamento quantitativo

- Pontos de Pivô

- Média Móvel: jeito simples de encontrar uma tendência

- Williams’ Percent Range (%R)

- Índice de vigor relativo

- Índice de Força (Force Index)

- Envelopes

- Poder dos Touros e Poder dos Ursos

- Average True Range

- Como negociar com base nas decisões de bancos centrais?

- CCI

- SAR Parabólico

- Stochastic (Estocástico)

- Relative Strength Index

- Osciladores

- ADX

- Bandas de Bollinger

- Indicadores de tendência

- Introdução aos indicadores técnicos

- Suporte e resistência

- Tendência

- Análise técnica

- Bancos centrais: política e efeitos

- Fatores fundamentais

- Análise fundamental

- Análise técnica vs fundamental