Come individuare un’inversione del mercato

Le informazioni non possono essere considerate consigli di investimento

Una tendenza è un importante stato del mercato, quindi ogni trader deve comprenderle bene. Nessuna tendenza dura per sempre: ci sarà sempre un momento in cui la tendenza che si sta negoziando si inverte e inizia una nuova tendenza.

L’analisi tecnica può indicare se una tendenza sta per cambiare direzione o confermare che si è effettivamente verificata un’inversione.

Un trader deve essere informato di un’imminente inversione di tendenza per due motivi: in primo luogo, se un trader ha già aperto una posizione su una tendenza, vorrà chiuderla prima che si inverta. In secondo luogo, l’inversione è un momento in cui appare una nuova tendenza. Se leggi correttamente il mercato e la individui in tempo, sarai in grado di entrare in questa tendenza prima e guadagnare di più.

La probabilità di un’inversione dipende in gran parte dalla forza della tendenza attuale: se una tendenza è debole, un’inversione è più probabile. Ci sono molti modi per stimare la forza di una tendenza. Consigliamo due metodi: analisi visiva e indicatori tecnici.

Analisi visiva di un’ inversione potenziale

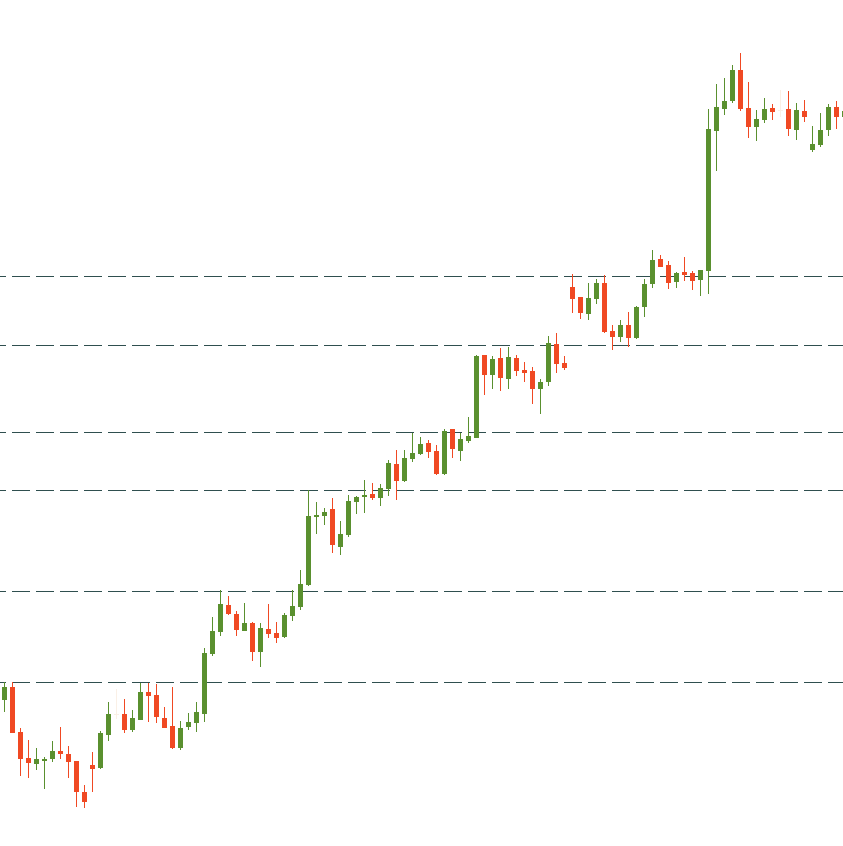

Osserva i massimi e i minimi di una tendenza. Se le correzioni sono brevi e il consolidamento si sviluppa in intervalli stretti, la tendenza è forte. In una tendenza rialzista, il prezzo rispetta rigorosamente il primo supporto che si forma ai massimi precedenti:

Nel caso di un trend rialzista lento, il prezzo può scendere sotto il massimo precedente (il supporto iniziale) ma rimane sopra il minimo precedente.

Una tendenza rialzista debole può essere riconosciuta dalla presenza di un massimo più basso. In questa situazione, i trader avranno paura della formazione del pattern “testa e spalle” nonché della potenziale inversione verso il basso del mercato.

Inoltre, quando il prezzo inizia a ritornare troppo spesso su una linea di supporto, questo suggerisce che la tendenza rialzista si sta indebolendo.

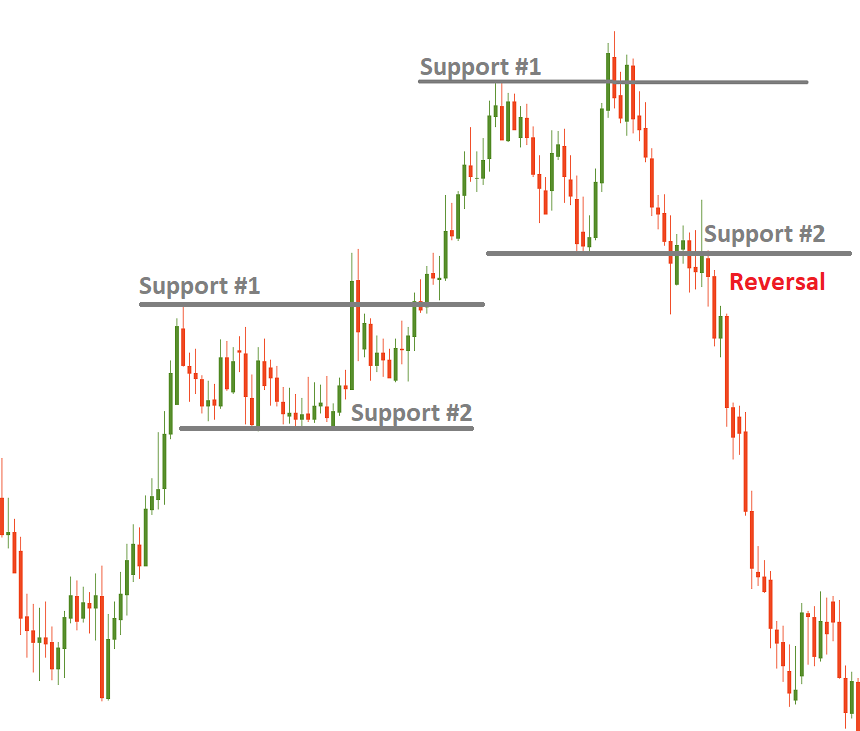

Come puoi vedere dalle spiegazioni appena date, è necessario distinguere il supporto #1 (il massimo precedente durante un trend rialzista) dal supporto #2 (il minimo precedente durante un trend rialzista). Si verifica un’inversione quando il prezzo supera il supporto #2. Nell’immagine qui sotto sono mostrate due situazioni. Nel primo caso, il prezzo è riuscito a rimanere al di sopra del secondo supporto. Nel secondo caso, è passato sotto il secondo supporto e ha confermato un’inversione.

Nota che è molto importante confermare che il prezzo ha effettivamente superato il supporto o la resistenza per identificare un’inversione. Osserva da vicino le candele giapponesi: la candela superata dovrebbe chiudersi sotto il supporto/sopra la resistenza. Una situazione ideale si verifica quando la linea superata viene nuovamente testata, ma il prezzo non ritorna sopra/sotto di essa. La conferma della rottura può anche provenire da indicatori tecnici e volumi.

Indicatori che possono aiutarti a identificare un’inversione

Una serie di indicatori tecnici può essere molto utile per identificare un’inversione.

Innanzitutto, le medie mobili di periodi diversi possono fornire livelli di supporto/resistenza oltre i quali i trader vedranno un’inversione o un intersezione che segnala un cambiamento della tendenza. Anche l’indicatore Ichimoku ha un insieme di linee che indicano quando il mercato passa da rialzista a ribassista e viceversa.

L’ADX è un indicatore avanzato della forza di una tendenza. La linea principale dell’indicatore aumenta man mano che la tendenza diventa più forte. La magnitudine dell’ADX va da 0 a 100. Se l’indicatore è maggiore di 25, la tendenza è distinta e forte. Quando l’ADX supera 25 può essere utilizzato per confermare una rottura e un’inversione di tendenza. La direzione dell’inversione può essere indicata dalle altre due linee dell’indicatore.

Vale anche la pena monitorare l’andamento dell’ADX. Se l’indicatore forma una serie di picchi più elevati, la tendenza è forte e un’inversione di tendenza è meno probabile.

Puoi anche usare gli indicatori di volume per stimare l’intensità del trend e confermare le inversioni. Se si era formato un massimo minore in una tendenza al rialzo e anche il volume è basso, è un forte segnale di un’inversione verso il basso.

Inversione o correzione?

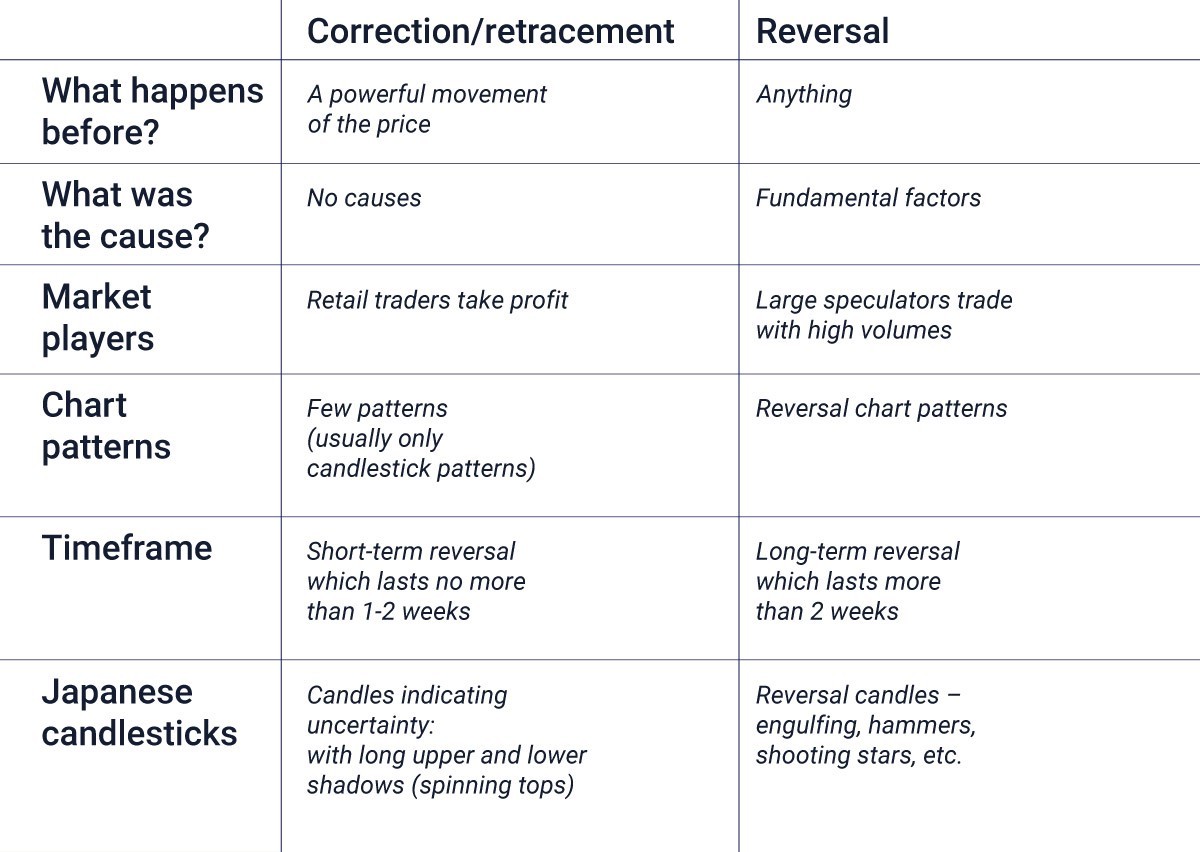

Il problema principale è che le inversioni iniziano spesso come correzioni. Pertanto, è spesso molto difficile distinguere l’una dall’altra. Nella tabella seguente, abbiamo raccolto informazioni che ti aiuteranno a farlo.

Le correzioni sono relativamente brevi. La loro natura è tecnica: le correzioni si verificano quando l’asset è ipercomprato o ipervenduto quando i partecipanti al mercato prendono profitti dopo un movimento conforme alla tendenza. Potrebbe essere utile usare gli strumenti di Fibonacci per misurare la profondità delle correzioni. Quando il ritracciamento del prezzo è contenuto al 38.5% di Fibonacci, la tendenza attuale è relativamente forte e non vi è alcun segno di inversione.

Le inversioni, d’altra parte, rappresentano un cambiamento maggiore nella direzione dell’azione del prezzo e sono spesso causate da motivi fondamentali. La caratteristica principale di un’inversione è che il prezzo supera il livello principale di supporto/resistenza di una tendenza. Se il mercato supera il livello di ritracciamento di Fibonacci del 50%, potrebbe essere un’inversione.

Conclusione

Nel complesso, per aumentare la precisione delle previsioni, consigliamo di utilizzare diversi metodi di analisi per determinare correttamente le inversioni. Ricorda che i metodi descritti non garantiscono una probabilità del 100% di successo. È quindi necessario rispettare le regole della gestione del rischio quando si negozia sulle inversioni.

Altri articoli in questa sezione

- Fan Lines di Fibonacci

- Espansioni di Fibonacci

- Come usare i ritracciamenti di Fibonacci

- Pattern di inversione con candele

- Pattern di continuazione con candele

- Come gestire il rumore del mercato?

- Come fare il backtest di una strategia di trading

- Oscillatore Gator

- Awesome Oscillator

- Range

- Alligatore

- Teoria di Bill Williams

- Frattali

- Pattern grafici

- Alla scoperta degli indicatori di Gann

- Come creare la propria strategia di trading?

- Pattern di candele

- Trend trading

- Carry trade

- Swing trading

- Position trading

- Day trading

- Lo scalping

- Stili di trading

- Cosa sono gli strumenti di Fibonacci?

- Psicologia

- Candele giapponesi

- Trends

- Condizioni e fasi del mercato