Inflación y expectativas de tasas. Análisis técnico EURUSD y GBPUSD

¡No pierdas tu tiempo – mantente informado para ver cómo las NFP afectan al USD!

Aviso de Recopilación de Datos

Mantenemos un registro de tus datos para ejecutar este sitio web. Al hacer click en el botón, estás aceptando nuestra Política de Privacidad.

Manual para Principiantes de Forex

Tu guía definitiva a través del mundo del trading.

¡Revisa Tu Correo!

En nuestro correo electrónico, encontrarás el Manual de Forex 101. ¡Solo toca el botón para descargarlo!

Advertencia de Riesgo: Los ᏟᖴᎠs son instrumentos complejos y tienen un alto riesgo de pérdida de dinero rápidamente debido al apalancamiento.

El 68,53% de las cuentas de los inversores minoristas pierden dinero al operar ᏟᖴᎠs con este proveedor.

Deberías tener en consideración si comprendes el funcionamiento de los ᏟᖴᎠs y si puedes darte el lujo de arriesgarte a perder tu dinero.

Esta información no son consejos para inversión

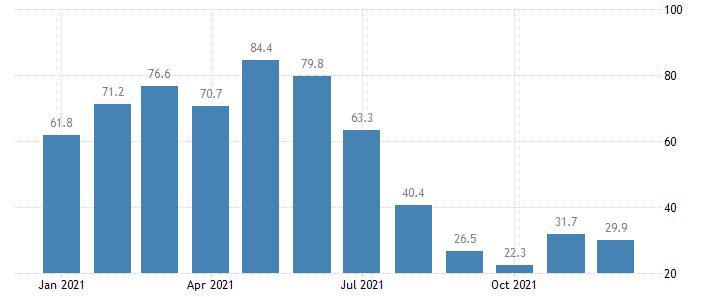

Leibniz Centre for European Economic Research (ZEW) will release an economic sentiment index for Germany on January 18, 12:00 GMT+2. This index represents the view of institutional investors and analysts on the current economic conditions. The ZEW survey is historically focused on the German economy, and Germany tends to lead the Eurozone economy, so the Eurozone outlook that is released on the same day tends to be overshadowed by the German data released at the same time.

Usually, ZEW index gives more information about economic health as investors and analysts are highly informed about their jobs. Thus, their sentiment is nothing but important for understanding the market. There are no expectations from analysts about the next release. However, the latest reading suggested that hopes for much more substantial growth in the next six months are fading, as Europe's largest economy struggles with the latest developments in the COVID-19 pandemic as well as the persisting supply bottlenecks on production and retail trade.

December reading boosted the volatility in EUR/USD, moving it by 650 points in two hours.

Higher numbers mean that economy is recovering, and investors are optimistic, which usually moves the euro higher.

Check the economic calendar

Instruments to trade: EUR/USD, EUR/JPY, EUR/GBP, EUR/CAD.

Inflación y expectativas de tasas. Análisis técnico EURUSD y GBPUSD

El EURUSD se sitúa en el nivel más bajo en lo que va de semana, cerca de 1,0550, cortesía de la aversión al riesgo alimentada por las tensiones en Medio Oriente y el aumento de los rendimientos de los bonos del Tesoro estadounidense…

Logan de la Fed: advierte sobre la necesidad de condiciones financieras restrictivas durante un tiempo: la presidenta del Banco de la Reserva Federal de Dallas, Lorie Logan, señaló que los rendimientos de los bonos a largo plazo en los Estados Unidos han…

Noticias, calendario y análisis detallado del Índice dólar (DXY)

El Índice tecnológico Nasdaq 100 alcanza nuevos máximos históricos, empujado por las ganancias en el subsector de chips, en especial tras el ascenso de más de 6% de las acciones de Taiwan Semiconductor Manufacturing Co…

Análisis GBPUSD y atención con el IPC inglés y europeo, además de las ventas minoristas en EE.UU.

Su solicitud ha sido aceptada

Te llamaremos en el intervalo de tiempo que elijas

La próxima solicitud de devolución de llamada para este número de teléfono estará disponible en 00:30:00

Si tienes algún problema urgente, contáctanos a través del

Chat en vivo

Error interno. Por favor, inténtelo nuevamente más tarde