L'Australian Bureau of Statistics annuncerà i dati aggiornati sul tasso di disoccupazione e sulla variazione dell'occupazione giovedì 19 maggio alle 04:30 MT.

Non perdere tempo: analizza l’influenza dei NFP sul dollaro statunitense!

Avviso sulla raccolta dei dati

Manteniamo un registro dei tuoi dati per gestire questo sito web. Cliccando il pulsante accetti la nostra Informativa sulla privacy.

Seguici su Facebook

Segui le notizie sull'azienda, le notizie di mercato e molto altro!

Grazie, seguo già la vostra pagina!

Guida Forex per i principianti

Una grande guida al mondo del trading.

Controlla la cartella “In arrivo”!

Nella nostra email troverai la Guida Forex. Premi il pulsante per ottenerla!

Avviso di rischio: I ᏟᖴᎠ sono strumenti complessi che comportano un rischio elevato di perdere denaro rapidamente per via della leva.

Il 69,21% degli investitori retail perde denaro negoziando ᏟᖴᎠ con questo provider.

Dovresti considerare se comprendi come funzionano i ᏟᖴᎠ e se puoi permetterti di correre il rischio di perdere il tuo denaro.

Le informazioni non possono essere considerate consigli di investimento

Now traders follow the economic events with new vision as inflation in the US seems like decreasing. Let’s see what releases will influence the market due to that factor.

November 15, 15:30 GMT+2

The US Bureau of Labor Statistics will announce the Producer Price Index on Tuesday, November 15, at 15:30 GMT+2. It's a leading indicator of consumer inflation as producers' expenses are usually passed on to consumers. If results are lower than expected, it might mean that the inflation growth is slowing down. As a result, the Fed may conduct a more dovish monetary policy pushing the USD down.

As an example, we can look at the USDCAD chart. Since the beginning of November, the USD has been falling slowly. CPI release showed a decline in inflation, аnd the USDCAD lost almost 2400 points. PPI will prove it one more time.

Last time, the actual data exceeded expectations, 0.4% vs. 0.2% expected. It was the first increase in three months and showed an 8.5% gain from last year. Prices paid to US manufacturers rose more than expected in September, indicating that inflationary pressures will take time to ease and that the Federal Reserve will continue aggressive rate hikes.

Instruments to trade: EURUSD, USDCAD, GBPUSD.

November 16, 09:00 GMT+2

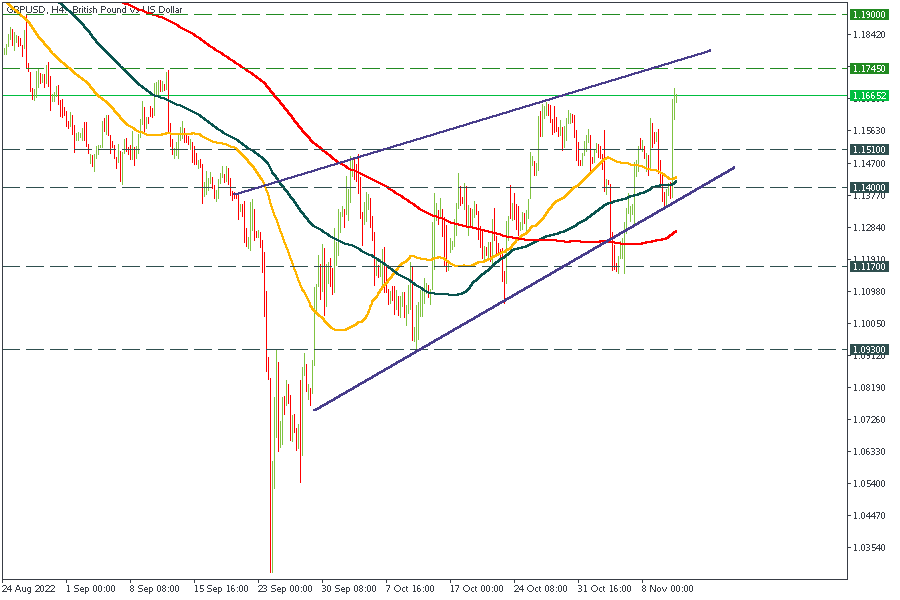

The UK Office of National Statistics will announce its Consumer Price Index on Wednesday, November 16, 09:00 GMT+3. It’s the indicator of the overall inflation.

Inflation in the UK reached a 40-year high of 10.1% in September, and economists expect further growth through the end of the year. The Bank of England has recently raised interest rates in the UK by 0.75 percentage point, the biggest increase in 30 years. A year ago, the interest rate was 0.1%. Today it is 3%.

The BoE raised interest rates due to inflation, trying to maintain price stability. Traditionally, this means keeping inflation around 2%. Sometimes inflation, of course, deviates from this target, and small short-term fluctuations are normal. However, inflation has been above the target since mid-2021 and is now at a 40-year high of around 10%.

Now the GBPUSD is recovering, slowly but surely climbing up.

Instruments to trade: GBPUSD, GBPCAD, EURGBP.

November 16, 15:30 GMT+2

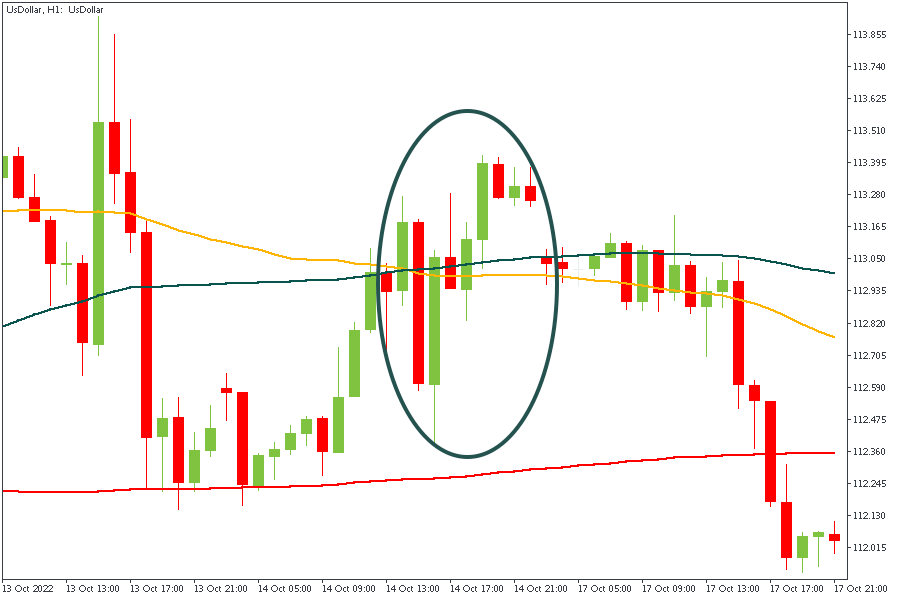

The US will publish Retail Sales and Core Retail Sales on November 16 at 15:30 GMT+2. Both indicators demonstrate a change in the total value of sales at the retail level. Core Retail Sales differ from the primary indicator, as the former does not count automobile sales.

The retail data helps track consumer spending, which accounts for most of the overall economic activity. If the economic activity intensifies, the country's overall economic health improves. In the previous release, Retail Sales and Core Retail Sales were mixed, 0.0% vs. 0.2% expected and 0.1% vs. -0.1%, respectively. Inflation is slowing down, so this release will show how the fight against inflation goes.

Last time, the release caused the fluctuations in the market. The US dollar index dipped down, and recovered quickly.

Instruments to trade: XAUUSD, EURUSD, USDCAD, USDCHF.

L'Australian Bureau of Statistics annuncerà i dati aggiornati sul tasso di disoccupazione e sulla variazione dell'occupazione giovedì 19 maggio alle 04:30 MT.

L'Office for National Statistics del Regno Unito rilascerà i dati dell'indice dei prezzi al consumo (IPC) mercoledì 18 maggio alle 09:00 MT.

Il Census Bureau degli Stati Uniti annuncerà le vendite al dettaglio Core e le vendite al dettaglio martedì 17 maggio alle 15:30 GMT+3.

In questa analisi parleremo di notizie importanti per la prossima settimana. Cosa influenzerà i mercati finanziari? Come reagiranno le principali coppie di valute?

L'Australian Bureau of Statistics annuncerà i dati aggiornati sul tasso di disoccupazione e sulla variazione dell'occupazione giovedì 19 maggio alle 04:30 MT.

L'Office for National Statistics del Regno Unito rilascerà i dati dell'indice dei prezzi al consumo (IPC) mercoledì 18 maggio alle 09:00 MT.

La vostra richiesta è accettata.

Ti chiameremo durante l’intervallo di tempo che hai scelto

La successiva richiesta di richiamata per questo numero di telefono sarà disponibile in 00:30:00

Se hai un problema urgente, ti preghiamo di contattarci tramite

chat live

Errore interno. Si prega di riprovare più tardi